The Fed held its benchmark Federal-Funds fee regular yesterday at 5.25% – 5.5%, leaving the opportunity of cuts sooner or later. Jerome Powell repeated his “Knowledge Dependent” mantra. “Persuasive proof” that greater rates of interest had been now not essential to deliver down inflation is what the FOMC needs, and right now I wish to share just a few items of that proof.

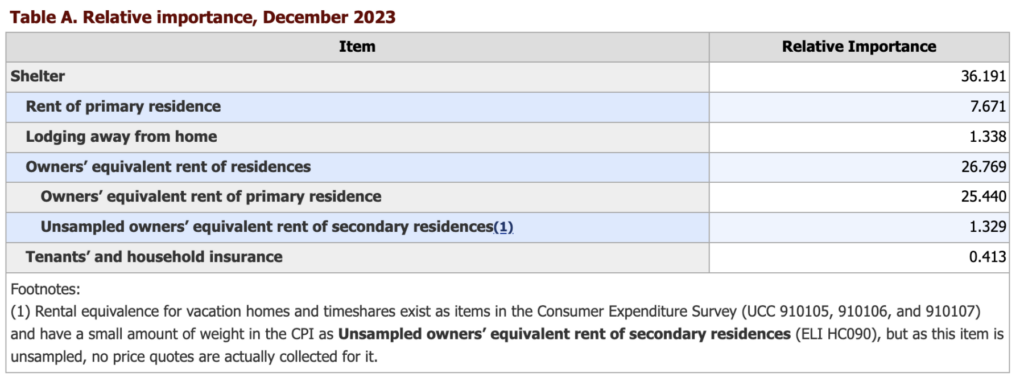

Our start line is the shelter element of the Client Worth Index. At about 40%, Shelter is the biggest portion of the CPI. Because the Bureau of Labor Statistics (BLS) explains:

“The information used as inputs within the development of the index for shelter, in addition to the indexes for hire and OER, are collected in two surveys. The Client Expenditure (CE) Survey asks households the share of their funds which fits in direction of totally different classes of products and companies, and is subsequently utilized by the CPI program to create weights for index estimation. The Housing Survey collects worth observations of rental housing models throughout the USA.”

Right here is the BLS desk exhibiting the weighting:

Let’s maintain the issues with survey information for an additional put up, and as an alternative zoom in on precise measures of rents.

