That is the final of my information replace posts for 2023, and on this one, I’ll concentrate on dividends and buybacks, maybe essentially the most most misunderstood and misplayed aspect of company finance. As an instance the warmth that buybacks evoke, contemplate two tales within the final two weeks the place they’ve been within the information. Within the first, critics of Norfolk Southern, the company that operates the trains that had been concerned in a dreadful chemical accident in Ohio, pointed to buybacks that it had performed because the proximate trigger for brake failure and the injury. Within the second, Warren Buffet used some heated language to explain those that opposed buybacks, calling them “financial illiterates” and “silver tongued demagogues “. Going again in time to final 12 months’s inflation discount act, buybacks had been explicitly focused for taxes, with the attitude that they had been damaging US firms. I feel that there are official questions value asking about buybacks, however I don’t assume that neither the critics nor the defenders of buybacks appear to know why their use has surged or their impression on shareholders, companies and the financial system.

Dividend Coverage in Company Finance

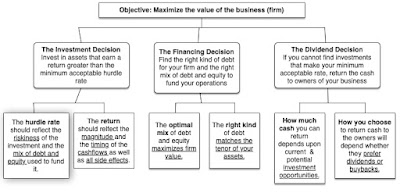

To know the place dividend coverage suits within the bigger context of operating a enterprise, contemplate the next massive image description of company finance, the place each resolution {that a} enterprise makes is put into one in every of three buckets – investing, financing and dividends, with every one having an overriding precept governing decision-making inside its contours.

In my fifth information replace for 2023, I targeted on the funding precept, which states that companies ought to spend money on tasks/belongings provided that they anticipate to earn returns larger than their hurdle charges, and introduced proof that utilizing the return on capital as a proxy for returns and prices of capital as a measure of hurdle charges, 70% of world firms fell brief in 2022. In my sixth information replace, I seemed on the commerce off that ought to decide how a lot firms borrow, the place the tax advantages are weighed off towards chapter prices, however famous that agency usually select to borrow cash for illusory causes and due to me-tooism or inertia. The dividend precept, which is the main target of this put up is constructed on a quite simple precept, which is that if an organization is unable to search out investments that make returns that meet its hurdle fee thresholds, it ought to return money again to the homeowners in that enterprise. Seen in that context, dividends as simply as integral to a enterprise, because the investing and financing choices. Thus, the notion that an organization that pays dividends is considered as a failure strikes me as odd, since simply farmers seed fields in an effort to harvest them, we begin companies as a result of we plan to finally accumulate money flows from them.

Put in logical sequence, dividends needs to be the final step within the enterprise sequence, since they symbolize residual money flows. In that sequence, corporations will make their funding choices first, with financing choices occurring concurrently or proper after, and if there are any money flows left over, these might be paid out to shareholders in dividends or buybacks, or held as money to create buffers towards shocks or for investments in future years:

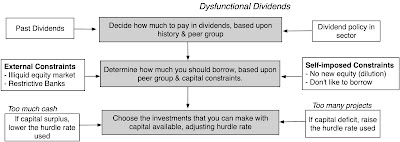

In follow, although, and particularly when firms really feel that they need to pay dividends, both due to their historical past of doing so (inertia) or as a result of everybody else of their peer group pays dividends (me-tooism), dividend choices startthe sequence, skewing the funding and financing choices that comply with. Thus, a agency that chooses to pay out extra dividends than it ought to, will then prove and both reject value-adding tasks that it ought to have invested in or borrow greater than it could afford to, and this dysfunctional dividend sequence is described beneath:

On this dysfunctional dividend world, some firms can pay out much more dividends than they need to, hurting the very shareholders that they assume that they’re benefiting with their beneficiant dividends.

Measuring Potential Dividends

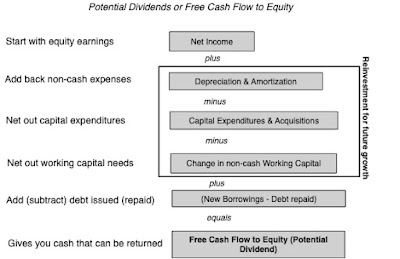

Within the dialogue of dysfunctional dividends, I argued that some firms pay out much more dividends than they need to, however that assertion suggests you could measure how a lot the “proper” dividends needs to be. On this part, I’ll argue that such a measure not solely exists, however is well calculated for any enterprise, from its assertion of money flows.

