I’ve checked out nation danger, in all its dimensions, in direction of the center of every yr, for the final decade, for a lot of causes. One is curiosity, as political and financial crises roll by way of areas of the world, roiling long-held beliefs about secure and dangerous nations. The opposite is pragmatic, since it’s nearly inconceivable to worth an organization or enterprise, with no clear sense of how danger publicity varies internationally, since for a lot of corporations, both the inputs to or their manufacturing processes are in international markets or the output is exterior home markets. Coca Cola is a US firm, when it comes to historical past and incorporation, but it surely generates a good portion of its revenues from the remainder of the world. Royal Dutch could also be a UK (or Dutch) firm, when it comes to incorporation and buying and selling location, but it surely extracts its oil and fuel from a number of the riskiest elements of the world. Since nation danger is multidimensional and dynamic, my annual nation danger replace runs to greater than 100 (boring) pages, however I’ll attempt to summarize what the final yr has introduced on this put up.

Drivers of Nation Threat

What makes some nations riskier than others to function a enterprise in? The reply is sophisticated, as a result of every little thing has an impact on danger, beginning with the political governance system (democracy, dictatorship or one thing in between), the extent of corruption within the system, the authorized system (and its safety for property rights) and the presence or absence of violence within the nation (from wars inside or with out). The desk under, which I’ve utilized in prior updates, captures the mail drivers of nation danger:

Issues get much more sophisticated whenever you acknowledge that these drivers are sometimes correlated with, and drive, one another. Thus, a rustic that’s ravaged by warfare and violence is extra more likely to have a weak authorized system and be corrupt. Moreover, all of those danger exposures are dynamic, and alter over time, as governments change, violence from inner or exterior forces flares up.

As you assess these components, you’ll be able to see in a short time that nation danger is a continuum, with some nations uncovered much less to it than others. It’s for that cause that we needs to be cautious about discrete divides between nations, as is the case once we categorize nations into developed and rising markets, with the implicit assumption that the previous are secure and the latter are dangerous. To the extent that divide is not only descriptive, but additionally drives actual world funding, each corporations and buyers could also be misallocating their capital, and I’ll argue for finer delineations of danger.

1. Democracy throughout the Globe

In case your focus stays on financial danger, the query of whether or not democracies or authoritarian regimes are much less dangerous for companies to function in relies upon largely on whether or not these companies are extra unsettled by day-to-day steady danger, which is commonly the case with democracies, the place the foundations can change when new governments will get elected, or by discontinuous danger, which might lie dormant for lengthy intervals, however when it does happen, it’s bigger and generally catastrophic, in an authoritarian authorities. Assessing freedom and democracy in nations is a fraught train, with each political and regional biases enjoying out, and that needs to be stored in thoughts whenever you take a look at the warmth map that exhibits the outcomes of the Economist’s measures of democracy, by nation and area, in 2022, in addition to pattern traces throughout time:

Whereas the worldwide combination worth for 2022 is similar to the worth in 2021, there was a major drop off since 2016, at the least in line with this measure. In 2022, North America and Western Europe scored highest on the democracy index, and Center East and Africa scored the bottom.

For my part, the query of whether or not companies desire the continual change (or, in some instances, chaos) that characterizes democracies or the potential for discontinuous and generally jarring change in authoritarian regimes has pushed the controversy of whether or not a enterprise ought to really feel extra snug investing in India, a generally chaotic democracy the place the foundations hold altering, or in China, the place Beijing is healthier positioned to vow continuity. For 3 many years, China has gained this battle, however in 2023, the battleground appears to be shifting in favor of India, however it’s nonetheless too early to make a judgment on whether or not this can be a long run change, or only a hiccup.

2. Violence throughout the Globe

When a rustic is uncovered to violence, both from the surface or from inside, it not solely exposes its residents to bodily danger (of assault or dying), but additionally makes it harder to run companies inside its borders. That danger can present up as prices (of shopping for safety or insurance coverage) or as uninsurable dangers that drive up the charges of return buyers and companies must make, in an effort to function. Once more, there are subjective judgments at play in these measures, however the map under offers you 2023 scores for peace scores, with decrease (larger) scores indicating much less (extra) publicity to violence.

