You’re in your 30s or 40s (and heyyyy all of you inching over the road into your 50s). You might have what seems like a lot of cash. However when you consider the truth that you would possibly stay for an additional 50 or 60 years? It begins to sound like perhaps not that a lot cash.

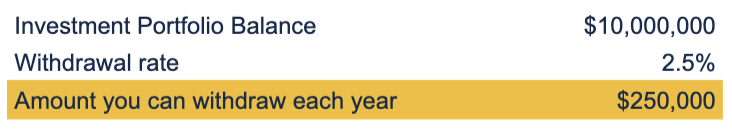

In a latest weblog publish, I mentioned how to consider turning your funding portfolio into an precise stream of earnings to stay on. I launched the thought of the 4% withdrawal price: you multiply 4% instances your funding portfolio, and that’s how a lot you’ll be able to withdraw out of your portfolio annually. For instance, 4% x $1M portfolio = you’ll be able to take $40,000 out annually.

I additionally urged that in case you have a time horizon that’s means longer than 30 years (which is the standard planning horizon for retirees), you probably need to cut back that 4% to three%, perhaps even 2.5%, to make it extra probably that your portfolio will final the remainder of your doubtlessly very lengthy and craaaaaazy life.

(There may be extra nuance to the 4% withdrawal price, which I’d encourage you to be taught in the event you wished to really do your individual planning. For this publish’s functions, what I wrote above needs to be sufficient.)

Due to the size of life nonetheless awaiting these purchasers, and the inherent uncertainty of alllll that point, our purchasers understandably really feel higher when they’re conservative with their portfolio withdrawals.

So, we deem a 2.5% withdrawal price a superb guess, and make the calculation. When you’ve got a $10,000,000 funding portfolio (that’s a lot of cash!), meaning you’ll be able to take out $250,000 per yr (this feels means smaller than you’d suppose $10M might help).

Now that we all know this $250,000 quantity, you might have a alternative:

- Withdraw greater than 2.5%, to totally help a better price of residing.

- Withdraw 2.5% and cut back your bills to match that.

- Withdraw 2.5%, hold spending extra than that…and make up the distinction by incomes some cash with a jobbity job.

As for #1: Within the overwhelming majority of circumstances, within the authentic 4% research, individuals who withdrew 4% for 30 years ended up with extra wealth on the finish. The 4% is a worst-case-scenario technique. So, in the event you withdraw, say, 4% or 5% (or extra!) out of your portfolio, it might final the remainder of your life. But it surely’s far much less more likely to.

I’ve had some purchasers select #1, with the (mental if not emotional) information that that is an unsustainable price they usually’ll have to scale back it (perhaps radically) sooner or later. Typically they’re merely going by huge transitions of their lives and are theoretically okay with the thought of taking some huge cash from their portfolio to make that transition.

I’ve had some purchasers select #2. Although the share is low, the ensuing {dollars} have been sufficient for them to stay fortunately on.

Incomes Cash on High of Portfolio Withdrawals. How A lot?

I need to linger on #3. Not that I don’t like #1 and #2, however #3 is, for my part, a very enjoyable instance of planning the place a compromise makes every little thing a lot simpler. I’ve walked by this evaluation with a number of purchasers lately, they usually all discovered it clarifying and reassuring.

Particularly on condition that my purchasers are so younger, even when they’re at the moment not working, they’re nearly definitely going to work once more, in some capability. It’s due to this fact normally affordable to imagine they’re going to earn some cash within the not-too-distant future.

One good thing about method #3 is that it minimizes the sum of money you have to make from that job, thereby opening up profession potentialities for you, to take jobs extra for ardour or which means than for earnings, or to work half time.

