By Angela Ang, Elwyn Panggabean, Ker Thao, Nonggol Darapati

Because the world shifts to residing in a brand new regular world, whereas nonetheless recovering from the aftermath of the COVID-19 pandemic, no different shift has been better than the shift from conventional economies to what’s now recognized immediately because the gig financial system.

COVID-19 created disproportionate impression to girls, primarily as an impression in employers lowering their workforce at unprecedented charges around the globe together with Indonesia. As employers diminished their workforce, the financial impression within the labor market shifted as properly, specifically, girls’s livelihoods have modified. Girls around the globe both had to decide on to proceed working or caring for his or her households full time or have an additional burden for paid-work in addition to do home work. Due to the development of expertise, many ladies noticed the chance to start out their very own enterprise on-line, from the comforts of their houses.

Previous to COVID-19, the variety of Extremely Micro Entrepreneurs in Indonesia (UMi) entrepreneurs utilizing digital platforms in Indonesia was round eight million folks. This quantity has practically doubled to fifteen.9 million folks for the reason that begin of the pandemic*. Now, greater than ever, it’s crucial to harness the ability of digital platforms for girls’s financial empowerment.

Indonesia’s financial system depends closely on small-scale entrepreneurs. Micro, small, and medium-sized enterprises make up 61% of Indonesia’s financial system, and the bulk (64%) of those entrepreneurs are girls. COVID-19’s specific financial challenges have pushed low-income folks to entrepreneurship because the formal job market contracts.

Final 12 months, BRI, Pegadaian, and Permodalan Nasional Madana (PNM) – a subsidiary of BRI, fashioned an Extremely Micro holding with BRI because the dad or mum holding. PNM has an current Extremely Micro buyer base with their group-lending enterprise mannequin named Mekaar. BRI goals to enhance monetary literacy and lending penetration for at the very least 29 Million Extremely Micro clients by 2024. BRI additionally goals to have a million Extremely Micro clients graduate from the micro section. As the brand new State owned Enterprise for Extremely Micro holding, BRI sees the Extremely Micro section as a brand new supply of development engine in attaining their 2025 imaginative and prescient to be “Probably the most Useful Banking Group in Southeast Asia & Champion of Monetary Inclusion.”

With a view to achieve an understanding of Extremely Micro Entrepreneurs in Indonesia (clients’ perspective and BRI’s Extremely Micro ecosystem, habits, wants and pursuits, Girls’s World Banking in cooperation with BRI carried out a analysis on UMi clients. The analysis was designed in thoughts with a selected goal to establish behavioral obstacles which will exist for these entrepreneurs in accessing BRI’s micro finance merchandise resembling KECE (a mortgage product designed for the ultra-micro section with the idea of ease and pace for of mortgage utility course of) and Simpedes UMi (a saving’s product which may be very price efficient and has no minimal steadiness to keep up).

These three personas differ not solely of their digital utilization in terms of their companies but additionally of their motivation in beginning their companies. The Necessity entrepreneur began their enterprise resulting from their revenue wants, the Steady entrepreneur ventured into their enterprise to complement their household revenue. Whereas the Development Oriented entrepreneur began their enterprise to concentrate on a enterprise and achieve success. Regardless of the distinct differentiations between these three varieties of entrepreneurs, they share an identical trait in that in terms of working capital, all of them use casual lending and non-formal establishments as their working capital, whether or not or not it’s via household, buddies, and even their very own financial savings.

