[ad_1]

I’ve at all times liked sports activities, taking part in tennis and cricket once I was rising up, earlier than transitioning to fan standing, cheering for my favored groups from the sidelines. I additionally like finance, maybe not as a lot as sports activities, however there are winners and losers within the funding sport as effectively. Thus, it ought to come as no shock that when the 2 join, as is the case when groups are purchased and offered, or gamers are signed, I’m doubly . The time is ripe now to speak about how skilled sports activities, in its many variations world wide, has blown a monetary gasket, as you see groups offered for costs that appear out of sync with their monetary fundamentals and gamers signed on contracts that equate to the GDP of a small nation. On this submit, that’s my goal, and if get sidetracked, as a sports activities followers, I apologize prematurely.

The Lead In

In its idealistic kind, sports activities is about competitors and the human spirit, and is divorced from cash. That was the best behind not simply the Olympic ban on athletes from being paid for performing, but in addition behind main tennis tournaments being restricted to only amateurs till 1968 and the whole collegiate sports activities scene. Each restrictions finally fell, laden by hypocrisy, for the reason that similar entities that preached the significance of protecting cash out of sports activities, and insisted that the gamers on the sector couldn’t make a residing from taking part in it, engorged themselves on its financial spoils. At this level, it appears plain that sports activities and cash are entwined, and that attempting to separate the 2 is pointless.

The Story Strains

Because the partitions between sports activities and cash have crumbled, we’ve grow to be used to seeing mind-boggling numbers on sports activities transactions, whether or not or not it’s within the kind on broadcasting networks paying for the rights to hold sporting occasions or participant contracts pushing into the tons of of thousands and thousands. Even by these requirements, although, the previous couple of months have delivered surprises which have staggered even probably the most jaded sports-watchers:

- Participant contracts: Whereas participant contracts have grow to be larger over time, the $776 million provide by Al-Hilal, a Saudi group, to Kylian Mbappe, the French famous person on contract with PSG, for a one-year contract to play with the group was eye-popping in magnitude. Whereas Mbappe turned down the provide and is contemplating a ten-year cope with PSG, the numbers concerned within the Al-Hilal deal are nearly unimaginable to justify on purely financial phrases. In parallel, because the 2023 baseball season winds down, questions on which group would signal Shohei Ohtani, its finest participant, and for how a lot had been broadly debated within the media.

- Sports activities franchise transactions: In 2023, the Washington Commanders, an NFL group with a decidedly combined report on the sector and a historical past of controversy round its identify and proprietor, was offered for over $6 billion to a consortium, making it the very best priced sports activities franchise transaction in historical past. It adopted a decade or extra of ever-rising costs for sports activities franchises world wide, from the Premier League (soccer) within the UK, to the IPL (cricket) and throughout skilled sports activities within the US.

- Sport disruptions: The final yr has additionally introduced threats to sports activities franchises, hanging at their very existence. The Saudi group bid for Mbappe mirrored a broader try by the nation to disrupt skilled sports activities, with skilled golf, particularly, within the cross hairs. When LIV made its bid by signing up a few of the best-known golf gamers on the earth to play in its tournaments, few gave it an opportunity of success in opposition to the PGA, however in 2023, it was the PGA that conceded the battle within the cash sport.

- Broadcasting upheaval: Because the revenues from sports activities has shifted from the taking part in fields to media, it’s the dimension of the media contracts that decide how profitable a sport is. In 2021, we noticed the NFL, the richest franchise on the earth, enter into new media contracts to cowl the subsequent decade of broadcasting rights for the game. These contracts will not be solely anticipated to usher in a staggering $114 billion in revenues to the NFL within the subsequent decade, however in a mirrored image of the occasions, they’re break up amongst 4 completely different broadcasters (ESPN, CBS, NBC and Fox), with Amazon Prime choosing up the slack. The growing significance of streaming within the media enterprise was illustrated when the IPL, India’s cricket league, offered its media rights for the subsequent 5 years for tv broadcasting to Star India, a Disney-owned subsidiary, for roughly $3 billion, and the streaming rights for a similar interval to Viacom18, a Reliance-controlled three way partnership, for about the identical quantity.

Whereas these tales cowl disparate elements of sports activities, and the one factor they share in frequent is the explosively giant monetary numbers, I’ll argue, on this submit, that they signify an acceleration in a phenomenon that may change how these sports activities will get performed and watched.