Iceland and Denmark high the listing of most peaceable nations, however in an indication that geography is just not future, Singapore makes an look on that listing as properly. On the lease peaceable listing, it ought to come as no shock that Russia and Ukraine are on the listing, however Sub-Saharan Africa is disproportionately represented.

3. Corruption throughout the Globe

Corruption is a social ailing that manifests itself as a price to each enterprise that’s uncovered to it. As anybody who has ever tried to get something accomplished in a corrupt setting will attest, corruption provides layers of prices to routine operations, thus change into an implicit tax that corporations pay, the place the cost as a substitute of going to the general public exchequer, finds its approach into the pockets of intermediaries. Transparency Worldwide measures corruption scores, by nation, internationally and their 2022 measures are within the map under:

A lot of Western Europe, Australia & New Zealand and Canada/United States fall into the least corrupt class, however corruption stays a major concern in a lot of the remainder of the world. Whereas it simple to attribute the corruption drawback to politicians and governments, it’s price noting that when corruption turns into embedded in a system, it’s troublesome to take away, because the construction evolves to accommodate it. Put merely, a system the place the rule-makers, regulators and bureaucrats receives a commission a pittance (on the idea that they are going to be complement their pay with aspect funds) to log out on contracts which might be price billions will inevitably create corruption as a aspect price.

4. Authorized Safety throughout the Globe

To function a enterprise efficiently, you want a authorized system that enforces contractual obligations and protects property rights, and does so in a well timed method. When a authorized system permits contracts and authorized agreements to be breached, and property rights to be violated, with no or extraordinarily delayed penalties, the one companies that survive would be the ones run by lawbreakers, and never surprisingly, violence and corruption change into a part of the package deal. The Property Rights Alliance measures the safety provided for property rights (mental, bodily), with larger (decrease) scores going with higher (worse) safety, and their most up-to-date replace (from 2022) is captured within the image under:

By now, you’ll be able to see the purpose in regards to the correlation throughout the assorted dimensions of nation danger, with the elements of the world (North America, Europe, Australia and Japan) which have essentially the most democratic techniques and the least corruption scoring highest on the authorized safety scores. Conversely, the areas (Africa, giant parts of Asia and Latin America) which might be least democratic, with essentially the most violence and corruption, have essentially the most porous authorized techniques.

Measures of Nation Threat

With the lengthy lead in on the size of nation danger, we will now flip to the extra sensible query of the right way to convert these completely different parts of danger into nation danger measures. We are going to begin with a restricted measure of the danger of default on the a part of governments, i.e., sovereign default danger, earlier than increasing that measure to think about different nation dangers, in political danger scores.

1. Default Threat

Companies and people that borrow cash generally discover themselves unable to fulfill their contractual obligations, and default, and so can also governments. The distinction is that authorities or sovereign default has a lot higher spillover results on all entities that function inside its borders, thus creating enterprise dangers. We begin with an evaluation of sovereign scores, a extensively accessible and hotly contested, of presidency default danger after which transfer on to market-based measures of this danger within the type of sovereign default spreads.

a. Sovereign Scores

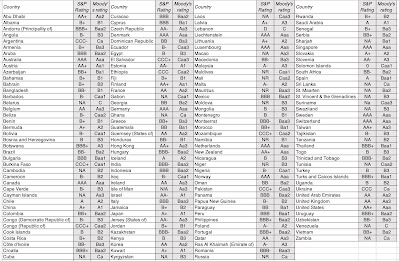

Probably the most extensively used measures of sovereign default danger come from a well-known supply for default danger measures, the scores companies. S&P, Moody’s and Fitch, along with ranking corporations for default danger, additionally charge governments, and so they charge them each on native forex debt, in addition to international forex debt. The explanation for the differentiation is easy, since nations needs to be much less more likely to default, after they borrow of their home currencies, than after they borrow in a international forex. The desk under summaries the sovereign native forex scores for nations in June 2023, from S&P and Moody’s:

Native Forex Scores for nations (Some UAE emirates have scores which might be impartial of the scores for the UAE, as a result of they situation their very own sovereign debt)

