J.P. Morgan Self-Directed Investing

Product Identify: J.P. Morgan Self-Directed Investing

Product Description: J.P. Morgan Self-Directed Investing gives commission-free brokerage accounts with minimal investments of simply $1.

Abstract

J.P. Morgan Self-Directed Investing gives buying and selling in particular person shares, ETFs, mutual funds, and choices. Trades are commission-free, and you’ll start investing with simply $1 — though there are not any fractional shares, so that you’ll want extra cash to get began than with another brokers.

Execs

- Fee-free buying and selling of shares and ETFs

- Signal-up bonus of as much as $700

- No account minimal

- Fee-free buying and selling of mutual funds

- Wonderful selection for present Chase Financial institution prospects

Cons

- Not as many funding decisions as different brokers

- No fractional shares supplied

- Extra restricted customer support hours than different giant brokers

- No self-employed retirement plans supplied

- No robo-advisor possibility (J.P. Morgan Automated Investing is being discontinued as of mid-2024)

If you’re a Chase Financial institution buyer or plan to be one quickly, chances are you’ll have an interest to know which you can make investments with the identical firm the place you financial institution.

However even in the event you’re not an present Chase buyer, J.P. Morgan Self-Directed Investing is obtainable to everybody and could be a wonderful selection in the event you’re trying to put money into mutual funds, because it’s one in all solely a handful of brokers providing commission-free trades in mutual funds.

At a Look

- Gives commission-free buying and selling of shares and ETFs.

- Open an account with no minimal deposit required.

- Fee-free buying and selling of mutual funds.

- Alternative to take a position with the biggest financial institution in America.

- Native branches in 48 states.

Who Ought to Use J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is accessible to the overall investing public, however it might be of particular curiosity to present Chase Financial institution prospects. Not solely will it allow you to have interaction in self-directed investing on the identical establishment the place you financial institution, however it would present a seamless solution to switch funds between accounts.

You might also be all in favour of J.P. Morgan Self-Directed Investing in the event you favor investing in mutual funds. The platform gives commission-free trades in practically 3,000 mutual funds — a critical benefit in the event you frequently commerce these.

J.P. Morgan Self-Directed Investing might be not a sensible choice for brand new and small buyers. The platform doesn’t accommodate buying and selling in fractional shares, so that you’ll want a bigger amount of money to take a position — despite the fact that no minimal preliminary funding deposit is required.

J.P. Morgan Self-Directed Investing Options

Desk of Contents

- At a Look

- Who Ought to Use J.P. Morgan Self-Directed Investing?

- J.P. Morgan Self-Directed Investing Options

- What Is J.P. Morgan Self-Directed Investing?

- Investments Provided

- Pricing

- Signal-Up Bonus – as much as $700

- Different Options

- J.P. Morgan Self-Directed Investing vs. E*TRADE

- J.P. Morgan Self-Directed Investing vs. Webull

- J.P. Morgan Self-Directed Investing vs. Robinhood

- FAQs

- Abstract

What Is J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing gives taxable funding brokerage accounts, conventional IRAs, and Roth IRAs. Every account could be opened with no cash, and you’ll start buying and selling along with his little as $1.

Nevertheless, J.P. Morgan Self-Directed Investing doesn’t provide a number of different account sorts generally offered by its opponents. These embrace self-employed retirement accounts, corresponding to SEP and SIMPLE IRAs and Solo 401(ok) plans, in addition to 529 school financial savings plans and belief accounts.

Investments Provided

J.P. Morgan Self-Directed Investing gives buying and selling in particular person shares, exchange-traded funds (ETFs), mutual funds, and choices.

Fastened-income investments out there embrace:

- U.S. Treasury payments, notes, and bonds, each at public sale and on secondary markets.

- Secondary market buying and selling of company bonds, municipal bonds, and authorities company bonds.

- Brokered certificates of deposit (CDs), each new problem and secondary market trades.

No fractional shares. J.P. Morgan Self-Directed Investing doesn’t provide fractional shares. That’s if you buy slices of shares (moderately than full shares). This may occasionally restrict the worth of this platform for newer and smaller buyers.

Funding Analysis

Funding analysis is offered by J.P. Morgan Analysis, in addition to by Concepts & Insights, each proprietary providers supplied by J.P. Morgan Chase. They’re designed that will help you make knowledgeable choices with strategic evaluation and funding recommendation.

J.P. Morgan Analysis supplies an in depth evaluation of greater than 1,200 publicly traded U.S. corporations.

Pricing

J.P. Morgan Self-Directed Investing supplies the next pricing construction for funding buying and selling:

- Shares and ETFs: $0 per commerce, topic to a transaction price of between $0.01 and $0.03 per $1,000 in principal

- Choices: $0 per commerce + $0.65 per-contract price, topic to a transaction price of between $0.01 and $0.03 per $1,000 in principal

- Mutual funds: $0 per commerce

Name-in trades require a price of $25 per commerce for shares, ETFs, and choices, and $20 for mutual funds.

