Debt’s place in enterprise

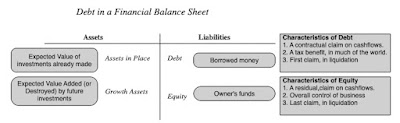

To know debt’s function in a enterprise, I’ll begin with an enormous image perspective, the place you break a enterprise down into assets-in-place, i.e., the worth of investments it has already made and progress property, the worth of investments you count on it to make sooner or later. To fund the enterprise, you’ll be able to both use borrowed cash (debt) or proprietor’s funds (fairness), and whereas each are sources of capital, they characterize totally different claims on the enterprise. Debt supplies contractual claims, within the kind on curiosity funds and principal repayments, whereas fairness is a residual declare, i.e., you obtain no matter money flows, if any, which might be left over after different declare holders have been paid:

Good Causes for Borrowing

What are the pluses and minuses of borrowing, for those who take a clear-eyed take a look at it simply as a capital supply? First, borrowing cash can’t alter the working danger in a enterprise, which comes from the property that it holds, both in-place or as progress investments, however it’s going to have an effect on the chance to fairness traders in that enterprise, by making their residual declare (earnings) extra unstable, As well as, the contractual declare that comes with debt can create truncation danger, as a result of failing to make curiosity or principal funds can lead to chapter, and efficient lack of fairness. Second, borrowing cash at a decrease charge, by itself, can’t alter your general value of funding, since that value is decided by the chance of your property. Therefore, the advantages of borrowing at a decrease charge will all the time be offset by a better value for fairness traders, leaving the price of funding unchanged, until a finger is placed on the dimensions, giving one supply particular advantages. In a lot of the world, governments have written tax codes that do precisely this, by making curiosity funds on debt tax-deductible, whereas requiring that money flows to fairness be made out of after-tax money flows. That tax advantage of debt will enhance with the marginal tax charge, making it way more helpful to borrow in nations with excessive tax charges (Germany, Japan, US) over these with decrease tax charges (Eire, a lot of Jap Europe). The chart under lists the tax advantages as the first advantage of borrowing and the anticipated chapter value as the first draw back of debt:

There are additionally ancillary advantages and prices that the chart notes, with debt working as a disciplinary instrument in some companies, when managers take into account taking new initiatives, since dangerous initiatives can plunge the agency into chapter 11 (and trigger managers to lose their jobs), and the problem of managing the conflicting pursuits of fairness traders and lenders, that manifest in covenants, restrictions, and authorized prices.

Dangerous Causes for Borrowing

On the opposite aspect of the ledger, there are some firms that refuse to borrow cash for dangerous causes as properly. The primary is that borrowing cash will decrease internet earnings, as curiosity bills get deducted from working earnings, however that decrease internet earnings shall be accompanied by much less fairness invested within the agency, typically resulting in greater earnings per share, albeit with greater volatility. The second is that borrowing cash will enhance perceived default danger, and if the corporate is rated, decrease rankings, and that too is true, however borrowing cash at a BBB ranking, with the tax profit integrated, would possibly nonetheless yield a decrease value of funding that staying at a AA ranking, with no debt in use.

The “Proper” Financing Combine

Is there an optimum mixture of debt and fairness for a enterprise? The reply is sure, although the payoff, when it comes to worth, from transferring to that optimum could also be so small that it’s generally higher to carry again from borrowing. On this part, I’ll lay out a mechanism for evaluating the consequences of borrowing on the price of funding a enterprise, i.e., the price of capital, and discuss why companies might beneath or overshoot this optimum.

An Optimizing Software

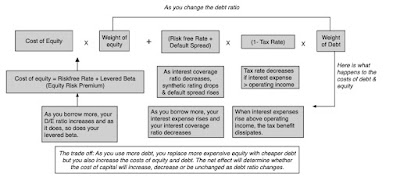

In my second and third information posts for this yr, I chronicled the consequences of rising rates of interest and danger premiums on prices of fairness and capital. In computing the latter, I used the present debt ratios for companies, however made no try to guage whether or not these mixes had been “proper” or not. That mentioned, the price of capital can be utilized as an optimizing instrument in assessing the correct mix of debt and fairness, with the optimum combine being the one which yields the bottom value of capital. That computation, although, is a dynamic one, since each the price of fairness and the price of debt will change as a enterprise modifications its debt ratio:

In impact, you’re buying and selling off the advantages of changing dearer fairness with lower-rate debt towards the ensuing greater prices of fairness and debt, if you borrow extra. As you’ll be able to see, the online impact of elevating the debt ratio on the price of capital will rely on the place a agency stands, relative to its optimum, with beneath levered companies seeing prices of capital lower, as debt ratio will increase, and over levered companies seeing the other impact.