Rising Franchise Costs

Even an informal follower of the information on sports activities franchises altering palms, it doesn’t matter what the game, should have observed the surge within the pricing of sports activities franchises, with little or no apparent connection to group success on the sector; the Washington Commanders, the goal of $6 billion acquisition, have gained 63 video games, whereas shedding 97, within the final decade. Actually, the 5 highest costs paid for sports activities groups have all be paid within the final two years, as may be seen within the listing of ten costliest sports activities franchise transactions in historical past:

|

|

|

|

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These excessive costs, although, signify the continuation of a pattern that we’ve seen over the previous couple of many years in franchise pricing, with the graph under taking a look at each main sports activities transaction between 1998 and 2023:

As you’ll be able to see, transaction costs for sports activities franchises have been marching upwards for the final 20 years, with NBA and NFL groups registering the largest will increase, however have seen breakaway surges in the previous couple of years.

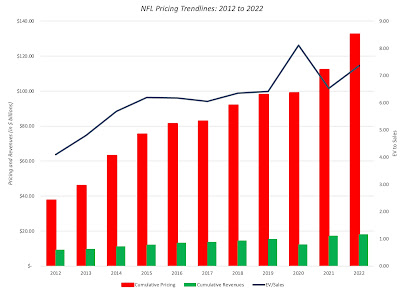

A few of you might be accustomed to the Forbes annual listings of probably the most worthwhile groups on the earth, and you will have puzzled how they worth sports activities groups. The reality, and I’ll make clear what I imply shortly, is that Forbes doesn’t worth sports activities franchises, however costs them. Since Forbes will get attracts on precise transaction costs as steering of their estimates, the pricing that Forbes attaches to groups has risen with transaction costs. Within the graph under, as an example, I report the cumulative pricing of all NFL groups, as estimated by Forbes, from 2012 to 2022:

The collective pricing of all NFL groups, based on Forbes, has risen from $37.6 billion in 2012 to $132.5 billion in 2022. Actually, I will likely be prepared to foretell that given the Washington Commanders transaction, the pricing of each NFL group on the Forbes listing will likely be larger in 2023.

With the pricing course of in thoughts, it’s instructive to have a look at the collective pricing, in thousands and thousands of US {dollars}, of world sports activities franchises, as of the latest updates from 2022 and 2023:

| Cumulative Pricing (in $ mil) | Highest Priced | Lowest Priced | |

|---|---|---|---|

| NFL (US Soccer) | $132,500 | $7,640 | $4,140 |

| NBA (Basketball) | $85,910 | $7,000 | $1,600 |

| MLB (Baseball) | $69,550 | $7,100 | $1,000 |

| NHL (Hockey) | $32,350 | $2,200 | $450 |

| MLS (US Soccer) | $16,200 | $1,000 | $350 |

| Premier League (To twenty) | $30,255 | $5,950 | $145 |

| IPL (Indian Cricket) | $10,430 | $1,300 | $850 |

The NFL is probably the most worthwhile franchise on the earth, by way of collective pricing of all of its groups, adopted by basketball and baseball. The collective pricing of all soccer groups world wide may very well be near and even exceed the pricing of baseball or basketball groups, however simply the highest 20 Premier League groups have a pricing of about $30 billion. The ten groups that comprise the IPL, the Indian cricket league, have a collective pricing in extra of $10 billion. One fascinating distinction throughout franchises is the variations between the very best and lowest priced franchises, with the NFL having the smallest distinction, and we are going to speak about how the way in which broadcasting income are shared can clarify this divergence throughout sports activities franchises.

Lastly, there’s a subset of sports activities franchises which are publicly traded, however it’s a very small one. Amongst US sports activities franchises, the one which comes closes is Madison Sq. Backyard Sports activities, which along with proudly owning the world (Madison Sq. Backyard) additionally owns the New York Knicks (NBA) and the New York Rangers (hockey), however it’s carefully held, with the Dolan household firmly in management. Exterior of the US, Manchester United is the highest-profile instance of a publicly traded firm, nevertheless it too is carefully held, with management within the palms of the Glazer household. There are a number of European soccer groups which are publicly traded, however all of them are typically carefully held, with gentle liquidity.

Value vs Worth

Should you discover me finicky, once I label the Forbes estimates for franchises as costs, slightly than values, it’s best understood by contrasting worth and worth, two phrases that, at the very least to me, imply very various things and require completely different mindsets:

As you’ll be able to see from the image, whereas worth is pushed by acquainted fundamentals (money flows, progress and threat), worth is set by demand and provide, which, in flip, are pushed by temper and momentum, behavioral components that don’t play a key function in figuring out worth. I used this distinction, a number of years in the past, to categorise investments and speak about worth and worth with every one:

As you’ll be able to see, collectibles and currencies can solely be priced, and whereas commodities could have an mixture elementary worth, they’re extra prone to be priced than valued. It’s only with belongings which are anticipated to generate cashflows sooner or later that worth even comes into play. An organization or a enterprise may be valued, and that worth will replicate its capability to generate money flows sooner or later, nevertheless it may also be priced, primarily based upon what others are paying for related firms. Actually, nearly each funding philosophy may be framed by way of whether or not you consider that there generally is a hole between worth and worth, and when there’s a hole, how rapidly it is going to trigger, in addition to catalyst that trigger that closing.