Free Money Flows to Fairness (Potential Dividends)

Essentially the most intuitive method to consider potential dividends is to think about it because the money movement left over after each conceivable enterprise want has been met (taxes, reinvestments, debt funds and so on.). In impact, it’s the money left within the until for the proprietor. Outlined thus, you may compute this potential dividend from elements which are listed on the assertion of money flows for any agency:

Be aware that you simply begin with internet earnings (since you’re targeted on fairness traders), add again non-cash bills (most notably depreciation and amortization, however together with different non-cash fees as effectively) and internet out capital expenditures (together with acquisitions) and the change in non-cash working capital (with will increase in working capital lowering money flows, and reduces growing them). The final adjustment is for debt funds, since repaying debt is a money outflow, however elevating contemporary debt is a money influx, and the web impact can both increase potential dividends (for a agency that’s growing its debt) or cut back it (for a agency that’s paying down debt).

Delving into the main points, you may see that an organization can have unfavorable free money flows to fairness, both as a result of it’s a cash shedding firm (the place you begin the calculation with a internet loss) or is reinvesting giant quantities (with capital expenditures operating effectively forward of depreciation or giant will increase in working capital). That firm is clearly in no place to be paying dividends, and if it doesn’t have money balances from prior intervals to cowl its FCFE deficit, should increase contemporary fairness (by issuing shares to the market).

FCFE throughout the Life Cycle

I do know that you’re in all probability uninterested in my use of the company life cycle to contextualize company monetary coverage, however to know why dividend insurance policies range throughout firms, there isn’t any higher gadget to attract on.

Younger firms are unlikely to return money to shareholders, as a result of they aren’t solely extra prone to be money-losing, but additionally as a result of they’ve substantial reinvestment wants (in capital expenditures and dealing capital) to generate future progress, leading to unfavorable free money flows to fairness. As firms transition to progress firms, they might turn into money-making, however on the peak of their progress, they may proceed to have unfavorable free money flows to fairness, due to reinvestment wants. As progress moderates and profitability improves, free money flows to fairness will flip constructive, giving these corporations the capability to return money. Initially, although, it’s seemingly that they may maintain again, hoping for a return to their progress days, and that can trigger money balances to construct up. As the belief dawns that they’ve aged, firms will begin returning more money, and as they do not want, money returns will speed up, as corporations shrink and liquidate themselves.

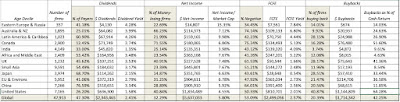

After all, you’re skeptical and I’m positive that you can imagine anecdotal proof that contradicts this life cycle concept, and I can too, however the final take a look at is to have a look at the information to see if there’s help for it. Firstly of 2023, I categorized all publicly traded corporations globally, based mostly upon their company ages (measured from the 12 months of founding by way of 2022) into ten deciles, from youngest and oldest, and checked out free money flows and money return for every group:

As you may see, the youngest corporations out there are the least prone to return money to shareholders, however they’ve good causes for that conduct, since they’re additionally the most certainly to be cash shedding and have unfavorable freee money flows to fairness. As corporations age, they’re extra prone to be money-making, have the potential to pay dividends (constructive FCFE) and return money within the type of dividends or buybacks.

Dividends and Buybacks: Reality and Fiction

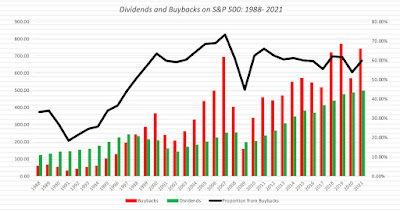

Till the early Nineteen Eighties, there was just one conduit for publicly traded firms to return money to proprietor, and that was paying dividends. Within the early Nineteen Eighties, US corporations, particularly, began utilizing a second possibility for returning money, by shopping for again inventory, and as we are going to see in this part, it has turn into (and can keep) the predominant automobile for money return not just for US firms, however more and more for corporations world wide.

The Info

4 many years into the buyback surge, there are sufficient information that we are able to extract by trying on the information which are value highlighting. First, it’s plain that US firms have moved dramatically away from dividends to buybacks, as their major mode of money return, and that firms in the remainder of the world are beginning to comply with swimsuit. Second, that shift is being pushed by the popularity on the a part of corporations that earnings, even on the most mature corporations, have turn into extra unstable, and that initiating and paying dividends can lure corporations into . Third, whereas a lot has been fabricated from the tax advantages to shareholders from buybacks, versus dividends, that tax differential has narrowed and maybe even disappeared over time.

