Ought to we put money into Nifty 500 Index Fund? Allow us to examine Nifty 500 Vs Nifty 100 Vs Nifty 50 by trying on the final 21 years knowledge and attempt to discover a solution.

With the growing recognition of Index Funds, mutual fund corporations are progressively introducing a variety of Index Funds to fulfill the various necessities of traders. Nevertheless, even though Index Funds are thought to be superior and easy funding choices, ought to one ponder investing in all Index Funds?

We all the time consider proudly owning a wider market than a restricted market and we really feel a wider market means higher diversification. Nevertheless, regardless that in plain it seems to be unbelievable whereas selecting the merchandise, it’s important to search for underlying shares and their share. One such basic instance is Nifty 500 Index.

What’s the Nifty 500 Index?

The Nifty 500 index represents the highest 500 corporations chosen based mostly on full market capitalization from the eligible universe. Nifty 500 Index is computed utilizing the free float market capitalization technique, whereby the extent of the index displays the whole free float market worth of all of the shares within the index relative to a specific base interval.

The Nifty 500 Index was created with a beginning worth on January 1, 1995, and is rebalanced each six months. As of April 30, 2024, the sector allocations are as follows: Monetary Companies at 29%, Oil, Gasoline, and Consumable Fuels at 9%, IT at 8.8%, Vehicle and Auto Parts at 7%, and FMCG at 7%.

Ought to we put money into Nifty 500 Index Fund?

Let’s look at the highest shares within the Nifty 500 index. A notable 58% of those shares are a part of the Nifty 50 index, whereas round 14% come from the Nifty Subsequent 50 Index. Which means a considerable 72% of the Nifty 500 shares are from Nifty 100. The remaining 28% of shares are from the mid and small-cap sectors.

In such a state of affairs is it smart to take a threat of investing within the Nifty 500 Index? Allow us to dig into the final 21 years’ knowledge to seek out the solutions. For our research function, allow us to take the information from 1st Jan 2003. Why from 2003? As a result of the Nifty 100 TRI knowledge is offered from 1st Jan 2003. Therefore, I’m contemplating the information of Nifty 500 TRI, Nifty 100 TRI and Nifty 50 TRI from 1st Jan 2003.

Do keep in mind that as of now, Motilal Oswal is providing two funds -one as an ETF and one other as an Index Fund.

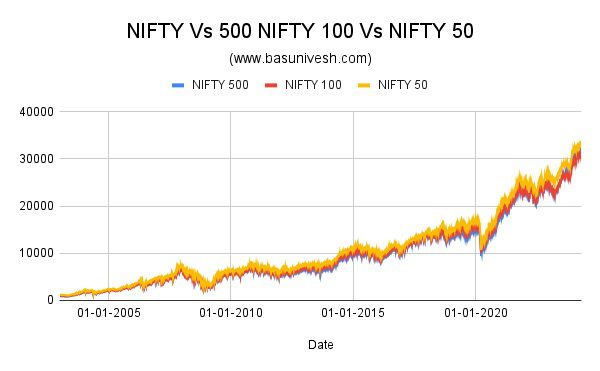

The motion from 1st Jan 2003 seems to be like under.

Nevertheless, this may not present us with an correct illustration of volatility and superior efficiency. Due to this fact, let’s analyze the three Indices’ rolling returns for 1 12 months, 3 years, 5 years, and 10 years. Moreover, we must always look at the constant outperformance of the Nifty 500 TRI Index in comparison with each the Nifty 100 TRI and the Nifty 50 TRI.

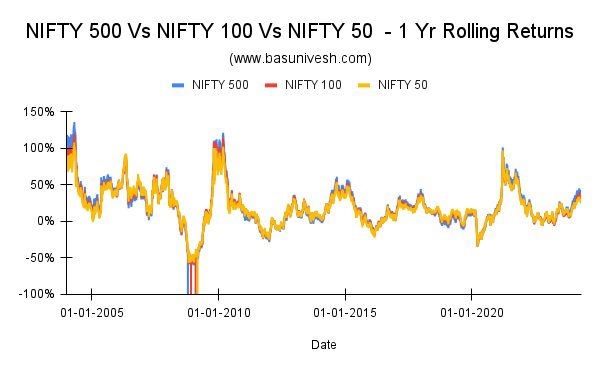

NIFTY 500 TRI Vs NIFTY 100 TRI Vs NIFTY 50 TRI – 1 Yr Rolling Returns

It is very important observe that there’s minimal variation among the many three, except for a shorter timeframe. However, when analyzing the constant outperformance of the Nifty 500 TRI Index over the Nifty 100 TRI Index and Nifty 50 TRI Index, it’s evident that the Nifty 500 TRI Index outperformed the Nifty 100 TRI Index for about 54% of the time when it comes to one-year rolling returns. Nevertheless, when evaluating the Nifty 500 TRI Index to the Nifty 50 TRI Index, the outperformance is even higher, with a margin of 56%.

Nevertheless, allow us to not choose the outperformance by taking a look at simply 1 12 months rolling returns.