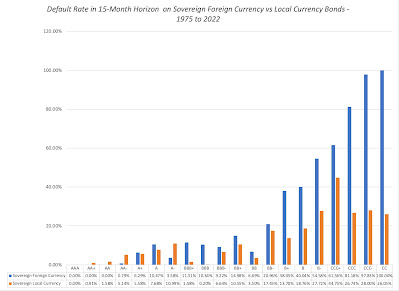

The scores scheme mirrors the one used to charge corporations, with the important thing distinction being on the Aaa (AAA) ranking, with a sovereign getting that ranking seen as having no default danger, whereas a company with that ranking nonetheless has some. In case you are questioning why there needs to be any default danger when governments borrow in a home forex, since these governments ought to have the ability to print cash to repay debt, the reply is that money-printing debases a forex and given a selection between forex debasement and default, many nations select to default. The determine backs up this proposition:

Notice that whereas nations are much less more likely to default on native forex than international forex bonds, the default charges within the former stay substantial. As well as, the excellent news, if you’re a person of sovereign scores, is that they clearly are correlated strongly with scores, with larger default charges for lower-rated sovereigns.

I do know that there are a lot of who’ve points with the scores companies, however I do assume that the battle of curiosity story, the place scores companies connect larger scores to entities, as a result of they receives a commission to charge them, is overdone, and particularly so with sovereign scores (the place the income streams are paltry). For my part, the most important drawback with scores companies is just not that they’re biased, however that they take too lengthy to regulate scores to modifications in a rustic and that they generally underrate or overrate areas of the world, due to their histories. Consequently, Latin American nations must work tougher to enhance their scores, or maintain present scores, than the US or European nations, which get a bye, as a result of they don’t have a historical past of default.

b. Sovereign CDS Spreads

One of many benefits of a market-based measure is that the market value displays investor perceptions of danger in the mean time. Sovereign Credit score Default Swaps (CDS) supply a market-based measure of default danger, since buyers purchase these swaps as safety in opposition to default on authorities bonds. When the sovereign CDS market got here into being a number of many years in the past, there have been solely a handful of nations that had been traded, however the market has expanded, and there are traded credit score default swaps on nearly 80 nations in June 2023. The graph under exhibits the sovereign CDS ranges, by nation:

Is a sovereign CDS unfold a greater measure of default danger than a sovereign ranking? The reply is blended. It’s true {that a} sovereign CDS unfold offers you a extra up to date measure of default danger, since it’s market-set, however as with all market-based measures, it comes with much more volatility and overshooting than a ratings-based unfold, and it’s out there for less than a subset of nations. My suggestion is that for nations the place latest political or financial occasions would lead you to imagine that sovereign ranking is dated, you need to change to utilizing sovereign CDS spreads.

2. Threat Scores

The benefit of default spreads is that they supply an observable measure of danger that may be simply included into low cost charges or monetary evaluation. The drawback is that they’re centered on simply default danger, and don’t explicitly issue within the different dangers that we enumerated within the final part. Since these different dangers are so extremely correlated with one another, for many counties, it’s true that default danger turns into an cheap proxy for total nation danger, however there are some nations the place this isn’t the case. Think about parts of the Center East, and particularly Saudi Arabia, the place default danger is just not important, because the nation borrows little or no and has an enormous money cushion from its oil reserves. Buyers in Saudi Arabia are nonetheless uncovered to important dangers from political upheaval or unrest, and should desire a extra complete measure of nation danger.

There are various companies, together with the World Financial institution and the Economist, who supply complete nation danger scores, and the map under consists of composite nation danger scores from Political Threat Companies in June 2023:

Fairness Threat throughout International locations

Default danger measures how a lot danger buyers are uncovered to, when investing in bonds issued by a authorities, however whenever you personal a enterprise, or the fairness in that enterprise, your danger publicity is not only magnified, but additionally broader. For 3 many years, I’ve wrestled with measuring this extra danger publicity and changing that measurement into an fairness danger premium, but it surely stays a piece in progress.