1. Buybacks are supplanting dividends as a mode of money return

I taught my first company finance class in 1984, and on the time, virtually the entire money returned by firms to shareholders took the type of dividends, and buybacks had been unusual. Within the graph beneath, you may see how money return conduct has modified over the past 4 many years, and the development traces are plain;

The transfer to buybacks began in earnest within the mid Nineteen Eighties and by 1988, buybacks had been a few third of all money returned to shareholders. In 1998, buybacks exceeded dividends for the primary time in US company historical past and by final 12 months, buybacks accounted for nearly two thirds of all money returned to shareholders. In brief, the default mechanism for returning money at US firms has turn into buybacks, not dividends. Lest you begin believing that buybacks are a US-centric phenomenon, check out international dividends and buybacks, within the mixture, damaged down by area in 2022:

Be aware that whereas the US is the chief of the pack, with 64% of money returned in buybacks, the UK, Canada, Japan and Europe are additionally seeing a 3rd or extra of money returned in buybacks, versus dividends. Among the many rising market areas, Latin America has the best % of money returned in buybacks, at 26.90%, and India and China are nonetheless nascent markets for buybacks. The shift to buybacks that began in the USA clearly has now turn into a world phenomenon and any clarification for its progress needs to be due to this fact international as effectively.

2. Buybacks are extra versatile than dividends

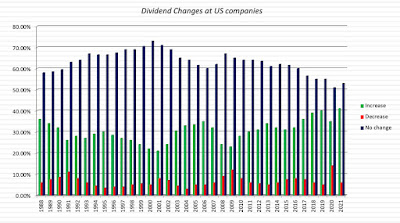

Should you purchase into the notion of a free money movement to fairness as a possible money return, firms face a alternative between paying dividends and shopping for again inventory, and at first sight, the impression on the corporate of doing both is precisely the identical. The identical amount of money is paid out in both case, the results on fairness are similar (in each e-book worth and market worth phrases) and the operations of the corporate stay unchanged. The important thing to understanding why firms might select one over the opposite is to start out with the popularity that in a lot of the world, dividends are sticky, i.e., as soon as initiated and set, it’s tough for firms to droop or minimize dividends with no backlash, as might be seen on this graph that appears on the % of US firms that improve, lower and do nothing to dividends every year:

Be aware that the variety of dividend-paying firms that go away dividends unchanged dominates firms that change dividends each single 12 months, and that when firms change dividends, they’re much more prone to improve than minimize dividends. The placing characteristic of the graph is that even in disaster years like 2008 and 2020, extra firms elevated than minimize dividends, testimonial to its stickiness. In distinction, firms are much more keen and prone to revisit buybacks and slash or droop them, if the circumstances change, making it a much more versatile method of returning money:

On the core, this flexibility is on the coronary heart of the shift to buybacks, particularly as fewer and fewer firms have the boldness that they will ship steady and predictable earnings sooner or later, some as a result of globalization has eliminated native market benefits and a few as a result of their companies are being disrupted. It’s true that there’s a model of dividends, i.e., particular dividends, which will supply the identical flexibility, and will probably be fascinating to see if their utilization will increase as governments goal firms shopping for again inventory for punishment or greater taxes.

3. There are tax advantages (to shareholders) from buybacks, however they’ve decreased over time

From the attitude of shareholders, dividends and buybacks create completely different tax penalties, and people can have an effect on which possibility they like. A dividend provides rise to taxable earnings within the interval that it’s paid, and taxpayer have little or no method of delaying or evading paying taxes. A buyback provides traders a alternative, with these opting to promote again their shares receiving a realized capital achieve, which will likely be taxed on the capital good points tax fee, or not promoting them again, giving rise to an unrealized capital achieve, which will likely be taxed in a future interval, when the inventory is offered. For a lot of the final century, dividends had been taxed within the US as abnormal earnings, at charges a lot greater than that paid on capital good points.

Whereas the differential tax profit within the final century is usually talked about as the explanation for the rise of buybacks, be aware that the tax differential was even worse previous to 1980, when dividends primarily dominated, to the post-1980 interval, when buybacks got here into vogue. For a lot of this century, at the very least within the US, dividends and buybacks have been taxed on the identical fee, beginning at 15% in 2003 and rising to 23.8% in 2011 (a 20% capital good points fee + 3.8% Medicare tax on all earnings), thus erasing a lot of the distinction between dividends and realized capital good points for shareholder tax burdens. Nevertheless, shareholders nonetheless get a profit with unrealized capital good points that may be carried ahead to a future tax-advantageous 12 months and even handed on in inheritance as untaxed good points.