As to the variables that decide what that optimum debt ratio is for a agency, and why the optimum debt ratio can vary from 0% for some companies to shut to 90% for others, they’re easy and intuitive:

- Marginal tax charge: If the first advantage of borrowing is a tax profit, the upper the marginal tax charge, the upper its optimum debt ratio. In reality, at a zero p.c tax charge, the optimum debt ratio, for those who outline it as the combo that minimizes value of capital is zero. The image under captures variations in company marginal tax charges, getting into 2023, internationally:

Obtain marginal tax charges, by nation As you’ll be able to see from the warmth map and desk, most nations have converged round a tax charge of 25%, with just a few outliers in Jap Europe and components of Center East having marginal tax charges of 15% or decrease, and some outliers, together with Australia, India and components of Africa with marginal tax charges that exceed 30%. Of those nations, Australia does provide safety from double taxation for fairness traders, successfully endowing fairness with some tax advantages as properly, and decreasing the marginal tax advantages from including debt.

- Money producing capability: Debt funds are serviced with working money flows, and the extra working money flows that companies generate, as a p.c of their market worth, the extra that they’ll afford to borrow. One simplistic proxy for this money producing capability is EBITDA as a p.c of enterprise worth (EV), with greater (decrease) values indicating larger (lesser) money movement producing capability. In reality, that will clarify why companies that commerce at low EV to EBITDA multiples usually tend to develop into targets in leveraged buyouts (LBOs) or leveraged recapitalizations..

- Enterprise danger: Not surprisingly, for any given stage of money flows and marginal tax charge, riskier companies shall be able to carrying much less debt than safer companies. That danger can come from many sources, some associated to the agency (younger, evolving enterprise mannequin, extremely discretionary merchandise/providers), some to the sector (cyclical, commodity) and a few to the general economic system (unstable). The corporate-specific elements present up within the danger parameters that you simply use for the agency (beta, ranking) and the macro and market-wide elements present up within the macro inputs (riskfree charges, fairness danger premiums)

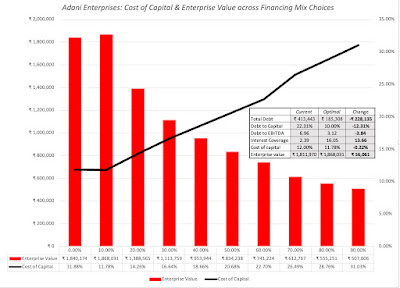

If you’re fascinated about checking how this optimization works, obtain this spreadsheet, and take a look at altering the inputs to see the impact on the optimum. I appeared Adani Enterprises, the holding firm for the Adani Group and estimated the price of capital and estimated worth at totally different debt ratios:

In my evaluation, Adani Enterprise carries an excessive amount of debt, with precise debt of 413,443 million greater than double its optimum debt of 185,309 million, and decreasing its debt load is not going to simply decrease its danger of failure, but in addition decrease its value of capital. This firm is a part of a household group, the place greater debt at one of many Adani firms could also be offset by much less debt at one other. To cope with this cross subsidization, I aggregated numbers throughout all seven publicly traded Adani firms and estimated the optimum debt combine, relative to the mixed enterprise values:

The Adani Group collectively carries about thrice as a lot debt because it ought to, confirming that the group is over levered as properly, however observe that that is dangerous enterprise apply, not a con. In reality, as you’ll be able to see from the price of capital graph, there’s little, if any, profit when it comes to worth added to Adani from utilizing debt, and vital draw back danger, until the debt is being sponsored by somebody (authorities, sloppy bankers, inexperienced bondholders).

If in case you have taken a company finance class someday in your previous life are most likely questioning how this strategy reconciles with the Miller-Modigliani theorem, a key part of most company finance courses, which posits that there isn’t any optimum debt ratio, and that the debt combine doesn’t have an effect on the worth of a enterprise. That theorem deserves the credit score that it will get for organising the framework that we use to evaluate debt at the moment, however it additionally makes two key assumptions, with the first being that there are not any taxes and the second being that there isn’t any default. Eradicating debt’s greatest profit and price from the equation successfully negates its impact on worth. Altering your debt ratio, within the Miller-Modigliani world, will go away your value of capital unchanged. In the actual world, although, the place each taxes and default exist, there’s a “proper” combine (albeit an approximate one) of debt and fairness, and corporations can borrow an excessive amount of or too little.