To estimate the fairness danger premium, for many nations I begin with default spreads, both based mostly on the sovereign scores assigned by the scores companies, or from the market, within the type of sovereign CDS spreads. To account for the truth that equities are riskier than bonds, I scale the usual deviation of an rising market fairness index (S&P Rising BMI) to an rising market authorities bond ETF (iShares JPM USD Rising Markets Bond ETF), and use this ratio (1.42 in my July 2023 replace) and apply this scalar to the default unfold, to reach at a nation danger premium. Including that nation danger premium on to the premium that I estimate for the S&P 500 (which was 5.00% at first of July 2023, and is my measure of a mature market premium), yields the whole fairness danger premium for a rustic:

To offer an instance, think about India, which with a sovereign ranking of Baa3, has a default unfold of two.35% in July 2023. Multiplying this default unfold by the scalar (1.42) and including to the fairness danger premium for the S&P 500 leads to an fairness danger premium of 8.33% for India.

India ERP = Implied ERP for S&P 500 + Default unfold for India * Scalar for Fairness Threat

= 5.00% + 2.35% (1.42) = 8.33%

It’s price noting that utilizing the sovereign CDS unfold for India of 1.42% would have resulted in a decrease fairness danger premium for India, at 7.02%.

Utilizing the ratings-based default spreads as beginning factors, I estimate the fairness danger premiums for all nations rated by both S&P and Moody’s within the image under. (For the many individuals who will level to their nation’s geographical boundaries being misrepresented on this map, please lower me some slack. This map is solely a tool to summarize fairness danger premiums, by nations, not arbitrate on the place borders ought to go. Suffice to say that if you’re working a enterprise in part of the world that’s contested by two nations, your danger ranges are within the hazard zone, regardless of the place on this planet you’re.)

Caveats and Questions

I began publishing fairness danger premiums about 30 years in the past, and whereas knowledge sources have change into richer and extra full, the core method that I exploit for the estimation has remaining secure. That mentioned, there isn’t a mental firepower or analysis behind these numbers, since I’m letting the default scores companies and danger measurement companies carry that weight. I’m not a rustic danger researcher, and I strive to not let my private views alter the numbers that emerge from the evaluation, since that might open the door to my biases. I’ll use three nations within the newest replace as an instance my level:

- Saudi Arabia: As I famous earlier, utilizing default spreads as my start line can lead to understating the danger premium for nations like Saudi Arabia, which rating low on default danger however excessive on different dangers.

- Libya: As indicated within the final part, the fairness danger premium for Libya, an unrated nation, is fully based mostly upon the nation danger rating from PRS. That nation danger rating is surprisingly excessive (indicating low danger) and it leads to an fairness danger premium that’s low, relative to different nations within the area.

- China: China has a excessive sovereign ranking and a low sovereign CDS unfold, indicating that buyers in Chinese language authorities bonds do not see a lot default danger within the nation. Within the aftermath of a Beijing crackdown on Chinese language tech giants and discuss of a commerce warfare between China and the US, the notion appears to be that China has change into a riskier place to take a position. Which will or is probably not true, however taking a look at how Chinese language equities are priced, buying and selling nonetheless at a number of the highest multiples of earnings on this planet, buyers in fairness markets do not appear to share that view.

With all three of those nations, I selected to not change the numbers that emerged from the info, however when you have sturdy views on these nations or others, nothing is stopping you from changing my numbers with yours.

Firm Hurdle Charges

This put up has already change into for much longer than I supposed it to be, however I wish to finish by bringing these fairness danger premiums right down to the corporate stage, and analyzing how they play out in hurdle charges, for use in funding evaluation by corporations and valuation by buyers.

The Forex Query

In my dialogue thus far, you’ll discover that I’ve stayed away from speaking about forex danger in my fairness danger premium dialogue and from forex selections in funding evaluation. I’ve my causes.

-

I do know that the forex selection is the supply of angst for a lot of analysts, and I believe unnecessarily so. Your selection of forex will have an effect on your money flows and your low cost charges, however solely as a result of every forex brings it is personal expectations of inflation, with larger inflation currencies resulting in larger development charges for money flows and better low cost charges.

The mechanism that permits for the low cost charge adjustment to replicate forex is the danger free charge, with currencies with larger anticipated inflation carrying larger danger free charges. In a downloadable dataset linked on the finish of this put up, I estimate riskfree charges in world currencies, based mostly upon the US T.Bond charge because the riskfree charge in US {dollars}) and differential inflation. To offer an instance, utilizing the IMF’s estimate of anticipated inflation for 2023-28 of three% for the US and 13.50% for Egypt, and constructing on the US treasury bond charge of three.80%. the riskfree charge in Egyptian kilos is 14.38%.

