[ad_1]

Once we consider gold, we immediately acknowledge how a lot folks in our nation worth it. Gold has at all times been extremely fascinating in India, and through the years, this sturdy curiosity has made India one of many high gold customers on this planet.

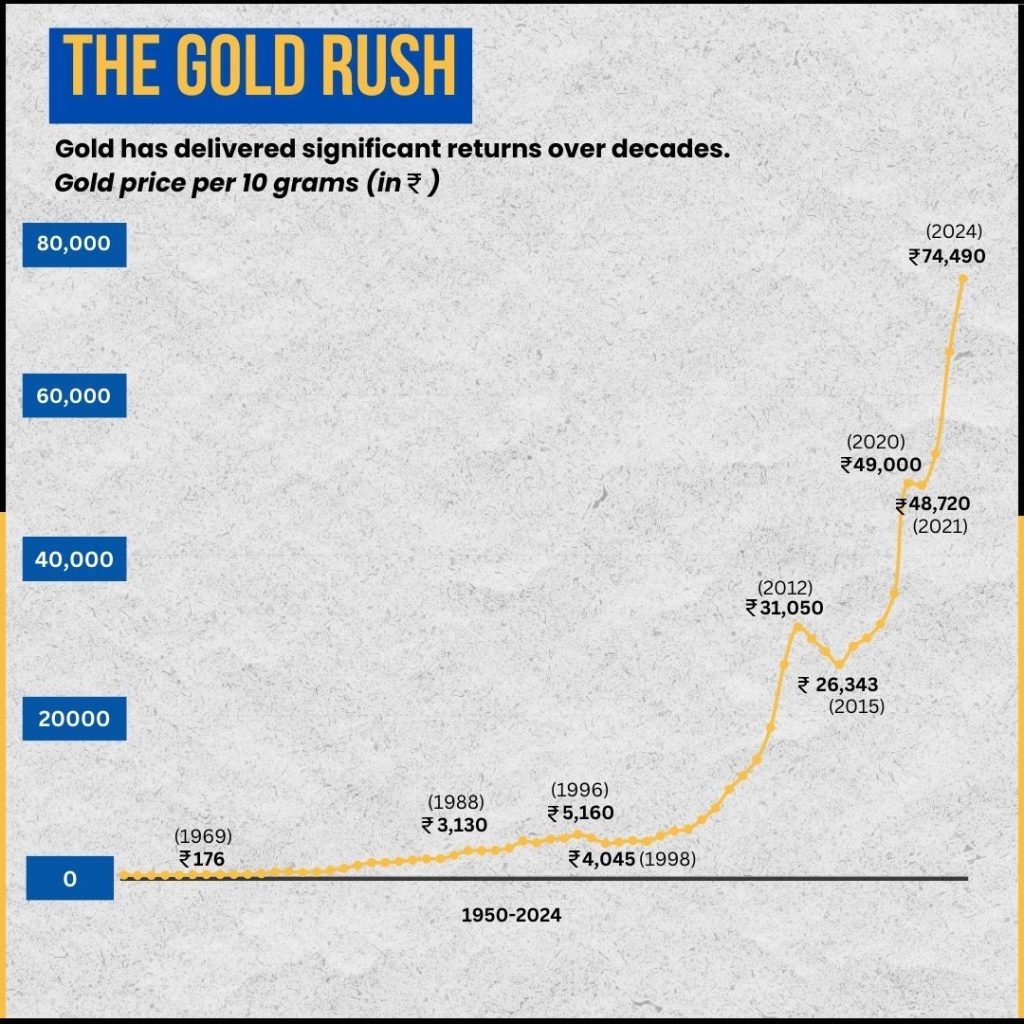

Gold Costs Over the Previous Years

| 12 months | Worth per 10 grams (INR) | Return |

| 1950 | 99 | – |

| 2000 | 4,400 | 4,344% |

| 2020 | 49,000 | 1,013% |

| 2024 | 74,490 | 52% |

The historic worth knowledge of gold showcases its substantial appreciation over time. For example, in 1950, the worth of gold was fairly modest at Rs 99 per 10 grams. By 2024, it has surged to Rs 74,490 per 10 grams, offering a outstanding return of 750 instances the unique worth. This interprets to a Rs 1,000 funding in 1950 rising to Rs 7.5 lakh.

From 2000 onwards, when gold was priced at Rs 4,400 per 10 grams, it has supplied a big return of roughly 1,500%. In the course of the 2020 pandemic, gold costs rose sharply to Rs 49,000 per 10 grams resulting from its fame as a “protected haven” asset throughout financial uncertainty. This development continued within the post-COVID interval, with costs reaching new highs in 2023 and 2024.