Till final 12 months, there have been no variations in tax penalties to firms from paying dividends or shopping for again inventory, however the Inflation Discount Act of 2022 launched a 1% tax fee on buybacks, thus creating at the very least a marginal extra price to firms that bough again inventory, as an alternative of paying dividends. If the one goal of this buyback tax is elevating revenues, I do not have an issue with that as a result of it should assist shut the finances hole, however to the extent that that is designed to alter company conduct by inducing firms to not purchase again inventory or to take a position extra again into companies, it’s each incorrect headed and will likely be ineffective, as I’ll argue within the subsequent part.

The Fiction

The fictions about buybacks are widespread and are pushed as a lot by ideological blinders as they’re by a failure to know what a enterprise is, and function it. The primary is that buybacks can improve or lower the worth of a enterprise, with buyback advocates making the previous argument and buyback critics the latter. They’re each incorrect, since buybacks can solely redistribute worth, not create it. The second is that surge in buybacks has been fed by debt financing, and it’s half of a bigger and darker image of over levered firms catering to grasping, brief time period shareholders. The third is that buybacks are dangerous for an financial system, with the logic that the money that’s getting used for the buybacks shouldn’t be being invested again within the enterprise, and that the latter is best for financial progress. The ultimate argument is that the big buybacks at US firms symbolize money that’s being taken away from different stakeholders, together with workers and clients, and is thus unfair.

1. Buybacks improve (lower) worth

Worth in a enterprise comes from its capability to take a position cash and generate money flows into the long run, and outlined as such, the act of returning money by itself, both as dividends or buybacks can not create or destroy worth. It’s true that the best way wherein dividends and buybacks are funded or the implications that they’ve for investing can have worth results, however these worth results don’t come from the money return, however from investing and financing dysfunction. The image beneath captures the pathways by which the best way dividends and buybacks are funded can have an effect on worth:

The implications are straight ahead and customary sense. Whereas a buyback or dividend, by itself, can not have an effect on worth, the best way it’s funded and the investments that it displaces can decide whether or not worth is added or destroyed.

- Leverage impact: If an organization that’s already at its right combination of debt (see my final put up) select so as to add to that debt to fund its dividend funds or buybacks, it’s hurting its worth by growing its price of capital and publicity to default danger. Nevertheless, a agency that’s below levered, i.e., has too little debt, might be able to improve its worth by borrowing cash to fund its money return, with the rise coming from the skew within the tax code in direction of debt.

- Funding impact: If an organization has a surplus of value-adding tasks that it could take, and it chooses to not take these tasks in order to have the ability to pay dividends or purchase again inventory, it’s hurting it worth. By the identical token, an organization that’s in a foul enterprise and is struggling to make its price of capital will achieve in worth by taking the money it might have invested in tasks and returning that money to shareholders.

Lastly, there’s a subset of firms that purchase again inventory, not with the intent of decreasing fairness and share depend, however to cowl shares wanted to cowl stock-based compensation (possibility grants). Thus, when administration choices get exercised, slightly than difficulty new shares and dilute the possession of current shareholders, these firms use shares purchased again to cowl the train. The worth impact of doing so is equal to buybacks that cut back share depend, as a result of not issuing shares every year to cowl possibility workouts is effecting conducting the identical goal of preserving share depend decrease.

There is a component the place there dividends and buybacks can have contrasting results. Dividends are paid to all shareholders, and thus can not make one group of shareholders higher or worse off than others. Buybacks are selective, since solely these shareholders who promote their shares again obtain the buyback worth, and so they have the potential to redistribute worth. In what sense? An organization that buys again inventory at too excessive a worth, relative to its intrinsic worth, is redistributing worth from the shareholders who stay within the firm to those that promote their shares again. In distinction, an organization that buys again shares at a low worth, relative to its intrinsic worth, is redistributing worth from the shareholders who promote their shares again to those that keep shareholders within the agency. That is on the coronary heart of Warren Buffet’s protection of buybacks at Berkshire Hathaway as a device, since he provides the constraint that the buybacks will proceed provided that they are often performed at lower than intrinsic worth, and the belief is that Buffet does have a greater sense of the intrinsic worth of his firm than market members. It’s true that some firms purchase again inventory on the excessive costs, and if that’s your motive, as a shareholder within the firm for taking a stand towards buybacks, I’ve a a lot easier and simpler response than banning buybacks. Simply promote your shares again and be on the fitting aspect of the redistribution sport!

