Have you ever skilled sticker shock on the pump not too long ago? Likelihood is, you most likely observed a value hike the final time you topped off your tank. In accordance with the Power Info Administration, the value of standard gasoline has risen 57 p.c prior to now yr, and shoppers are feeling the squeeze.

So, how unhealthy is it? The headlines are telling us that fuel costs have by no means been increased. However is that this essentially the most we’ve ever paid for gasoline on the pump? Technically, sure, however there’s extra to the story.

Nominal Vs. Actual Costs

The headlines and fears about all-time highs in gasoline costs are taking part in into an financial idea known as cash phantasm, which is the tendency for shoppers to view their wealth (and costs) in nominal phrases slightly than actual phrases. To assume in actual phrases, it’s essential to grasp that the buying energy of a greenback in March 2022 just isn’t the identical because it was in March 1992. Costs rise over time, so the worth of a single greenback will decline over time because it buys fewer items and companies, all else equal.

Let’s stroll by means of an instance for instance what I imply. Let’s say your revenue in 1992 was $10,000 per yr and the fee to purchase a used automotive was $5,000. Over the following 30 years, each your revenue and the value of automobiles enhance; in 2022, they’re $50,000 and $25,000, respectively. In relation to your revenue, the price of a automotive as we speak is similar because it was in 1992 (one-half revenue). In actual greenback phrases, the fee to you has remained the identical over your complete interval, despite the fact that the sticker value of the automotive has elevated over these 30 years. However, in case your revenue had solely elevated to $40,000, the price of the automobile would’ve elevated in actual greenback phrases as a result of it might require a bigger portion of your revenue.

Budgeting for Gasoline

Let’s apply the identical logic to the price of gasoline in as we speak’s surroundings. Presently, the typical value of standard gasoline is about $3.50 per gallon. (This worth almost definitely differs from what you see on the pump as a result of it excludes state tax.) Whereas $3.50 is a sticker shock, what ought to matter most as a client is how the value per gallon pertains to revenue and the way that compares to earlier durations. That view gives a more true measure of the value within the context of buying energy of the greenback, just like the instance above.

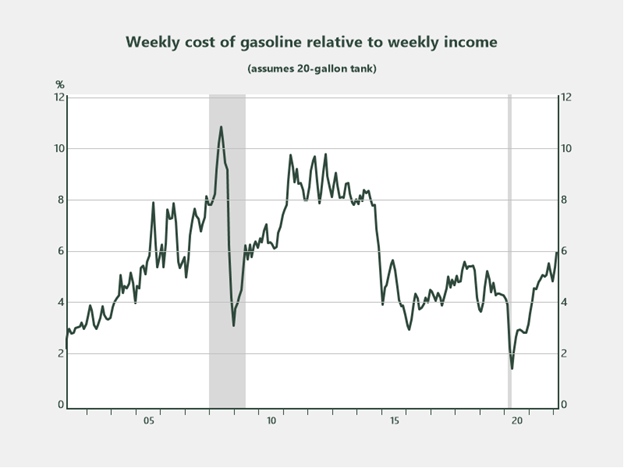

For a 20-gallon automobile that requires a single fill per week, shoppers must set a weekly finances of $70 in as we speak’s surroundings. Relative to the typical American’s weekly revenue, $70 equates to about 6 p.c of pay. In March 2012, the value of fuel was $0.50 decrease, and the fee to fill a 20-gallon tank was $60 as an alternative of $70; nonetheless, incomes 10 years in the past had been additionally decrease. With the intention to make a real evaluation of the place issues stand as we speak, we have to perceive the ratio of gasoline costs to incomes over time. The outcomes are proven within the chart under, which shows the weekly price of gasoline relative to weekly revenue.

Supply: Haver/Commonwealth Monetary Community

It seems that customers wanted to put aside a bigger portion of their weekly wages to fill a tank of fuel in 2012 than they do as we speak (assuming mileage pushed is similar). Ten years in the past, shoppers needed to put aside a finances of just about 10 p.c of weekly pay, whereas as we speak it’s solely 6 p.c. It could really feel like a tank fill-up is taking a bigger chunk out of budgets than ever earlier than (because the headlines counsel), however the actuality is we’re proper across the 20-year common of gasoline costs relative to incomes.

Extra Mileage for the Buck

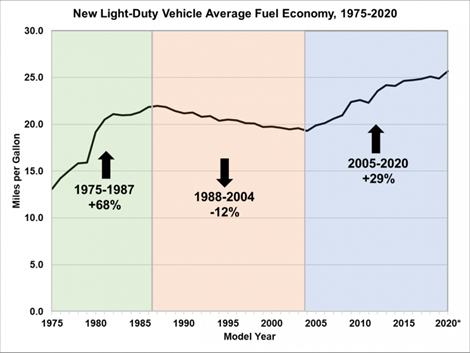

One other factor to think about is that the majority autos pushed as we speak are extra fuel-efficient than they had been a decade in the past. So, chances are high you’re requiring fewer fill-ups per thirty days than you probably did in 2012. The chart under reveals the typical gas economic system of light-duty autos over time, with a 29 p.c enchancment within the interval 2005–2020. As autos develop into extra fuel-efficient, Individuals are making fewer journeys to the pump, and which means much less cash spent on fuel over time at the same time as costs rise.

Supply: vitality.gov

Wanting Past the Headlines

Our job as analysts is to assist readers perceive the numbers, which regularly contains wanting past the headlines. On this case, it’s essential to grasp that whereas fuel costs have elevated not too long ago, we’re not too far off from the place we’ve been traditionally because it pertains to budgets and the actual price of gasoline. A part of the rationale we’re getting sticker shock lately is that we’ve gotten accustomed to paying very low costs in recent times. For the typical American, the share of wages required to fill a 20-gallon tank of fuel hit an all-time low of lower than 2 p.c within the depths of the pandemic. Now that costs have risen so dramatically in such a brief time frame, it appears like issues have by no means been increased.

In closing, I’d wish to stress that the data introduced is on no account an try and diminish the very actual state of affairs many households are experiencing in as we speak’s inflationary surroundings. The numbers used are primarily based on averages. As we all know, averages don’t provide perspective on each state of affairs. There are various households on the market on mounted incomes that haven’t skilled a pay enhance prior to now decade to assist offset the value enhance in different items and companies. Additionally, there are people who haven’t had the posh of buying and selling up for a extra fuel-efficient automobile prior to now 10 years. These conditions are very actual. Our hope is that inflation reverts to a extra affordable stage within the coming yr to assist ease the burden on these at present experiencing hardship.

Editor’s Word: The authentic model of this text appeared on the Impartial Market Observer.