I used to be poking across the Bogleheads discussion board after I found this thread about an interval fund.

I’ve heard of all types of funds, however that is the primary time I’ve heard about interval funds. Relating to funds, I’m just about an index mutual fund or index exchange-traded fund (ETF). They’re all at Vanguard, although I feel Constancy, Charles Schwab, and all the opposite low-cost suppliers are nice, too.

Interval funds are a very totally different animal, and, on this case, the unique poster invested in a Variant Different Revenue Fund (NICHX):

Thanks prematurely on your time. Two years in the past I used to be coping with some nervousness in my life. My spouse and I made the choice to enlist an advisor to handle a portion of our holdings. That turned out to not be the precise factor to do and he didn’t serve us properly. Now we have terminated his contract and now I’m working to reallocate our accounts into extra applicable funds.

He invested a not-insignificant quantity of funds right into a Variant Different Revenue Fund (NICHX). I assume it’s thought-about an “interval fund.” That I can solely exit quarterly. The value-per-share has been flat, however it pays a good quarterly dividend that’s robotically reinvested. An preliminary funding of $103k in late 2022 has paid over $15k in dividends over six quarters (545 new shares).

This after all triggers the very nervousness I wrestle with. My intention was to get to a 70/30 AA. I assume my choices are:

1) Get out of the fund as quickly as the following quarterly-sell interval opens.

2) Maintain all or some and attribute it both to the fairness aspect or the bond/money aspect of my AA.

3) Maintain all or a few of it, however go away it exterior of my AA (which means fake it’s not there).Your knowledge is welcome.

Desk of Contents

What’s an Interval Fund?

An interval fund is a mutual fund that may be a closed-end fund the place you possibly can solely promote your shares throughout a repurchase interval. This era varies from fund to fund however many are on a quarterly interval and the fund will state what number of of their excellent shares they’ll repurchase (redeem), often said as a proportion.

When you learn “closed-end fund” after which “redemption durations” and already knew what a closed-end fund was, this may very well be complicated. Sometimes, closed-end funds concern shares at an IPO after which by no means purchase them again. The shares can commerce on the open market, however new cash doesn’t return into the fund.

With an interval fund, they’re in between open-end and closed-end funds as a result of they’ll provide new shares however solely redeem them at varied intervals (quarterly, semi-annually, and many others.) and just for a set proportion of property.

I wager you possibly can see how issues get difficult as a result of this fund is comparatively illiquid. If an interval fund says they’ll repurchase 10% and greater than 10% of the shares need to be repurchased, everybody will get pro-rated down.

This construction advantages the interval fund as a result of loads of redemptions may cause issues for the fund, because it has to provide you with the cash to offer again to shareholders. With a set cadence for coping with redemptions, the supervisor can plan for them (each in timing and measurement).

The scheduled redemptions enable managers to spend money on extra complicated securities and contracts, which can themselves be extra illiquid.

NICHX: Peek at an Interval Fund

The Bogleheads submit talked about NICHX, so I assumed I’d look nearer at this.

NICHX is attention-grabbing – it invests in unconventional income-generating property like litigation finance, royalties, and many others. It’s a fixed-income fund, so don’t evaluate it to an S&P 500 index, and it invests in various money move property that I’ve checked out beforehand.

It’s an interval fund that doesn’t commerce on the open market, so the one solution to promote your shares is thru NICHX. Not like many interval funds, although, there doesn’t look like a gross sales cost.

You may see that NICHX compares itself with many fixed-income property, such because the Bloomberg U.S. Combination Bond Index and Bloomberg U.S. Excessive Yield Bond Index, which appears cheap. They beat the fully principal-safe T-bills and evaluate favorably with high-yield company bonds and the like.

With interval funds, it’s vital to know the method and asset lessons that they spend money on, in addition to the charges. These funds do much more than monitoring an index, so that they sometimes cost way more.

For NICHX, we see that they’ve a internet expense ratio of 1.67% (which incorporates the Administration payment of 0.95%). Additionally, NICHX solely permits a quarterly redemption of 5% of the fund’s internet asset worth.

Is that this costly? It seems costly in comparison with an S&P500 Index fund that expenses you solely 0.04%, however that’s not a good apples-to-apples comparability as a result of they’re invested in several issues with totally different danger profiles.

It’s important to evaluate it with one thing that invests in various investments.

Yieldstreet Different Revenue Fund

Yieldstreet presents a Yieldstreet Different Revenue Fund that benchmarks towards the Bloomberg U.S. Combination Bond Index and Bloomberg U.S. Excessive Yield Bond Index. It invests in income-producing various property like business actual property, plane, authorized finance, provide chain finance, artwork finance, and many others.

Additionally they restrict redemptions to twenty% of shares excellent within the prior calendar 12 months or not more than 5% in every quarter, on a quarterly foundation—the identical as NICHX.

