Throughout the insurance coverage trade, we perceive that as a way to stay related and retain market share we have to be agile, revolutionary and undertake new applied sciences. From a technical standpoint, because of this insurers want to have the ability to adapt their enterprise structure shortly and sustainably as a way to reinvent themselves and develop. Nevertheless, in an trade rife with legacy structure, programs modernization is a urgent downside. How can insurers design future programs that each uphold the legacy they’ve created and combine into the fashionable world?

Accenture is working alongside its insurance coverage purchasers to deal with this problem. The result’s a brand new frontier in how technological infrastructure is constructed.

Insurance coverage structure design is altering

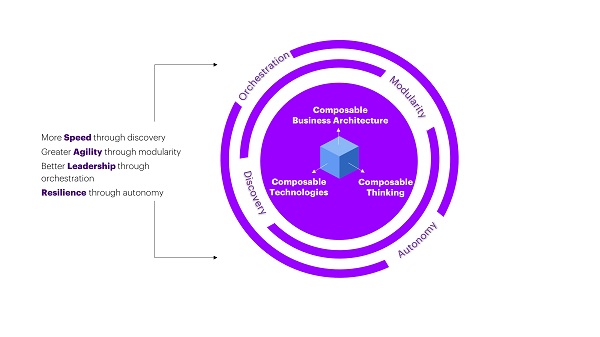

We have to change how insurance coverage structure is designed for better agility and development. This isn’t confined to our trade alone. Throughout all industries, there’s a seismic shift from rigid, monolithic structure to modular apps that may adapt to enterprise change by assembling, reassembling, and increasing. This assists organizations in maintaining tempo with altering buyer calls for, provide chain disruptions, financial uncertainty, and the speedy tempo of technological development.

Insurance coverage is an trade wealthy with knowledge but usually encumbered by legacy expertise. New, adaptable options will set main insurers aside. In keeping with Gartner, by 2023 organizations which have adopted an clever composable strategy will outpace competitors by 80% within the velocity of recent function implementation.

The composable enterprise in insurance coverage – what’s new

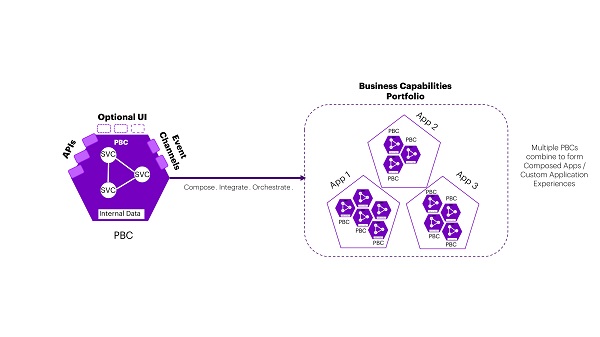

A composable enterprise might be outlined as a corporation that delivers enterprise outcomes successfully and adapts to the tempo of enterprise change. The digital structure that permits the composable enterprise is constructed on a powerful Utility Program Interface (API)-centric mindset, with enterprise features which might be encapsulated in interchangeable elements. In composable structure, APIs assist to reinforce pliability and ecosystem oversight. This helps the organizations to democratize the enterprise course of and change into a extremely scalable digital enterprise. For insurers, this strategy holds quite a few prospects to simplify and scale their digital operations. Packaged enterprise Capabilities (PBCs) – encapsulated software program elements that symbolize a well-defined enterprise functionality – might be created to be simply recognizable to enterprise customers. Whereas the idea of composable structure has been round for a number of years, we are actually harnessing the facility of PBCs to create really replicable and scalable infrastructure options.

How insurers can profit

By leveraging the chances of a composable enterprise and PBCs, insurers can scale with velocity and agility. to create a powerful basis for a composable enterprise:

- Construct Modular Enterprise Capabilities: If insurers wish to construct a scalable composable structure, they should have a set of autonomous enterprise capabilities that may be plugged collectively to execute a enterprise course of uniquely that brings a aggressive benefit. These modular enterprise capabilities ought to have the power to be managed independently and improved whereas collaborating in a bigger enterprise mannequin.

- Create Modular Know-how Capabilities: To help the modular enterprise capabilities, insurers must construct modular expertise capabilities that may be simply built-in to allow smarter enterprise fashions. These have to be autonomous, managed and modular as a way to be mixed by way of a normal interface to help the required enterprise want.

In abstract, taking a composable strategy to technological structure in insurance coverage has game-changing potential. It permits insurers to future-proof technique by design, deal with proactive creation and see elevated velocity in function implementation. In our subsequent weblog submit on this collection, I’ll share sensible examples of composable structure in an insurance coverage claims context.

Get the newest insurance coverage trade insights, information, and analysis delivered straight to your inbox.