Riskfree Fee in EGP = (1+ US T.Bond Fee) (1 + Exp Infl in Egypt) (1+ Exp Infl in US) -1

= (1.038)* (1.135/1.03) -1 = .1438 or 14.38%)

- To the extent that forex danger provides to the working danger of an organization, it’s, for my part, already embedded within the fairness danger premiums that I’ve computed within the final part. In any case, nations with unstable governments, stricken by warfare and corruption, even have essentially the most unstable currencies. The opposite cause to tread flippantly with forex danger is that for buyers with world portfolios, it turns into diversifiable danger, as some corporations profit as a forex strengthens or weakened greater than anticipated and others lose for precisely the identical cause.

My recommendation to you whenever you make a forex selection to your evaluation is that you just choose a forex that you’re snug working with, however then just be sure you keep according to that forex in all your estimates. Thus, for those who select to worth a Russian firm in Euros, slightly than rubles, ensure that your development charges replicate inflation within the Euro zone, however that you just danger premiums and actual development replicate its Russian operations.

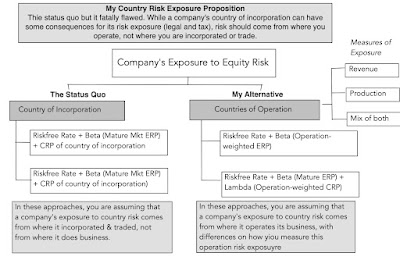

Publicity to Nation Threat

For a lot of my valuation journey, the established order in valuation has been to take a look at the place an organization is included to find out its danger publicity (and the fairness danger premium to make use of in assessing a hurdle charge). Whereas I perceive that the place you’re included and traded can impact your danger publicity, I believe it’s dwarfed by the danger publicity from the place you use. An organization that’s included in Germany that will get all of its revenues in Turkey, is way extra uncovered to the nation danger of Turkey than that of Germany. Within the image under, I distinction the normal country-of-incorporation based mostly danger measure with my various, the place fairness danger premiums come from the place you use:

We are able to debate how greatest to measure working danger publicity, since it might probably come from each the place you promote your services and products (revenues) in addition to the place you produce these services and products.

There are implications not only for buyers, however for corporations. For buyers, an operating-risk perspective will imply that there are some rising market corporations that others might understand as dangerous, merely due to their nation of incorporation, however are a lot safer, as a result of they get their revenues from a lot safer elements of the world. Embraer, the Brazilian aerospace firm, and Tata Consulting Companies, an Indian software program firm, could be good examples. Conversely, there are developed market corporations which might be considerably uncovered to nation danger, both due to the place they produce (Royal Dutch) or the place they promote their services and products (Coca Cola). For multinational corporations, an working danger perspective will indicate that there may be nobody hurdle charge throughout geographies, since a venture in Turkey ought to require the next fairness danger premium (and hurdle charge) than an in any other case related venture in Germany.

Conclusion

It’s ironic {that a} put up that was meant to shorten and summarize an extended paper has itself stretched to change into the equal of an extended paper, and I apologize. I do hope that you just get an opportunity to learn the paper or at the least overview my nation danger measures on this put up, since there may be important room for enchancment. I haven’t got all of the solutions, and I most likely by no means will, however progress is incremental, and every year, I hope that I can add a tweak or a element that may transfer me in the best path. Additionally, please don’t take any of those numbers personally. Briefly, for those who really feel that I’ve overestimated the danger in your nation and given it an fairness danger premium that you just imagine is undeservedly excessive, it’s not as a result of I don’t such as you and your nation. It’s fully Moody’s fault for giving your nation too low a ranking, and you need to take it up with them!

YouTube Video

Nation Threat Paper

Nation Threat Information

- Democracy, Violence, Corruption and Authorized System Scores, by Nation, in July 2023

- Sovereign Scores and CDS Spreads for International locations in July 2023

- Fairness Threat Premiums, by Nation, in July 2023

Forex Information