As for charges? 1.50%. It’s barely cheaper than NICHX however throughout the similar ballpark. (no gross sales load both)

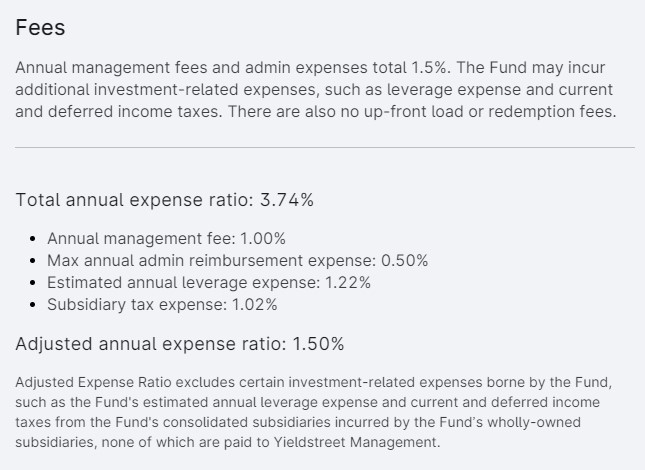

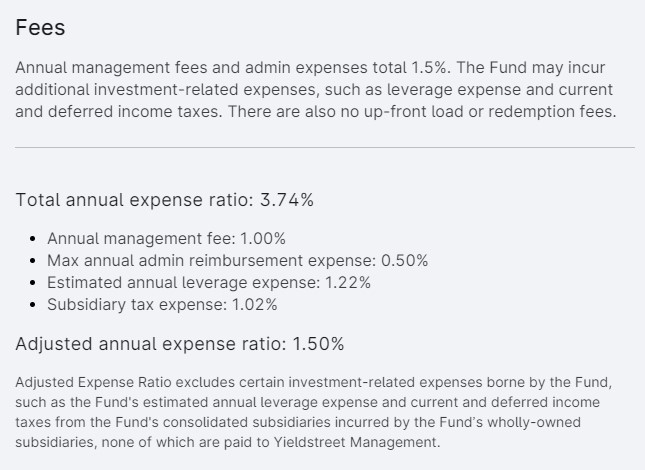

The half that’s barely complicated about this fund is that they record this as their charges:

If that’s arduous to see:

Charges

Annual administration charges and admin bills whole 1.5%. The Fund could incur extra investment-related bills, comparable to leverage expense and present and deferred revenue taxes. There are additionally no up-front load or redemption charges.

Complete annual expense ratio: 3.74%

- Annual administration payment: 1.00%

- Max annual admin reimbursement expense: 0.50%

- Estimated annual leverage expense: 1.22%

- Subsidiary tax expense: 1.02%

Adjusted annual expense ratio: 1.50%

Adjusted Expense Ratio excludes sure investment-related bills borne by the Fund, such because the Fund’s estimated annual leverage expense and present and deferred revenue taxes from the Fund’s consolidated subsidiaries incurred by the Fund’s wholly-owned subsidiaries, none of that are paid to Yieldstreet Administration.

The three.74% contains “estimated annual lever expense” and “subsidiary tax expense,” that are objects we don’t see in NICHX. I’m unsure why they embody them as they aren’t paid to Yieldstreet. Maybe they’re included within the returns of different funds (different funds could have comparable bills, although I don’t usually see them itemized like this).

The 1.50% itself, although, is on par with NICHX.

In doing extra analysis on interval funds, you’ll discover that they’ve increased charges, although, so the 1.69% at NICHX and the 1.50% from Yieldstreet are typical. You received’t see payment constructions like index funds, and that is sensible; these funds execute complicated transactions and don’t simply monitor an index.

Do You Want Interval Funds?

Right here’s the large query – do it’s good to spend money on interval funds?

I’d argue most individuals don’t.

When you take a look at the unique poster from Bogleheads, his advisor put at the very least 1,000,000 bucks (that’s the minimal for NICHX) into this fund, and he wasn’t even certain why. That’s a nasty signal. When you don’t perceive, it’s important to preserve asking questions till you do. They be just right for you, and if they’ll’t clarify it, they aren’t adequate.

As for interval funds normally, are the returns that significantly better to justify the illiquidity? You may solely get 5% out each quarter, so at a minimal, you’re speaking 5 years to exit the holding totally… and that’s if you happen to don’t get pro-rated.

The 1.50%+ payment also needs to be an enormous concern. The payment could also be justified, however it doesn’t imply you could purchase the product. With investing, we’ve got extra management over the associated fee than the returns, so paying the next payment means our funding has a a lot increased hurdle to beat.

For many, you’re higher off with a easy three-fund portfolio or one thing equally easy. There could also be some circumstances the place you’d need one (and maybe one which invests in one thing else). However for many, it’s a go. (heck, earlier than you ever get to the upper price, the illiquidity is sufficient to make me balk)

As for this asset class, “various investments” are enjoyable to examine and research, however they’re hardly required in any portfolio. I personal some farmland by means of AcreTrader and artwork through Masterworks, however that’s small quantities for enjoyable quite than as a result of I feel they’re a essential a part of my portfolio.