Financial institution FD Vs Debt Mutual Funds – Which is SAFE and BEST? When the returns and taxation of Debt mutual Funds are virtually the identical as FD, then why Debt Mutual Funds?

That is the standard inquiry I’m more likely to encounter following latest alterations within the taxation of Debt Mutual Funds. It’s extensively recognized that debt mutual funds at the moment are taxed equally to mounted deposits. Nevertheless, the important thing distinction lies within the absence of TDS in Mutual Funds (excluding NRIs). In mutual funds, taxation will come into the image when you find yourself promoting.

This text doesn’t delve into the options of Financial institution FD Vs Debt Mutual Funds. As a substitute, it focuses on inspecting the chance and volatility current in each merchandise.

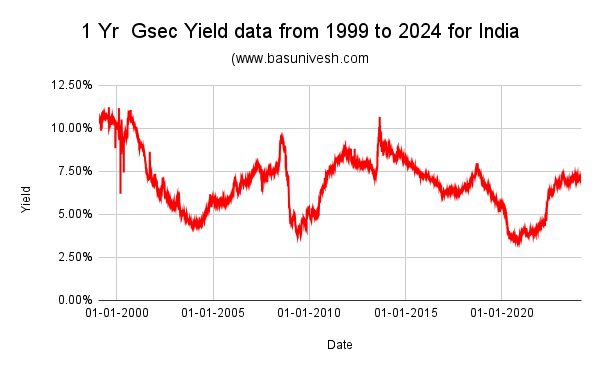

I’m analyzing the 1-year Gsec information spanning the previous 25 years, in addition to the HDFC Cash Market Fund information from the final 18 years (2006 to current) for this analysis.

The rationale for having such a restricted quantity of information is because of the availability of solely 25 years of Gsec information (obtained from Investing.com) and the NAV information of HDFC Cash Market Fund ranging from 2006.

Notice – To know extra about fundamentals of debt mutual funds, check with our all earliest posts at “Debt Mutual Funds Fundamentals“.

Financial institution FD Vs Debt Mutual Funds – Which is SAFE and BEST?

Allow us to attempt to look into the chance and volatility concerned in each merchandise.

Financial institution FD as an funding on your long-term objectives

Assuming you have an interest in investing in a Financial institution FD for a length of 1 yr, you will need to pay attention to the potential danger related to reinvestment after the maturity of the FD. Though long-term FDs are an choice, for the aim of demonstrating volatility, I’ll deal with the one yr FD.

For this objective, I’ve thought of the 1 yr Gsec information of final 25 years (from 1999 to 2024. You’ll be able to discover the volatility simply from the beneath graph.

The fluctuating trajectory of the 1-year Gsec yield over the previous 25 years is price noting. This volatility might be attributed to the ever-changing cycles of inflation and rates of interest. You will need to acknowledge that mounted deposit charges are straight influenced by inflation, which consequently amplifies the chance related to reinvestment.

Choosing long-term FDs will increase the reinvestment danger because of the uncertainty surrounding future inflation and rate of interest cycles.

FDs are designed to fulfill short-term wants. It’s not advisable to make use of FDs for long-term monetary objectives because of the annual TDS implications and the reinvestment danger after maturity.

Debt Mutual Funds as an funding on your long-term objectives

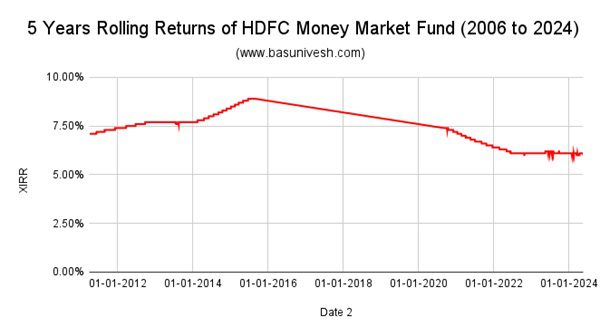

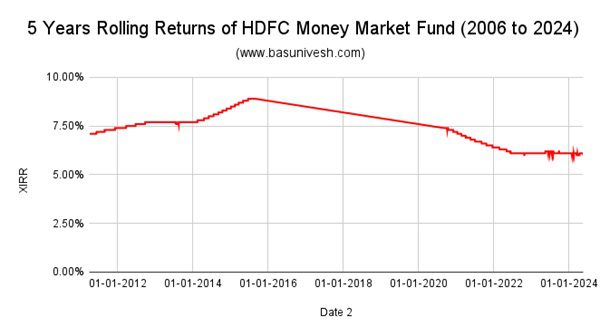

Let’s now look at the volatility of debt mutual funds. As beforehand said, I’ve chosen the HDFC Cash Market Fund for evaluation as a consequence of its lengthy historical past and substantial AUM. Regardless of being in existence for twenty-four years, I solely have entry to NAV information from 2006 onwards. Subsequently, my evaluation will probably be based mostly on information from 2006 onwards.

The number of the Cash Market Fund goals to exhibit the instability that may happen even with short-term funds. It is because Cash Market Funds sometimes put money into cash market devices that can attain maturity inside a yr.

Discover the rolling coaster trip of 1-year rolling returns of HDFC Cash Market Fund. Allow us to now evaluate by contemplating the 5 years of rolling returns.

Regardless of the lower in volatility, you will need to observe that there are intervals of upward and downward returns. These fluctuations might be attributed to the inflation and rate of interest cycles that occurred throughout these particular intervals.

Conclusion – When deciding between Financial institution FDs and Debt Mutual Funds, the selection of which is safer and higher is dependent upon your particular funding objectives and danger tolerance. Whereas FDs are typically seen as steady and low-risk investments, it’s vital to recollect the impression of TDS taxation and reinvestment dangers. Alternatively, with debt mutual funds, it’s straightforward to miss rate of interest dangers and assume they’re utterly safe. Nevertheless, it’s essential to be cautious, particularly contemplating the totally different classes of debt funds accessible. For the sake of simplicity, let’s deal with cash market funds, however it’s important to acknowledge that different fund classes might pose totally different ranges of danger.

Nothing is protected on this earth. The one manner is to handle the chance. Additionally, danger is just too private. As a result of the chance I assume vital could also be negligible for you and vice versa.