Impact on worth

If you happen to can see the mechanics of how altering debt ratio modifications the price of capital, however are unclear on how reducing the price of capital modifications the worth of a enterprise, the hyperlink is a straightforward one. The intrinsic worth of a enterprise is the current worth of its anticipated free money flows to the agency, computed after taxes however earlier than debt funds, discounted again at its value of capital:

As you borrow extra, your free money flows to the agency ought to stay unaffected, normally, since they’re pre-debt money flows, and a decrease value of capital will translate into a better worth, with one caveat. As you borrow extra and the chance of failure/chapter will increase, there’s the likelihood that clients might cease shopping for your merchandise, suppliers might demand money and your workers might begin abandoning ship, making a dying spiral, the place working earnings and money flows are affected, in what’s termed “oblique chapter prices”. In that case, the optimum debt ratio for an organization is the one which maximizes worth, not essentially the one at which the price of capital is minimized.

Do firms optimize financing combine?

Do firms take into account the commerce off between tax advantages and chapter prices when borrowing cash? Moreover, do they optimize they debt ratios to ship the bottom hurdle charges. The reply could also be sure for just a few companies, however for a lot of, debt coverage is pushed by elements which have little to do with worth and extra with softer elements:

- Inertia: In my opinion, at most firms the important thing determinant of debt coverage, as it’s of most different facets of company finance, is inertia. In different phrases, firms proceed the debt insurance policies that they’ve used prior to now, on the mistaken view that if it labored then, it ought to work now, ignoring modifications within the enterprise and within the macro economic system. That, as an example, is the one technique to clarify why older telecom firms, which developed a apply of borrowing massive quantities throughout their time as monopoly cellphone companies, proceed that apply, at the same time as their enterprise have advanced into intensely aggressive, know-how companies.

- Me-to-ism: The second and virtually as highly effective a power in figuring out debt coverage is peer group conduct. Staying with the telecom agency theme, newer telecom firms getting into the house really feel the urge to borrow in massive portions, as a result of different telecom firms borrow. It is for that reason that debt coverage is much extra prone to range throughout trade teams than it’s to range inside an trade group.

- As a result of lenders are prepared to lend me cash: There’s a remaining perspective on debt that may lead firms to borrow cash, even when that borrowing is inimical to their very own properly being, and it’s that if lenders provide them the cash, you can not flip them away. In reality, it’s the excuse that actual property builders use after each growth and bust cycle to elucidate away why they selected to borrow as a lot as they did. The “lenders made me do it” excuse for borrowing cash is about as dangerous because the “the buffet lunch made me overeat” excuse utilized by dieters, and it simply as futile, as a result of finally, the harm is self inflicted.

- Management: In my put up on the Adani Group, I famous that of their zeal for management, insiders, founders and households generally make dysfunctional decisions, and a type of is on borrowing. A rising agency wants capital to fund its progress, and that capital has to return from fairness issuances or new borrowing. When management changing into the dominant prerogative for these operating the agency, they might select to borrow cash, even when it pushes up the price of funding and will increase truncation danger, quite than challenge shares to the the general public (and danger dilution their management of the agency).

Measuring Debt Hundreds

With the lengthy lead in on the commerce off that animates the borrowing resolution, allow us to speak about measure the debt load at an organization. Whereas the reply could appear apparent to you, it isn’t to me, and I’ll begin by debt scaled to capital, a measure of debt’s place within the financing combine, after which take a look at debt scaled to money flows or earnings, typically a greater measure of potential default danger.

Debt to Capital Ratios

Within the monetary steadiness sheet that I used at the beginning of this put up, I famous that there are two methods of elevating capital to fund a enterprise, debt, with its contractual claims on money flows, or fairness, with its residual claims. Following up, it does make sense to take a look at the proportions of every {that a} agency makes use of in funding and that may be measured by debt, as a p.c of capital within the agency. That mentioned, there are (at the very least) 4 variants that you will note in apply, relying on the composition of complete debt, and whether or not capital is obtained from an accounting steadiness sheet (e-book worth) or a monetary steadiness sheet (market worth):

- Gross versus Internet Debt: The gross debt is the overall debt owed by a agency, lengthy and quick time period, whereas the online debt is estimated by netting out money and marketable securities from the overall debt. Whereas there’s nothing inherently that makes one measure superior to the opposite, you will need to keep in mind that gross debt can by no means be lower than zero, however internet debt can, for companies which have money balances that exceed their debt.