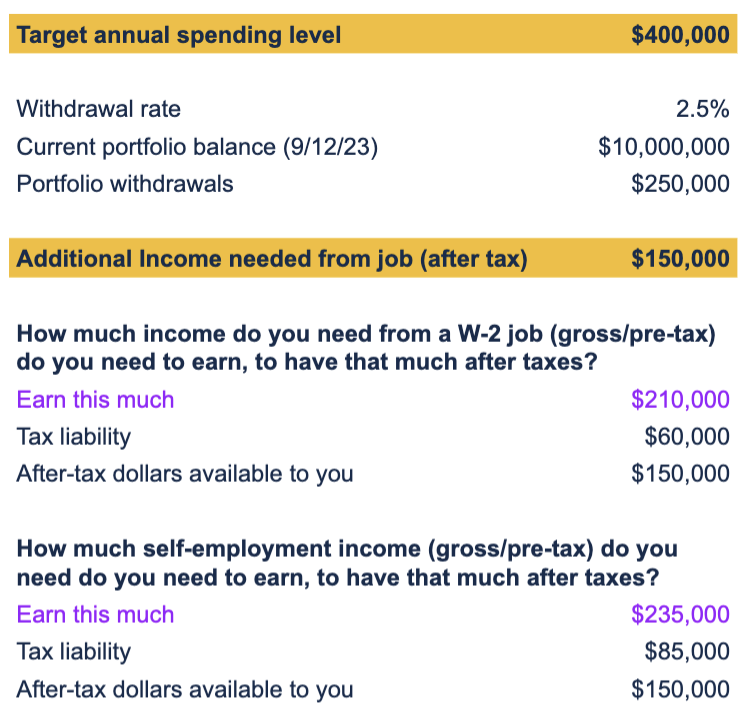

It is a nice instance, I believe, of monetary independence, even in the event you nonetheless truly must earn some cash. If you might want to help a way of life that prices $400,000/yr, nicely, that’s undoubtedly gonna slender the profession choices for you. However in the event you want as an alternative to earn sufficient to help $150,000 of spending, there are much more jobs that may present that to you.

Beneath is a simplified model of the evaluation we do for our purchasers exploring this path:

- We set up how a lot their desired life-style prices (“Goal annual spending degree”) ($400,000).

- We calculate how a lot they’ll most likely sustainably withdraw from their portfolio ($250,000).

- We calculate how a lot they then must earn from a job to make up the distinction ($150,000).

- We then use software program to determine how a lot earnings you might want to earn earlier than taxes are taken out to supply that $150,000 after tax. This quantity is completely different relying on whether or not you’re an worker (W-2) or self-employed. (Tax guidelines differ between these two camps.)

How would you calculate this earnings quantity your self? Our software program, made for monetary professionals, is fairly sturdy, and we will enter in all kinds of particulars about our purchasers’ tax state of affairs. You would most likely use one thing like this calculator, a minimum of for a W-2 job, to determine how a lot pre-tax earnings you might want to arrive at a sure after-tax worth. It may not be as detailed because the software program I exploit, nevertheless it ought to get you to a helpful ballpark. (There are most likely different good DIY instruments on the market. I’m merely not acquainted.)

After this evaluation, my purchasers know particularly how a lot they should earn from a job in the event that they need to preserve their present life-style. It’s definitely not sophisticated math. (Now, any time tax calculations are concerned, it’s undoubtedly sophisticated. However, mainly all monetary professionals use software program to calculate taxes as a result of the tax code is just too huge and too sophisticated to do back-of-the-napkin calculations.)

Till you might have the <I can take this a lot out of my portfolio> quantity and the <my job should pay me this a lot> quantity, you would possibly really feel like a few of my purchasers: you might have a giant pile of cash, no thought how a lot of it you’ll be able to safely withdraw/spend on what schedule, and accordingly, no thought what sort of life you’ll be able to construct for your self and your loved ones.

So, it’s kinda scrumptious {that a} calculation as easy because the one above (it’s largely simply arithmetic!) will be the “unlock,” as one shopper known as it, to you feeling far more in command of your monetary state of affairs and future.

If you happen to’re nonetheless younger(ish), have important wealth, and are questioning how you should use it to help your life-style, attain out and schedule a free session or ship us an electronic mail.

Join Movement’s twice-monthly weblog electronic mail to remain on prime of our weblog posts and movies.

Disclaimer: This text is offered for academic, basic data, and illustration functions solely. Nothing contained within the materials constitutes tax recommendation, a suggestion for buy or sale of any safety, or funding advisory companies. We encourage you to seek the advice of a monetary planner, accountant, and/or authorized counsel for recommendation particular to your state of affairs. Replica of this materials is prohibited with out written permission from Movement Monetary Planning, LLC, and all rights are reserved. Learn the total Disclaimer.