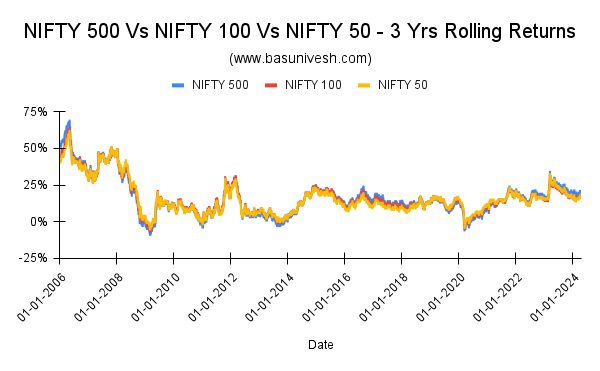

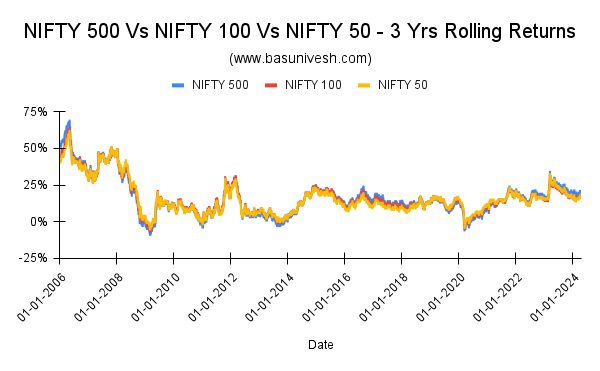

NIFTY 500 TRI Vs NIFTY 100 TRI Vs NIFTY 50 TRI – 3 Yrs Rolling Returns

The current outperformance of Nifty 500 TRI post-2022 may be simply visualized now. That is primarily as a result of efficiency of mid and small cap shares. Nevertheless, the period of this outperformance stays unsure. Upon analyzing the consistency between Nifty 500 TRI Index and Nifty 100 TRI, it’s evident that the previous outperformed the latter 47% of the time. Equally, the Nifty 500 TRI Index outperformed the Nifty 50 TRI 56% of the time.

Nevertheless, allow us to not choose the outperformance by taking a look at simply 3 years of rolling returns.

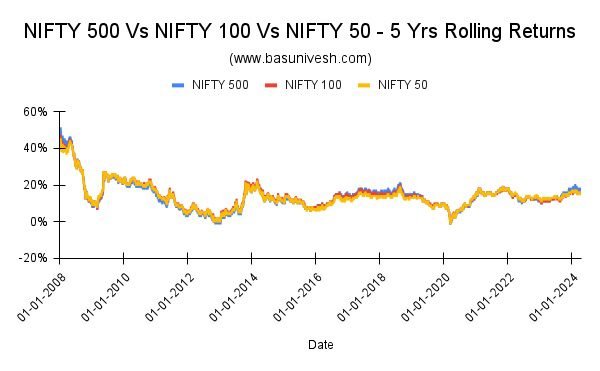

NIFTY 500 TRI Vs NIFTY 100 TRI Vs NIFTY 50 TRI – 5 Yrs Rolling Returns

It is very important point out that the distinction isn’t obvious when trying on the rolling returns over a 5-year interval. Nevertheless, when analyzing the consistency of the Nifty 500 TRI Index’s outperformance in comparison with the Nifty 100 TRI Index, it’s fairly astonishing. The Nifty 500 TRI Index outperformed the Nifty 100 TRI Index in solely 37% of instances, and when in comparison with the Nifty 50 TRI Index, it was 38%. The extent of constant outperformance decreased considerably from the 1-year and 3-year intervals to the 5-year interval.

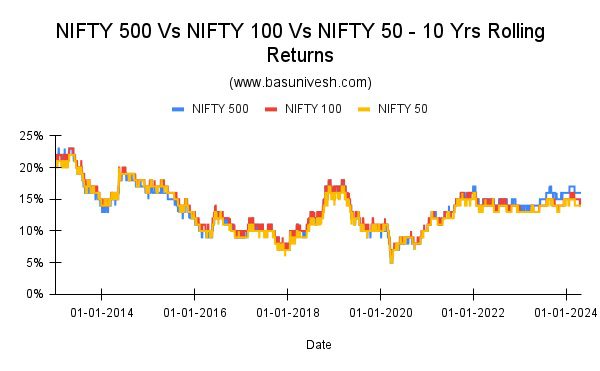

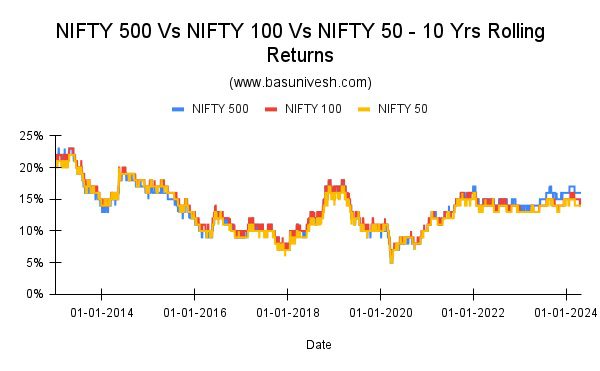

NIFTY 500 TRI Vs NIFTY 100 TRI Vs NIFTY 50 TRI – 10 Yrs Rolling Returns

In analyzing the 10-year rolling returns, it’s evident that the extent of outperformance consistency has considerably decreased. The Nifty 500 TRI Index surpassed the Nifty 100 TRI by 32% on a number of events. Conversely, the Nifty 500 TRI Index outperformed the Nifty 50 TRI Index by 62% on quite a few events. This outperformance is basically attributed to the Midcap and Smallcap sectors, significantly in recent times.

Conclusion – Don’t be influenced by the current efficiency of Midcap and Smallcap indices when deciding on an Index that has publicity to those sectors. Upon reviewing historic knowledge, it turns into evident that investing within the Nifty 500 Index might not be probably the most useful choice. Choosing a less complicated Nifty 50 or Nifty 100 Index would suffice for diversification functions.