- E book versus Market: The e-book debt ratio is constructed round utilizing the accounting measure of fairness, often shareholder’s fairness, as the worth of fairness. The market debt ratio, in distinction, makes use of the market’s estimate of the worth of fairness, i.e., its market capitalization, as the worth of fairness. Whereas accountants, CFOs and bankers are keen on the e-book worth measure, virtually all the pieces in company finance revolves round market worth weights, together with the debt to fairness ratios we use to regulate betas and prices of fairness and the debt to capital ratios utilized in computing the price of capital.

There are sub-variants, inside these 4 variants, with debates about whether or not to make use of solely long-term debt or all debt and about whether or not lease debt must be handled as debt. My recommendation is that you simply take into account all interest-bearing debt is debt, and that choosing and selecting what to incorporate is an train in futility.

I computed gross and internet debt ratios for all publicly traded, non-financial service companies, at the beginning of 2023, relative to each e-book and market worth, with the distribution of debt ratios at the beginning of 2023 under:

If in case you have been fed a gradual weight loss program of tales of rising indebtedness and profligate firms, you can be stunned by the outcomes. The median debt ratio, outlined each in e-book and market phrases, for a worldwide agency at the beginning of 2023 was between 10% and 20% of general capital. It’s true that there are variations throughout areas, as you’ll be able to see within the desk under, which computes the debt ratios based mostly upon aggregated debt and fairness throughout all companies and is thus nearer to a weighted common. On a e-book debt ratio foundation, the US, as a area, has the best debt ratio on the planet, however on a market debt ratio foundation, Latin America and Canada have the best debt hundreds.

The issue with utilizing debt to capital ratios to make judgments on whether or not companies are carrying an excessive amount of, or too little, debt is that, on the danger of stating the apparent, you can not make curiosity funds or repay debt utilizing capital, e-book or market. Put merely, you’ll be able to have a agency with a excessive debt to capital ratio with low default danger, simply as you’ll be able to have a agency with low debt to capital with excessive default danger. It’s one purpose {that a} banking concentrate on complete property and market worth, when lending to a agency, can result in dysfunctional lending and troubled banks. To the retort from some bankers which you could liquidate the property and get better your loans, I’ve two responses. First, assuming that e-book worth is the same as liquidation worth might let bankers sleep higher at night time, however it may be delusional in industries the place they’re no prepared consumers for these property. Second, even when liquidation is an choice, a banker who depends on liquidating property to gather on loans has already misplaced on the lending sport, the place the target is to gather curiosity and principal on loans, whereas minimizing defaults and liquidations.

Debt to EBITDA, Curiosity Protection Ratios

If debt to capital shouldn’t be a great measure for judging over or beneath leverage, what’s? The reply lies in an organization’s earnings and money movement capability, relative to its debt obligations. The curiosity protection ratio is the primary of two ratios that I’ll use to measure this capability:

Curiosity Protection Ratio = Earnings earlier than curiosity and taxes/ Curiosity bills

Debt to EBITDA = Whole Debt/ EBITDA

The logic behind this measure is straightforward. The denominator is a measure of working money flows, previous to an entire host of money outflows, however a agency that borrows an excessive amount of relative to EBITDA is stretching its capability to repay that debt.

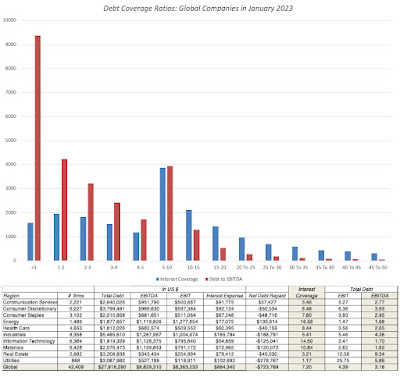

I compute each ratios (curiosity protection and Debt to EBITDA) for all publicly traded companies and the outcomes are graphed under, with the vital caveat that they transfer in opposing instructions, when measuring security, with safer companies having greater curiosity protection rations and decrease Debt to EBITDA multiples;

To get a more in-depth take a look at distinction throughout firms, I appeared on the 94 trade teams that I break down firms into, and take a look at probably the most extremely levered (with complete debt to EBITDA as my main sorting proxy, however reporting my different debt load measures) and least extremely levered trade teams, simply US publicly traded firms:

|

| Obtain all trade group information |

The Default Query

The largest draw back of debt is that it will increase publicity to default danger, and because the final a part of this evaluation, I’ll take a look at default charges over time, culminating in 2022, after which stay up for the challenges that firms will face in 2023 and past.