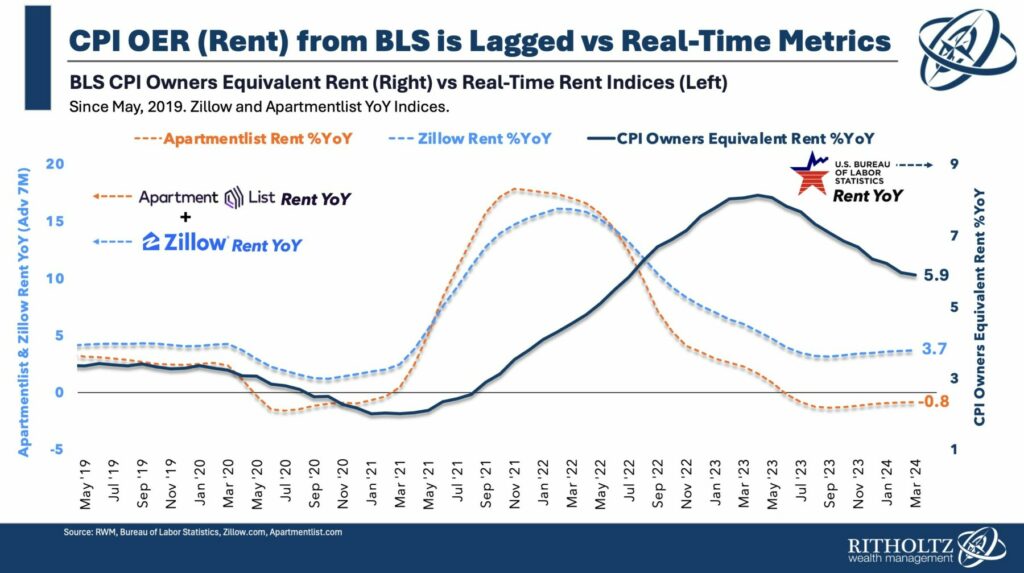

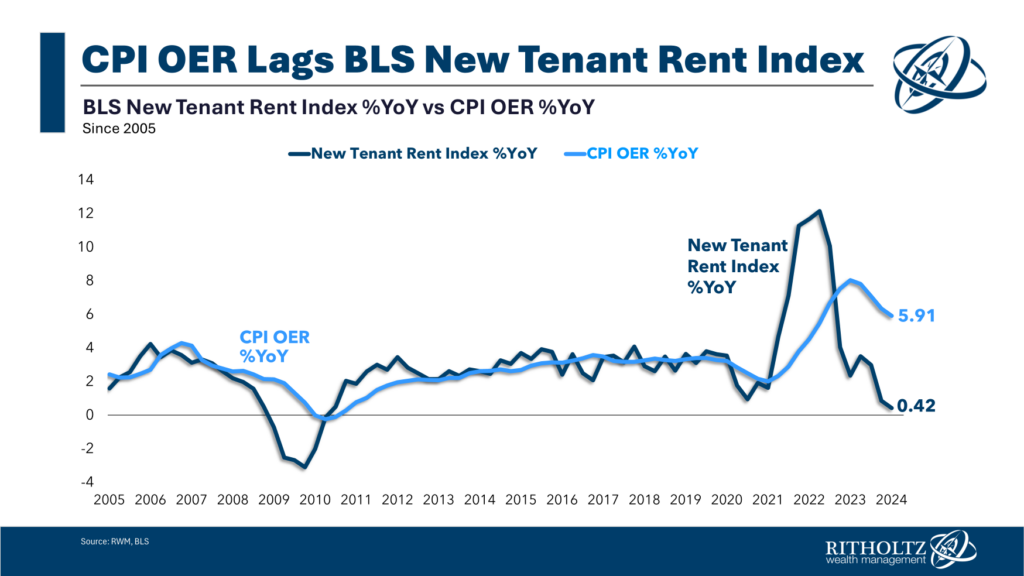

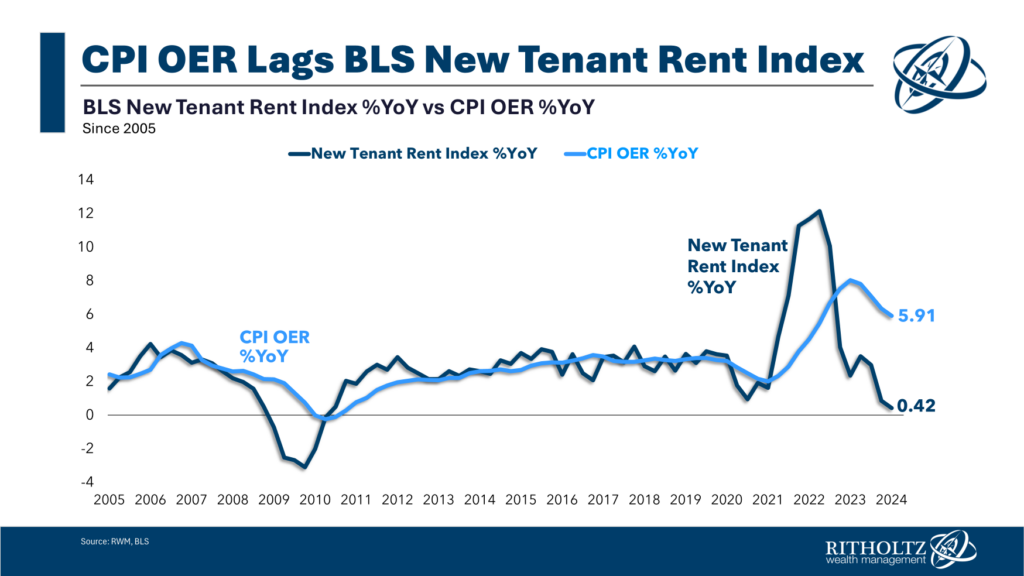

As our chart (high) exhibits, the CPI mannequin that measures hire yr over yr seems to lag different real-time measures by 18 months. The Residence Hire Index peaked in November 2021 at ~17% yr over yr; as of April 2024 its down -0.8% yr over yr. The Zillow Noticed Hire Index, with a distinct mixture of rental residences and homes, peaked round March 2022 at about 15%; it’s now at about +3.8% yr over yr.

BLS measures of Shelter peaked a lot later, round Could 2023 — a lag of 14-18 months. There are a number of technical the explanation why OER lags a lot within the BLS measure of shelter inflation — among the lag is in how the BLS information is collected and assembled, however maintain that apart for a second. I wish to give attention to a vital facet that makes the BLS measure of shelter inflation information so totally different from the noticed rents just like the Residence Index and Zillow.

In a phrase, Renewals.

Nearly two-thirds of all current leases for residences or home leases get renewed. Almost all of those renewals had been signed one or two years in the past. Leases are contracts, they usually lay out the precise phrases for renewals inside the doc.