2. Buybacks are being financed with debt

As I famous in my lead in to this part, an organization that borrows cash that it can not afford to borrow to purchase again inventory is not only damaging its worth however placing its company existence in danger. I’ve heard a couple of critics of buybacks contend that buybacks are being funded primarily or predominantly with debt, utilizing anecdotal examples of firms which have adopted this script, to again up their declare. However is that this true throughout firms? To handle this, I seemed firms within the US (as a result of this critique appears to be directed primarily at them), damaged down by whether or not they did buybacks in 2022, after which examined debt hundreds inside every group:

You might be the choose, utilizing each the debt to capital ratio and the debt to EBITDA a number of, that firms that purchase again inventory have decrease debt hundreds than firms that do not purchase again inventory, at odds with the “money owed fund buybacks” story. Are there corporations which are utilizing debt to purchase again inventory and placing their survival in danger? After all, simply as there are firms that select different dysfunctional company finance decisions. Within the cross part, although, there’s little proof you could level to that buybacks have precipitated a borrowing binge at US firms.

3. Buybacks are dangerous for the financial system

The ultimate argument towards buybacks has little to do with shareholder worth or debt however is centered round a mathematical reality. Corporations that return money to shareholders, whether or not as dividends or buybacks, are usually not reinvesting the money, and to buyback critics, that reality alone is enough to argue towards buybacks. There are two premises on which this argument is constructed and they’re each false.

- The primary is that an organization investing again into its personal enterprise is at all times higher for the financial system than that firm not investing, and that misses the truth that investing in dangerous companies, only for the sake of investing shouldn’t be good for both shareholders or the financial system. Is there anybody who would argue with a straight face that we might be all higher off if Mattress Tub and Past had constructed extra shops within the final decade than they have already got? Alternatively, would we not all have been higher served if GE had liquidated itself as an organization a decade in the past, once they may have discovered keen consumers and returned the money to their shareholders, as an alternative of constant as a strolling useless firm?

- The second is that the cash returned in buybacks, which exceeded a trillion {dollars} final 12 months, in some way disappeared right into a black gap, when the reality is that a lot of that cash bought reinvested again into the market in firms that had been in higher companies and wanted capital to develop? Put merely, the cash bought invested both method, however by firms apart from GE and Mattress Tub and Past, and that counts as a win for me.

Watching the controversy on buybacks within the Senate final 12 months, I used to be struck by how disconnected senators had been from the fact of buybacks, which is that they bulk of buybacks come from firms that haven’t any fast use for the cash, or worse, dangerous makes use of for the monty, and the impact of buybacks is that this cash will get redirected to firms which have funding alternatives and function in higher companies.

4. Buybacks are unfair to different stakeholders

If the argument towards buybacks is that the cash spent on buybacks may have been spent paying greater wages to workers or bettering product high quality, that’s true. That argument is admittedly one about how the pie is being cut up among the many completely different shareholders, and whether or not firms are producing earnings that extreme, relative to the capital invested. I argued in my fifth information put up that if there’s backing for a proposition, it’s that firms are usually not incomes sufficient on capital invested, not that they’re incomes an excessive amount of. I’ll wager that when you did break down pay per hour or worker advantages, they are going to be significantly better at firms which are shopping for again inventory than at firms that do not. Sadly, I do not need entry to that information on the company-level on both statistic, however I’m keen to think about proof on the contrary.

The Backside Line

It’s telling that among the most vehement criticism of buybacks come from individuals who least perceive enterprise or markets, and that the legislative options that they craft replicate this ignorance. Taxing buybacks since you are unable to lift company tax charges could also be an efficient income generator for the second, however pushing that fee up greater will solely trigger the money return to take completely different types. Simply because the makes an attempt to curb high administration compensation within the early Nineteen Nineties gave rise to administration choices and a decade of even greater compensation, makes an attempt to tax buybacks might backfire. If the top sport in taxing buybacks is to alter company conduct, attempting to induce make investments extra of their companies, will probably be for essentially the most half futile, and if it does work, will do extra hurt than good.

YouTube Video

Information Hyperlinks

- Dividend Statistics, by Business: US and World

- Dividends, Buybacks and FCFE, by Business: US and World

Information Replace Posts for 2023

- Information Replace 1 for 2023: Setting the Desk!

- Information Replace 2 for 2023: A Rocky 12 months for Equities!

- Information Replace 3 for 2023: Inflation and Curiosity Charges

- Information Replace 4 for 2023: Nation Threat – Measures and Implications

- Information Replace 5 for 2023: The Earnings Check

- Information Replace 6 for 2023: A Get up name for the Indebted?

- Information Replace 7 for 2023: Dividends, Buybacks and Money Flows