The Distress Index — the mixture of Inflation and unemployment — failed as a bearish criticism of the financial system. Unemployment stays at 60-year lows, and Inflation has plummeted from 9% right down to the 3s.

When you have a bearish mindset, and search affirmation of that perspective, then the following financial critique after the Distress Index you strive on for dimension is “Stagflation.” We have now heard the S-word from Jamie Dimon, Stanley Druckenmiller, Financial institution of America, Barclays, Fox, Marketwatch, Kiplingers, and lots of others.

The definition from the Seventies + ’80s was the mixture of sluggish progress, excessive unemployment, and rising inflation. But when Stagflation is your motive for being destructive, you run into the same downside: Progress has been strong, unemployment low, and inflation is means beneath its June 2022 highs.

Like a lot of the “If it bleeds it leads” media, there’s far much less to this scary menace within the knowledge than marketed.

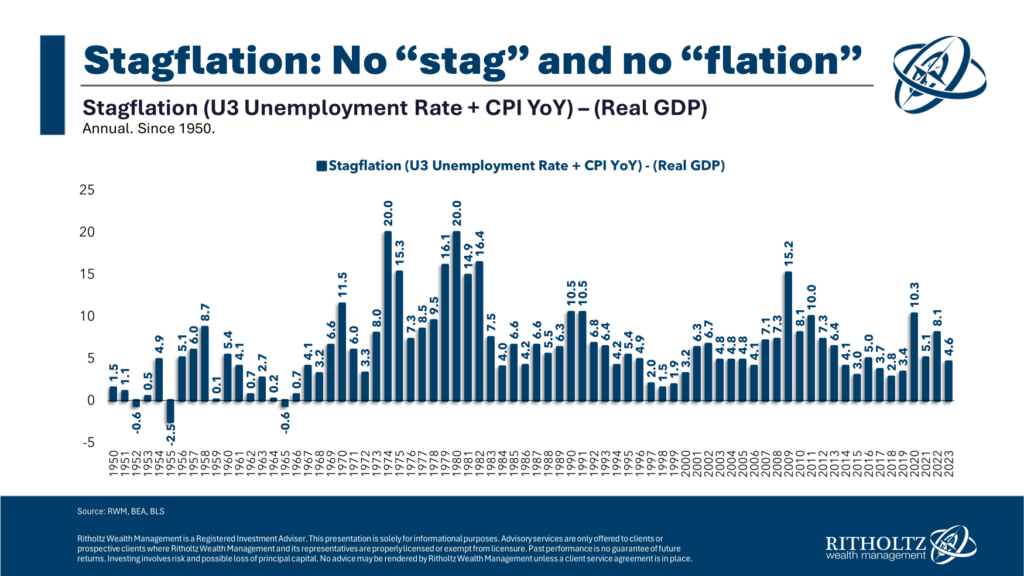

The USA has had bouts of Stagflation previously. We created a STagflation bar chart utilizing a easy method:

Stagflation = Unemployment (U3) + CPI Inflation (Yr over Yr) – Actual GDP

Because the chart above reveals, Stagflation ticked up within the early Seventies, spiking to twenty in 1974, and stayed elevated for many of the decade. It hit these excessive ranges once more in 1980 and stayed excessive till Inflation was vanquished by then-Fed CHair Paul Volcker and the financial system recovered in earnest after 1982. The financial collapse throughout the GFC despatched this again over 15 briefly and spiked once more throughout Covid over 10.

At the moment, ranges of stagflation are the identical as within the Nineties or the GFC 2000s. It’s one other financial fear that — no less than as of now — will not be backed up by any knowledge…

Or as Financial institution of America noticed immediately: “Stagflation was so 2022.” After a tender Q1 GDP, and lagging (blame OER) inflation, they observe the “stagflation” narrative has resurfaced. Pushing again on that, the statement is made that “actual providers spending has surged, regardless of elevated inflation. That is symptomatic of strong demand.” The important thing danger to observe is (in BofA’s view) not “stagflation,” however a re-acceleration in (providers) demand.

Given the massive shift in demand from Companies to Items throughout the pandemic lockdown, I view this shift again in the direction of Companies to be a part of the post-pandemic normalization.

As Elroy Dimson noticed, “Danger means extra issues can occur than will occur.” That suggests we must always not panic over each chance, particularly these which might be pretty unlikely to occur — and aren’t displaying up within the knowledge…

See additionally:

Why Traders Love Being Scared, (Michael Batnick, Might 14, 2024)

Nonetheless No Stag and Not A lot ‘Flation (Paul Krugman Might 3, 2024)

Beforehand:

What Does the Distress Index Say In regards to the 2024 Election? (January 25, 2024)

Why the FED Ought to Be Already Chopping (Might 2, 2024)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

Has Inflation Peaked? (Might 26, 2022)

Google searches for “Stagflation”