Does Microfinance Truly Enhance Lives?

December 5, 2022

Microfinance, as soon as hailed as a miracle resolution, has change into the topic of skepticism within the final a number of years. There isn’t a doubt that reimbursement charges are as excessive or larger than conventional financing, however many questioned whether or not these loans really led to enhancements in particular person and household dwelling situations.

For the primary time, Wisconsin Microfinance has been in a position to monitor what really issues, and is measuring modifications within the high quality of lifetime of debtors over the primary 18 months after receiving a mortgage.

Preliminary survey outcomes had been gathered from a small set of our debtors (36 debtors) in Haiti. Members had been surveyed with a collection of questions thrice: 1) previous to taking the primary mortgage, 2) previous to taking out a second mortgage (after paying the primary again), and three) previous to taking out a 3rd mortgage (after paying the second again).

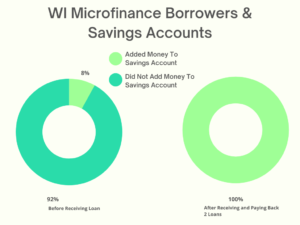

We start with the inspiring end in Determine 1 that the proportion of debtors who reported that they had added cash to a financial savings account within the final yr elevated from 8% (previous to receiving a mortgage financed by WI Microfinance mortgage) to 100% (after receiving – and paying again – two loans financed by WI Microfinance), exhibiting that each one of our debtors weren’t solely higher in a position to meet each day wants, but in addition put together for his or her futures.

Determine 1

Determine 1

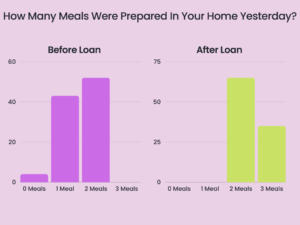

We then flip to the affect of receiving a mortgage on meals safety. Earlier than receiving their loans, 4% of debtors didn’t put together a meal of their home the day previous to the survey, with an extra 42% reporting that just one meal was ready. In Survey 2, after receiving a primary spherical mortgage, nobody responded that 0 or 1 meals had been ready of their houses the day prior, and 100% of debtors had entry to 2 or 3 meals yesterday. These improved outcomes continued into the third survey, exhibiting dramatically optimistic impacts. As for clear water, one of the basic of human wants, we discovered that previous to receiving their first mortgage, 8% of debtors sourced their consuming water from a river, making them inclined to water borne illness and contamination. After the primary mortgage, not one of the debtors obtained water from the river, and as a substitute used a mix of neighborhood and private wells.

Determine 2

Determine 2

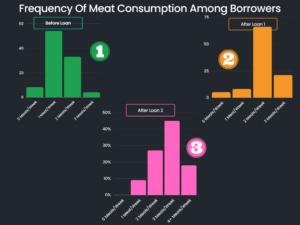

Previous to taking the primary mortgage, as seen in Determine 3, 54% (the bulk) of mortgage recipients reported consuming just one meal every week containing meat (beef, pork, rooster, or fish). After one mortgage, 87% of respondents indicated that they ate meat two or thrice every week. After a second mortgage, these numbers had once more improved with an extra 17% saying they had been consuming meat 4 or extra occasions every week. Total, the consumption of meat, rooster, and fish (usually heartier, costlier meals) elevated considerably.

Determine 3

Determine 3

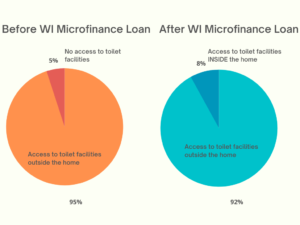

We subsequent moved to one of the fundamental of wants – bathroom services. Determine 4 reveals that within the preliminary survey, 95% of debtors reported that that they had entry to bathroom services, however that these had been exterior the house. One respondent reported not having bathroom services in any respect. After the primary mortgage, 92% of debtors reported having bathroom services exterior the house, whereas the remaining 8% had entry to bathroom services inside the house. Nobody reported not having bathroom services. These outcomes stayed constant even through the third survey, eight months later.

Determine 4

Determine 4

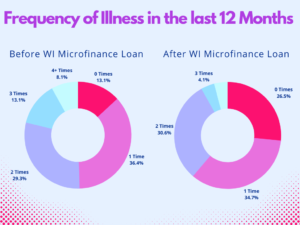

Determine 5 showcases improved well being and wellness as a measure of high quality of life. When monitoring the frequency of sickness, we discovered that previous to receiving their first mortgage, 13% said that throughout the final 12 months nobody had gotten sick. The remaining responses had been distributed over stories of somebody getting sick one, two, three or extra occasions. By the second survey, nearly 27% of respondents said that nobody had gotten sick over the earlier 12 months, indicating a big enchancment in well being that’s correlated with higher entry to funds.

Determine 5

Determine 5

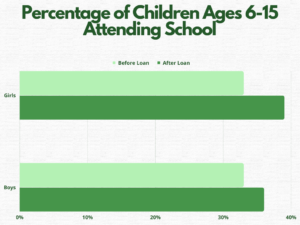

We then moved in direction of schooling. As we see in Determine 6, the proportion of boys ages 6-15 attending college at the very least as soon as every week elevated from 33% to 36%. For ladies, this share elevated from 33% to 39%.

Determine 6

Determine 6

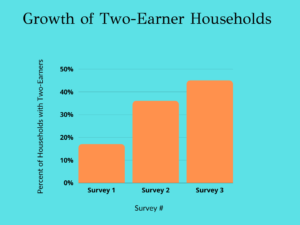

Wisconsin Microfinance targets loans to ladies, so we anticipate to see a rise within the variety of “breadwinners”, or folks that convey cash to a family. As we see in Determine 7, initially 83% of debtors reported that just one individual introduced in cash (for many households, this could have been the male). On the second survey, the proportion of single breadwinner households decreased to 63%. By the third survey, solely 55% reported a single breadwinner for the household.

Determine 7

Determine 7

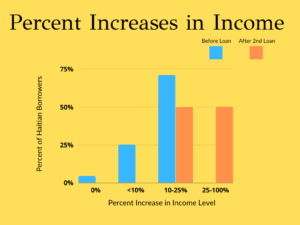

In the case of the simpler to measure points, like modifications in earnings, we discovered optimistic outcomes as nicely. Earlier than the primary mortgage, 70% of mortgage recipients reported that their earnings had elevated 10 – 25% through the earlier 12 months. Nobody reported their earnings growing greater than 25%. After the primary mortgage, 40% of mortgage recipients reported their earnings growing 25 – 100%. These numbers held up after paying again their second mortgage, the place once more, 40% of mortgage recipients reported that their earnings had elevated 25 – 100% over the previous 12 months.

Determine 8

Determine 8

It is very important observe that the outcomes additionally comprise unexplainable knowledge. Within the preliminary survey, 83% of debtors reported proudly owning the houses, however within the second survey, this quantity had dropped to 78% earlier than bouncing again as much as 100% within the third survey. Information irregularities could also be a operate of who was filling out the survey, or different unanticipated modifications in high quality of life that had been uncorrelated with the loans. Nevertheless, Wisconsin Microfinance believes that our loans really are representing a hand-up, not a hand out. The overwhelming majority of outcomes present a measurable enhance in high quality of life for Wisconsin Microfinance debtors, suggesting that microfinance could also be much more efficient than as soon as thought, and may really have a exceptional affect on individuals’s lives.

Creator: Jahnvi Datta