What charges do you assume landlords constructed into their lease renewals 12-24 months in the past after they had been drafting and negotiating these 2022 and ’23 leases? They clearly mirrored the inflation charges then — which had been peaking.

What do contracts negotiated and executed two years in the past must do with the speed of inflation right now? You would possibly assume “nothing,” however as we see within the BLS information, it has an outsized impression. It is extremely seen in BLS’ New Tenant Hire Index — that information, in contrast to OER, doesn’t embrace renewals.

No shock, it too peaked in 2022, and is now at +0.42% yr over yr:

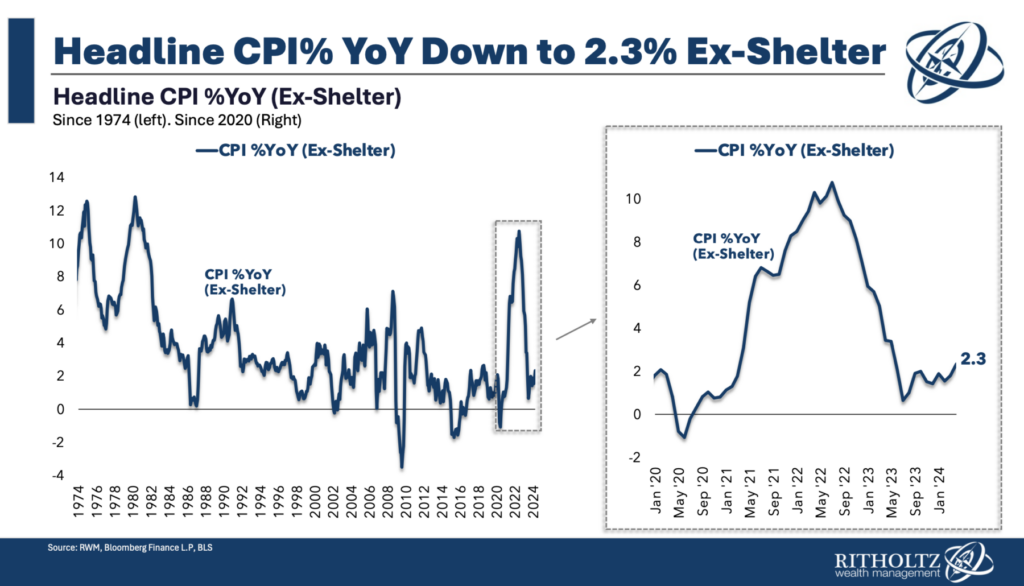

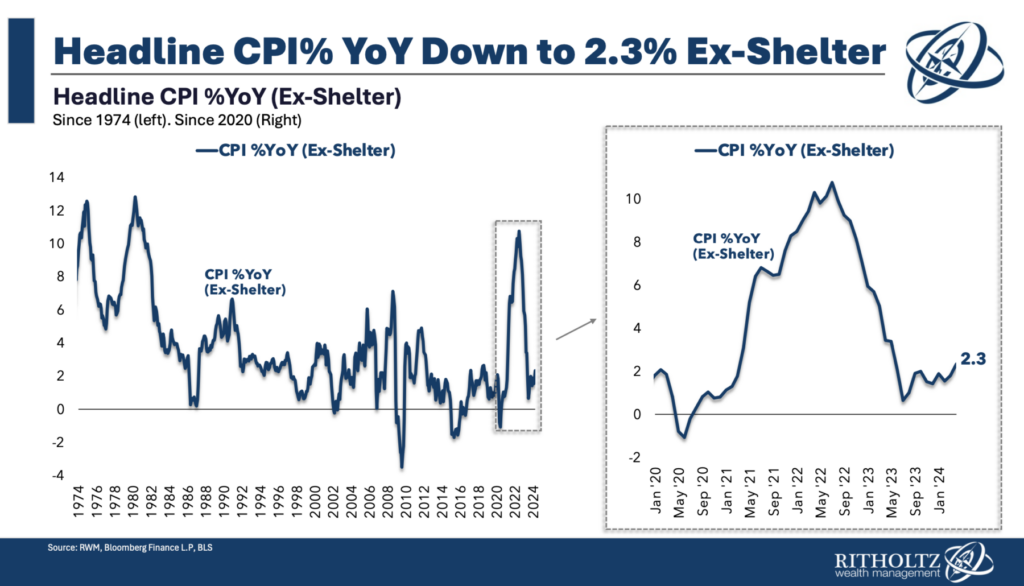

Again out shelter, which is overweighted by renewals, and the CPI is at 2.3%:

The place the rubber meets the highway is in mortgage charges: 61% of all householders have a mortgage; of these householders with mortgages, 78.7% have charges at or under 5%. Think about additionally 59.4% are at or under 4%. It needs to be properly understood by now that these charges have turn into golden handcuffs, locking folks in place who would possibly wish to transfer (commerce up, new location, and many others.).