For fixed-income securities, the fee construction is as follows:

- U.S. Treasury payments, notes, and bonds: $0 per commerce (consists of each auctions and secondary market purchases)

- Newly issued brokered CDs: $0 per commerce

- Company, municipal, and authorities company bonds, and brokered CDs bought on the secondary market: $10 per commerce + $1 per bond over 10 bonds ($250 most)

Name-in trades of company bonds, municipal bonds, authorities company bonds, and brokered CDs bought on the secondary market require a price of $30 per commerce + $1 per bond over 10 bonds ($270 most).

There isn’t any price premium for call-in trades of U.S. Treasury payments, notes, and bonds, or of newly issued brokered CDs. Margin rates of interest are as follows (as of April 25, 2024):

- $0 to $25,000: Prime + 4.75%

- $25,001 to $50,000: Prime + 4.50%

- $50,001 to $100,000: Prime + 4.00%

- $100,001 to $500,000: Prime + 3.75%

- $500,001 to $1,000,000: Prime + 3.00%

- $1,000,001 to $3,000,000: Prime + 2.50%

- $3,000,001 to $10,000,000: SOFR + 2.35%

- $10,000,001 and above: SOFR + 1.85%

The latest prime price revealed by Chase Financial institution is 8.50%. So if you’re making a margin commerce underneath $25,000, the margin price will likely be 13.25% (4.75% + 8.50%).

Different Charges

J.P. Morgan Self-Directed Investing additionally expenses the next extra charges:

- Brokerage account switch and termination: $75 when all belongings are transferred out of the account

- Retirement account switch and termination: $75 when all belongings are transferred out of the account

- Wire switch price: $25 per wire

- In a single day/specific mail: $10 per merchandise

- Cease funds: $30 per merchandise

- Safekeeping: $10 per place, per 30 days

Signal-Up Bonus – as much as $700

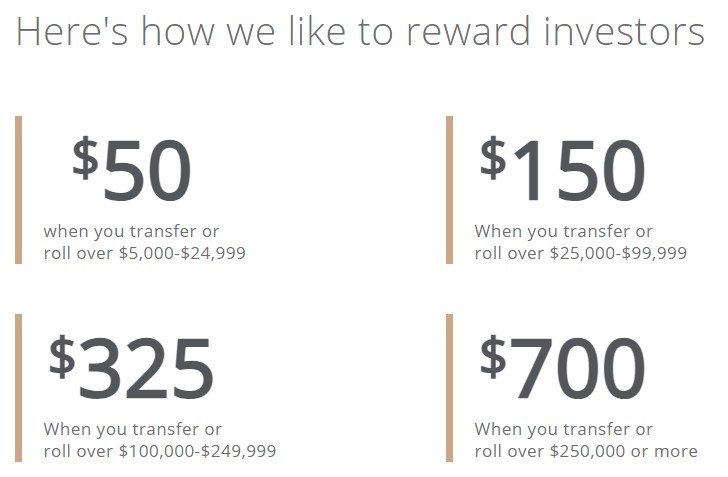

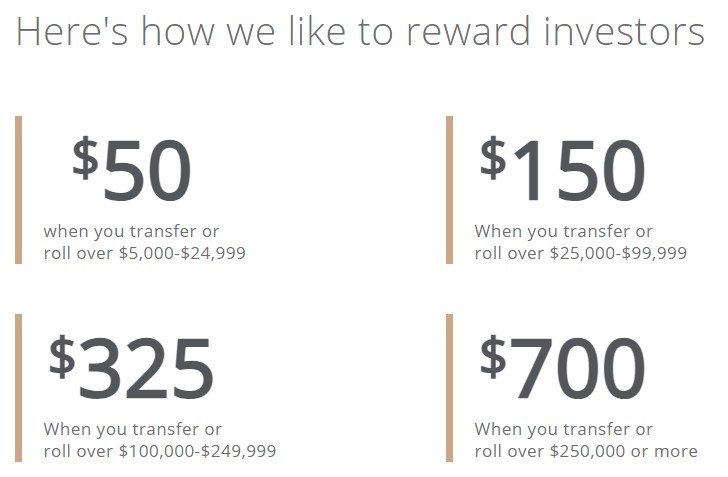

J.P. Morgan Self-Directed Investing is presently providing a tiered sign-up bonus of as much as $700 if you switch the next quantities into a brand new account by 7/19/2024:

The bonus is payable on newly opened accounts solely. It’s payable if you open a taxable funding account, a conventional IRA, or a Roth IRA. The funds have to be transferred inside 45 days of enrollment, and can’t be transferred from one other account with J.P. Morgan Chase and Co., or its associates.

As soon as the funds are deposited into the account, they have to be maintained for no less than 90 days from enrollment. The bonus will likely be credited to the account inside 15 days of assembly all necessities.

You might be eligible for just one bonus in 12 months from the final enrollment date.

IRS Type 1099-MISC could also be despatched to you, and filed with the IRS, which suggests it have to be included as earnings in your tax return.

Get your bonus from J.P. Morgan

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT – NOT FDIC INSURED – NO BANK GUARANTEE – MAY LOSE VALUE

How Does This Bonus Examine?