Enterprise Default: The what and the why

- Firm-specific troubles: A deterioration in an organization’s working enterprise, both due to aggressive pressures or the corporate’s personal errors, may cause working money flows to drop, placing a once-healthy firm susceptible to default. In some instances, the shock to the corporate’s earnings and money flows can come from the lack of a lawsuit (giving rise to massive new commitments), a regulatory advantageous or different sudden money outflow.

- Sector-wide points: If disruption is the phrase that has excited enterprise capitalists and traders internationally for a lot of this century, it comes with a darkish aspect, which is that the disrupted companies can discover themselves with imploding enterprise fashions (shrinking revenues and working margins beneath stress). As a consequence, over time, these disrupted companies discover themselves increasingly uncovered to default danger; Mattress, Bathtub and Past has much less debt excellent now than they did a decade in the past, however have gone from credit score worthy to bankrupt over that interval.

- Macroeconomic shocks/changes: Some companies, particularly in commodity and cyclical trade teams, have all the time been and can proceed to be uncovered to cycles that may trigger working earnings, even for the most effective run and most mature firms, to swing wildly from interval to interval. Oil firms, as an example, went from being money-losers (on an working earnings foundation) in 2020, when oil costs plunged, to among the many greatest money-makers within the enterprise world in 2022. Talking of 2020, all of us keep in mind the COVID-driven shutting down of the worldwide economic system within the first half of the yr and the havoc it wreaked on debtors and lenders, as a consequence.

- Debt fee surges: There’s a remaining purpose for default, which a surge in debt funds arising from rising rates of interest and the refinancing of current debt at these greater charges. Put merely, an organization with a billion {dollars} in debt excellent, at a 2% rate of interest, will see its curiosity funds double, if charges double to 4%, and the debt is refinanced. Traditionally, this has been extra a problem in rising markets, the place companies borrow quick time period and charges are unstable, than in developed markets, the place a mixture of longer-term debt and extra secure rates of interest has insulated companies from the worst of this phenomenon. However as I famous in my information put up on rates of interest, the final yr (2022) has been a most uncommon one, when it comes to rate of interest strikes, in developed markets.

Whereas all firms are uncovered in a method or one other to all of those elements, borrowing extra money (and rising contractual commitments) will amplify the consequences; a extra levered oil firm shall be extra uncovered to default danger than a much less levered oil firm, holding all else fixed.

Defaults – Historic

|

| Sources: Mortgage Delinquencies from Federal Reserve Web site (FRED) and Company Defaults from S&P |

Scores Actions and The 12 months Forward

|

| S&P Default and Misery, Feb 2023 |

Observe once more that the downgrades in 2022 are nowhere close to the downgrades that you simply noticed in 2008, through the banking disaster, and one purpose was that rising curiosity funds however, the economic system stayed sturdy through the yr.

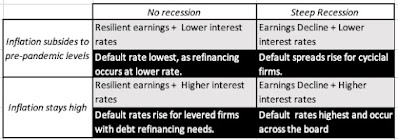

Not surprisingly, a mixture of excessive inflation and a steep recession will create probably the most defaults, because the vice of decrease earnings and better rates of interest will ensnare extra companies. On the different finish of the spectrum, a swift drop off in inflation with no recession will create probably the most benign surroundings for lenders, permitting default to stay low.

A Wrap

In each our private and enterprise lives, there are good causes for borrowing cash and dangerous ones. In spite of everything, the politicians who lecture companies about borrowing an excessive amount of are additionally those who write the tax code that tilts the taking part in discipline in direction of debt, and by bailing out companies or people that get into hassle by borrowing an excessive amount of, they scale back its risks. That mentioned, there’s little proof to again up the proposition {that a} decade of low rates of interest has led firms collectively to borrow an excessive amount of, however there are some that actually have examined the bounds of their borrowing capability. For these companies, the approaching yr shall be a take a look at, as that debt will get rolled over or refinanced, and there are pathways again to monetary sanity that they’ll take.

YouTube Video

Datasets

- Debt ratios, by trade groupings (US, International)

- Delinquency charges on financial institution loans, by Quarter (US): 1985- 2022