Going from a 3.75% mortgage fee to present charges of seven.5% will improve your month-to-month funds by about 50% — for the same-priced home! Think about shifting as much as a costlier home — one which could be bigger or in a nicer neighborhood; it could double or occasion triple your mortgage bills even for a modest improve in worth.

For this reason single-family home stock is down 75% from its peak of 4 million yearly to about 1 million right now. That lack of provide has saved costs elevated. Larger charges not solely are affecting current house provides, it’s limiting new house development, and making that costlier as properly.

I stated this just a few years in the past, nevertheless it bears repeating right here: If the Fed needs decrease inflation, they need to be decreasing charges now.

UPDATE: Could 2 2024 2pm

Torsten Slok of Apollo Group factors us to this March 2024 FHFA paper (PDF); “Lock-In Impact of Rising Mortgage Charges:”

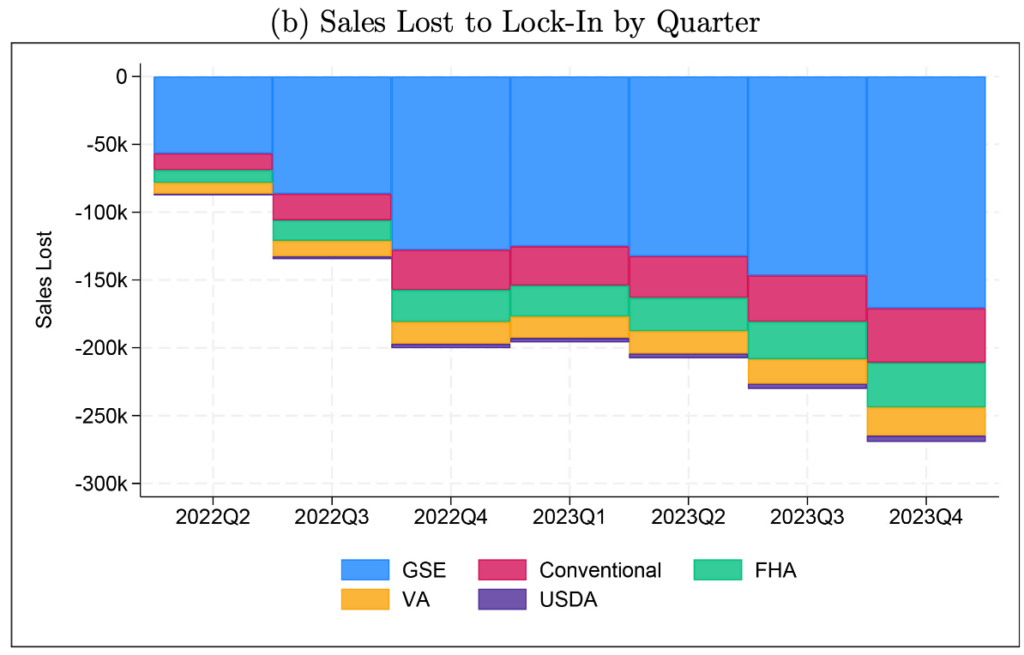

“This paper finds that for each share level that market mortgage charges exceed the origination rate of interest, the likelihood of sale is decreased by 18.1%. This mortgage fee lock-in led to a 57% discount in house gross sales with fixed-rate mortgages in 2023 This fall and prevented 1.33 million gross sales between 2022 Q2 and 2023 This fall. The provision discount elevated house costs by 5.7%, outweighing the direct impression of elevated charges, which decreased costs by 3.3%. These findings underscore how mortgage fee lock-in restricts mobility, leads to folks not dwelling in houses they would like, inflates costs, and worsens affordability.”

Beforehand:

How the Fed Causes (Mannequin) Inflation (October 25, 2022)

2% Inflation Goal is Foolish (July 26, 2023)

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

CPI Improve is Based mostly on Dangerous Shelter Knowledge (January 11, 2024)

How All people Miscalculated Housing Demand (July 29, 2021)

See additionally:

WSJ: Fed Says Inflation Progress Has Stalled and Extends Wait-and-See Price Stance.

Stalled Inflation Vexes the Fed. Is It Noise or a New Pattern? by Greg Ip, WSJ

The Lock-In Impact of Rising Mortgage Charges, by Ross M. Batzer Jonah R. Coste William M. Doerner Michael J. Seiler; Federal Housing Finance Company, March 2024 Working Paper 24-03