The provide from J.P. Morgan is just like your typical brokerage bonus and so far as brokerage bonuses go, it’s on par with others:

Different Options

Chase Cell App

J.P. Morgan Self-Directed Investing could be accessed from the J.P. Morgan Cell app, out there for each Android and iOS units.

With the app, you may see intraday funding account balances, place particulars, and transaction historical past, and entry J.P. Morgan Analysis and Concepts & Insights.

As well as, you may handle different Chase accounts on the cell app, and make transfers between accounts.

The Chase Cell App has a score of 4.8 amongst iOS customers, and 4.4 amongst Android customers as of publishing.

Buyer Service

Customer support is accessible by cellphone and by electronic mail, Monday by Friday, from 8:00 AM to 9:00 PM, and Saturdays from 9:00 AM to five:00 PM.

Customer support may additionally be out there at one in all greater than 4,800 Chase Financial institution branches positioned in 48 states.

Account Safety

Investments held with J.P. Morgan Self-Directed Investing are coated by the SIPC for as much as $500,000 in money and securities, together with as much as $250,000 in money.

This protection is designed to guard in opposition to dealer failure, and won’t apply if losses are attributable to market circumstances.

J.P. Morgan Self-Directed Investing vs. E*TRADE

E*TRADE is a well-established on-line brokerage providing most of the identical funding options as the largest brokers, together with commission-free trades of shares, ETFs, and choices.

Very like J.P. Morgan Self-Directed Investing, E*TRADE doesn’t provide fractional share purchases. However they do provide a number of extra funding decisions, together with futures and participation in preliminary public choices (IPOs).

E*TRADE additionally gives extra account choices, together with Coverdell ESAs, custodial accounts for minors, and beneficiary IRAs. And in the event you favor a managed funding possibility, E*TRADE gives their Core Portfolios.

E*TRADE additionally gives a greater choice of funding instruments, particularly concerning choices buying and selling. They even provide a paper buying and selling account that will help you check investing methods with out risking your individual cash.

Whereas E*TRADE does provide a premium financial savings account in addition to a checking account, they don’t present the total vary of banking providers out there by Chase Financial institution. That may be particularly necessary in the event you favor to take a position the place you financial institution.

Learn our full E*TRADE assessment.

J.P. Morgan Self-Directed Investing vs. Webull

Webull doesn’t provide a money sign-on bonus however frequently supplies promotions of free shares or fractional shares if you open a brand new account. Additionally they typically provide incentives for transferring from a competing dealer.

Much like J.P. Morgan Self-Directed Investing, they do provide commission-free buying and selling in shares, choices, and ETFs — however not mutual funds.

Webull is a extra restricted buying and selling platform than J.P. Morgan Self-Directed Investing, however it’s designed primarily for fast-paced buying and selling, like day buying and selling. And as a standalone dealer, there is no such thing as a financial institution tie-in.

Learn our full assessment of Webull.

J.P. Morgan Self-Directed Investing vs. Robinhood

Robinhood works a lot the identical manner as Webull, nevertheless it’s an funding dealer that additionally gives buying and selling in cryptocurrencies — which is an funding possibility J.P. Morgan Self-Directed Investing doesn’t provide.

Robinhood does provide buying and selling in fractional shares and expenses no fee for buying and selling in shares, ETFs, or cryptocurrencies. Robinhood additionally gives participation in a restricted variety of pre-IPO shares.

In a function certain to please IRA buyers, Robinhood is presently offering an identical contribution of between 1% and three% of the investor contribution to an IRA account. Although Robinhood isn’t a financial institution, it supplies curiosity on uninvested money of as much as 5.00% APY. Additionally they provide a money card offering most of the identical advantages as a rewards checking account.

Learn our full assessment of the Robinhood app.

FAQs

A J.P. Morgan Self-Directed Investing account is a brokerage account designed particularly for self-directed investing. Which means you select the investments, how lengthy you’ll maintain them, and in what portfolio configuration. No dealer help is supplied with any such account.

Choices trades can be found commission-free, with a $0.65 per contract price. Nevertheless, there’s a fee of $25 per commerce with dealer help.

You possibly can open an account with no cash in any respect and start investing with as little as $1. Nevertheless, since J.P. Morgan Self-Directed Investing doesn’t accommodate fractional shares investing, you’ll want not less than sufficient funds to buy a complete share of inventory in both a person firm or an ETF.

Although the service is anticipated to be withdrawn in 2024, the present annual advisory price is 0.35% of belongings underneath administration. All present accounts as of that date will likely be transformed to a J.P. Morgan Self-Directed Investing account.

Abstract

As a part of the biggest financial institution in America, J.P. Morgan Self-Directed Investing could be a wonderful selection for present Chase prospects who wish to make investments with the identical establishment the place they financial institution. You possibly can reap the benefits of face-to-face customer support at greater than 4,800 branches throughout the nation.

Whereas J.P. Morgan Self-Directed Investing in all probability isn’t a sensible choice for superior buyers, it may be a sensible choice for mutual fund buyers since there are not any commissions charged on a majority of these funds.