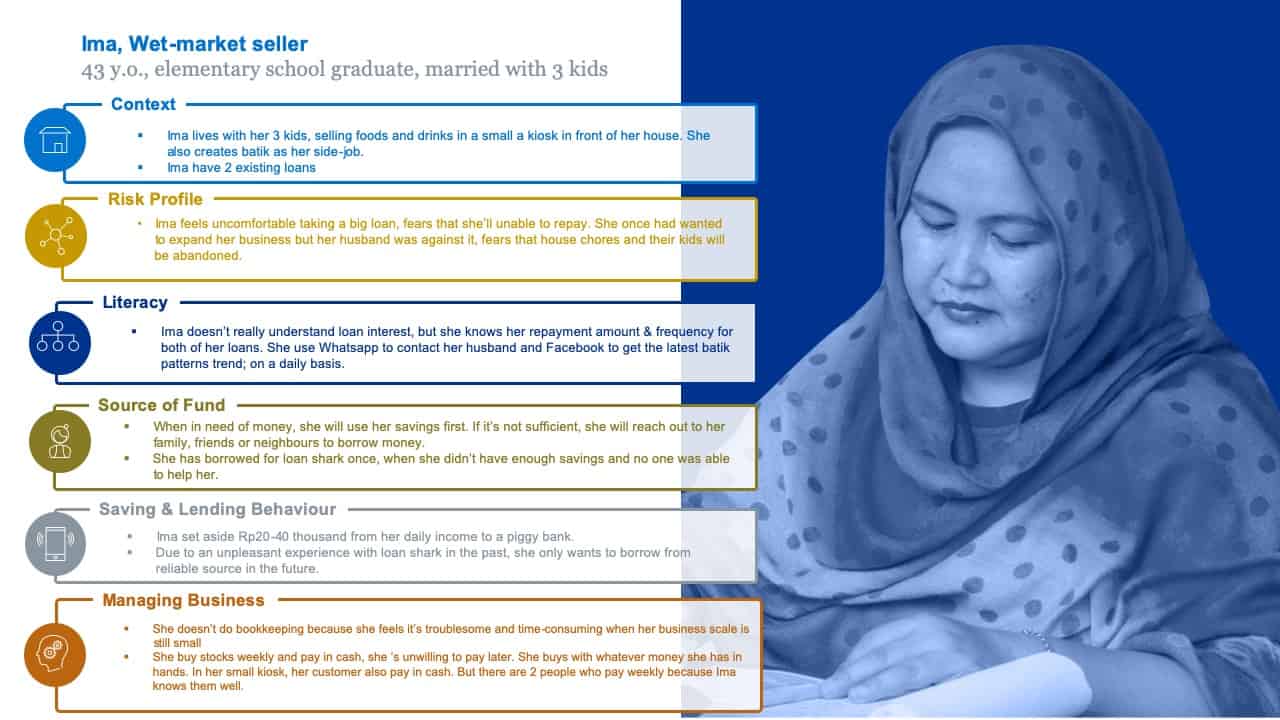

To achieve a greater understanding and illustrate of the wants of those Extremely Micro Entrepreneurs, Girls’s World Banking has created a persona, Ima, a illustration of a typical UMi buyer, based mostly on different the shoppers within the analysis research.

Ima, a wet-market vendor, is a 43-year-old girl with a husband and three children who owns a small kiosk in entrance of her home. She is an elementary college graduate and buys her backstock in money on a weekly foundation. She takes out a mortgage from household, buddies, neighbors and never via a proper monetary establishment. Along with her small kiosk the place she sells small day by day requirements resembling cleaning soap, espresso, and different small day by day consumable items, Ima additionally creates batik (conventional Indonesian textiles that includes ornate geometric and floral patterns created by brushing or stamping sizzling wax onto undyed material) to realize further revenue.

Ima’s place is just like what the vast majority of UMi entrepreneurs at present face with restricted monetary instructional background, being a dad or mum and regardless of of getting the ambition and drive to develop their enterprise, their greatest impediment additionally comes from their households. In Ima’s case it was her husband, who feared that by increasing her enterprise and the kiosk, together with taking an even bigger mortgage, Ima’s home chores and duties to her kids can be uncared for. For feminine UMi entrepreneurs, their greatest problem for monetary inclusion is having the liberty to have the ability to have entry to monetary services.

Ima’s restricted monetary schooling background has made her, and lots of like her, skeptical of formal monetary establishments and specifically banks. Among the perceptions that they’d concerning banks and its utilization was that financial savings needed to be made in giant quantities. Different skepticism revolved round uncertainties in utilizing ATM machines and that the cash saved in financial institution accounts can be diminished resulting from account charges.

“Withdrawing from the financial institution is sophisticated, if I die quickly, I pity my household for not with the ability to withdraw cash from the account.”

In relation to loans, for the UMi entrepreneurs, their greatest concern was the shortcoming to repay the mortgage. Along with this, in addition they feared to take out the mortgage itself since they’d by no means taken out a proper financial institution mortgage earlier than. For a lot of of those girls, they selected to avoid wasting in conventional strategies resembling saving within the type of gold or saving at residence. Saving within the type of gold is common in Southeast Asia, the place for generations, it was seen as an “funding” that would both be pawned or bought when wanted. It additionally stems from the assumption that gold is a helpful steel that can’t be misplaced nor will it depreciate over time. However most significantly, the primary motive for girls to avoid wasting in gold kind is that it’s thought of accessible at any time and is handy.

It’s evident that the obstacles for UMi entrepreneurs to be financially included lies with educating them on the banking course of and merchandise. Along with educating these entrepreneurs, there may be additionally a have to create tailor made merchandise and options, which might bridge the hole between the shopper’s data, expectations and calls for, together with the monetary merchandise that BRI at present presents its clients.

Girls’s World Banking partnered with BRI to developed an answer to bridge the hole between the UMi entrepreneurs wants and the merchandise provided by BRI to widen the monetary inclusion attain to those entrepreneurs and the financial institution. The answer goals to increase entry and understanding girls ultra-micro entrepreneurs of economic services notably financial savings and mortgage, in addition to to empower key contact factors for girls (e.g. brokers banking) to teach and provide monetary services, leading to better utilization of these companies and better girls’s financial empowerment in the long term.

Keep tuned for half two the place we delve into the challenges, resolution, and outcomes for these Extremely Micro Entrepreneurs in Indonesia of their journey to enter the formal monetary sector.