Nevertheless, it’s essential to notice that gold costs might be fairly unstable. Elements comparable to financial instability, inflation charges and geopolitical tensions have all contributed to fluctuations in gold costs through the years.

The dilemma

Because the attraction of gold as a secure and appreciating asset continues to develop, traders are confronted with a dilemma: Ought to they spend money on conventional bodily gold or go for the fashionable comfort of digital gold? Every possibility comes with its personal set of benefits and challenges, making the choice much less easy.With bodily gold, there’s the tangibility and conventional worth related to it. Nevertheless, it comes with considerations about storage, safety, and extra prices like making expenses for jewelry. Alternatively, digital gold affords ease of buy, safe storage, and usually decrease prices. Digital gold investments, like Sovereign Gold Bonds (SGBs) and Gold ETFs, present modern methods to spend money on gold with out the hassles of bodily possession, however additionally they introduce new components comparable to market liquidity and regulatory facets. Let’s dive into an in depth comparability:

Digital Gold vs Bodily Gold

| Function | Bodily Gold | Digital Gold (SGBs) | Digital Gold (ETFs) |

| Kind | Cash, Bars, Jewelry | Sovereign Gold Bonds issued by the Authorities of India | Gold Trade-Traded Funds traded on inventory exchanges |

| Buy | Accessible from jewellers, bullion merchants, and authorities establishments like MMTC | Could be bought throughout issuance durations by way of approved banks, put up places of work, and on-line platforms | Could be purchased any time by way of inventory exchanges by way of stockbrokers |

| Storage | Requires safe storage at house or in a financial institution deposit field | Saved electronically, eliminating the necessity for bodily storage | Saved electronically in a demat account, avoiding bodily storage considerations |

| Safety Dangers | Bodily dangers comparable to theft, harm, and the opportunity of buying impure gold | No bodily dangers as it’s saved electronically, making certain purity and authenticity | No bodily dangers, purity, and authenticity ensured as it’s held electronically |

| Prices | Contains making expenses (usually round 20% for jewelry), storage prices, and insurance coverage | No making expenses, affords an extra annual return of two.5% together with capital appreciation | Entails brokerage charges and administration charges, usually decrease than the prices related to bodily gold |

| Liquidity | Extremely liquid, might be bought at any time however might incur making expenses and market worth fluctuations | Redeemable after 5 years with an 8-year lock-in interval; affords each liquidity and stability | Excessive liquidity, might be traded on inventory exchanges at any time, providing flexibility |

| Returns | Market-dependent returns based mostly on present gold costs | Capital appreciation linked to gold costs plus an extra 2.5% annual curiosity | Market-dependent returns, carefully observe the worth actions of gold |

| Taxation | GST (3%) on buy, capital beneficial properties tax applies on promoting relying on holding interval | Capital beneficial properties are exempt from taxation upon maturity, making it tax-efficient | Topic to short-term or long-term capital beneficial properties tax based mostly on the holding interval |

| Collateral | Could be pledged as collateral for loans, usually as much as 75% of the gold’s worth | Can be utilized as collateral for loans, with banks providing loans starting from INR 20,000 to INR 20 lakh | Can be utilized as collateral for loans, however requires conversion to bodily gold first |

| Conversion | NA | Redeemed in financial phrases reasonably than bodily gold | Could be transformed into bodily gold, although this entails further procedures |

| Flexibility | Gives the bodily possession of gold, which some traders desire for long-term safety | Presents long-term stability with further returns, appropriate for these in search of a gentle and dependable funding | Presents excessive flexibility for short-term buying and selling and fast response to market adjustments |

Selecting one

Based mostly on the evaluation, Sovereign Gold Bonds (SGBs) are really useful as the best choice for these in search of long-term stability and extra returns. They provide capital appreciation together with an annual rate of interest, making them a positive alternative for regular returns. Moreover, SGBs supply tax advantages upon maturity, including to their attractiveness as a long-term funding.

Gold ETFs are available because the second-best possibility for traders who prioritize liquidity and adaptability. They permit for fast responses to market adjustments and supply a simple method to spend money on gold with out the necessity for bodily storage. These enable for straightforward shopping for and promoting on inventory exchanges, making them appropriate for many who are comfy with market fluctuations and need to capitalize on short-term actions in gold costs.

Lastly, bodily gold is really useful for long-term traders who worth the tangibility of the asset and are keen to deal with the related storage and safety considerations. This feature is greatest for many who desire to carry gold for prolonged durations and admire the sense of safety that comes with proudly owning bodily gold.

Want skilled assist?

So, are you able to make your gold funding rely? Whether or not you favor the digital comfort of SGBs and ETFs or the timeless attract of bodily gold, Fincart is right here that can assist you navigate your choices. Contact us in the present day and switch your gold funding desires into actuality with Fincart!

[ad_2]