Turn Everyday Spending into Personalized Cashback with Venmo Credit Card – No Annual Fee

Get automatic category-based cashback on every purchase with the Venmo Credit Card, no annual fee, instant virtual access, and easy cash or crypto redemptions in the app

Why the Venmo Credit Card fits modern spending

The Venmo Credit Card is built for people who live in the Venmo app and want simple, automatic rewards. With no annual fee and instant virtual access after approval, the Venmo Credit Card makes everyday purchases more rewarding without extra fuss.

Rather than forcing you to pick categories or track rotating bonuses, the Venmo Credit Card analyzes your spending and rewards your top categories automatically. For U.S. consumers who split bills, pay for rides, or order takeout, this card turns common habits into dependable cashback.

How rewards work and easy redemptions

Rewards on the Venmo Credit Card are straightforward: up to 3% cashback in your highest-spending category, 2% in the second-highest, and 1% on everything else. That adaptive structure means you don’t have to change your behavior to earn more—your spending pattern does the work for you.

Redemption is seamless inside the Venmo app—cash back posts to your Venmo balance, can be cashed out to your bank, or converted to crypto right in the app. Instant virtual card access lets you start earning on purchases the moment you’re approved, which boosts the utility of the Venmo Credit Card from day one.

Fees, APR and who qualifies

The Venmo Credit Card has no annual fee, no foreign transaction fees, and typical APRs that vary by creditworthiness; the card is best for those with good to excellent credit. If you carry a balance, be mindful of the variable APR and plan payments accordingly—this card rewards users who pay in full each month.

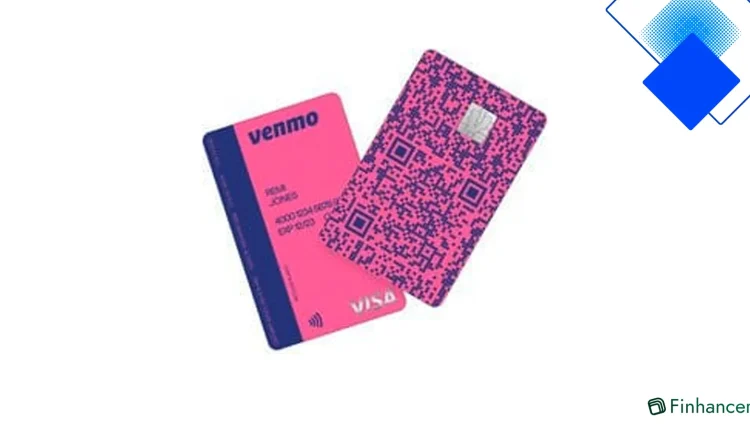

To apply you’ll need an active Venmo account and a FICO score that generally meets the issuer’s threshold. Because it’s issued by Synchrony, decisions are fast and approvals unlock a virtual card so you can start using the Venmo Credit Card immediately, then wait for the physical card with the unique QR code.

Maximizing cashback and final takeaways

To get the most from the Venmo Credit Card, track monthly categories in the app and time larger purchases when your highest categories align. Use the unique QR code on the physical card for quick peer-to-peer payments and to make splitting bills effortless—another little win that boosts the practical value of the Venmo Credit Card.

If you’re an active Venmo user, this card is a no-fuss way to earn consistent rewards with everyday spending. Compare it to flat-rate and rotating-category competitors if you want a big signup bonus or 0% intro APR, but for convenience and personalized cashback, the Venmo Credit Card is a solid, app-native choice—apply through the Venmo app and start earning.