There’s a sub-grouping of belongings, although, that’s value carving out and contemplating in a different way, and I’ll name these trophy belongings. A trophy asset has anticipated money flows, and may be valued like every other asset, however the individuals who purchase it usually achieve this, much less for its asset standing and extra as a collectible. Powered by emotional components, the costs of trophy belongings can rise above values and keep larger, since, in contrast to different belongings, there isn’t a catalyst that may trigger the hole between worth and worth to shut. So, what’s it that makes it for a “trophy belongings”?

- Emotional attraction overwhelms monetary traits: The important thing to a trophy asset is that the core of its attraction, to potential patrons or buyers, lies much less in enterprise fashions and money flows, and extra within the emotional attraction it has to patrons. That attraction could also be solely to a subset of people, however these patrons need to personal the asset extra for the emotional dividends, not the cashflows.

- It’s distinctive: Trophy belongings pack a punch as a result of they’re distinctive, insofar as they can’t be replicated by somebody, even when that somebody has substantial monetary assets.

- It’s scarce: For trophy belongings to command a pricing that’s considerably larger than worth, they should be scarce.

- It’s purchased and held for non-financial causes: If trophy belongings are opened up for bidding, the profitable bidder will nearly at all times be a person or entity that’s shopping for the asset extra for its historical past or provenance, not its monetary traits.

As soon as an asset crosses the brink to trophy standing, you’ll be able to anticipate the next to happen. First, it is going to look overestimated, relative to monetary fundamentals (earnings, revenues, money flows), and relative to look group belongings that don’t take pleasure in the identical trophy standing. Second, and that is vital, at the same time as worth will increase relative to worth, the mechanism that causes the hole to shut, usually stemming from a recognition that the you may have paid an excessive amount of for one thing, given its capability to generate earnings and money flows, will cease working. In spite of everything, if patrons worth trophy belongings primarily based upon their emotional connections, they’re coming into the transaction, understanding that they’ve paid an excessive amount of, and don’t care. Third, and this follows from the firs level, the forces that trigger the costs of trophy belongings to alter from interval to interval can have a weak or no relationship to the basics that will usually drive worth.

There’s an fascinating query of whether or not a publicly traded firm can purchase trophy standing, and whereas my reply, ten or twenty years in the past, would have been a fast no, I’ve to pause earlier than I reply it now. As a lot of you already know, I’ve tried to worth Tesla, primarily based upon my story for the corporate, and the anticipated money flows that emerge from that story, many occasions over the past decade. Whereas a few of the pushback has come from those that disagree with the contours of my story, and my expectations, a few of it has come from individuals who haven’t solely invested a big proportion of their wealth within the firm, however have executed so as a result of they need to be a part of what they see as a historic disruptor, one that may upend the way in which we not solely drive, however stay. The implication then is that Tesla will commerce at costs which are troublesome to justify, given the corporate’s financials, that it’ll entice a subset of buyers who obtain emotional dividends from proudly owning the inventory and that brief promoting the inventory, on the expectation that the hole will shut, will likely be a dangerous train.

Sports activities Franchises as Trophy Property

When the Rooney household purchased the Pittsburg Steelers, now a storied franchise in probably the most extremely priced sports activities league (NFL) is 1932 for $2,500, it was very probably that they had been shopping for it as a enterprise, hoping to generate sufficient in ticket gross sales to cowl their prices and earn a revenue. In spite of everything, soccer (at the very least the American model) was a nascent sport, not broadly adopted, and with just some groups and no organized construction. Actually, you’ll be able to nonetheless view the Steelers as a enterprise, and worth them as such, however as we are going to argue on this part, that quantity will bear little resemblance to the $4 billion pricing that Forbes hooked up to the group. Actually, sports activities franchises internationally have already grow to be, or are more and more on the pathway to changing into trophy belongings.

1. Costs disconnect from Fundamentals

To worth a sports activities franchise as a enterprise, it’s value inspecting how the revenues for franchises have advanced over time. Till the final 50 years, nearly the entire revenues for sports activities franchises got here from gate receipts collected from followers coming in to observe video games, and the meals and merchandise that these followers purchased, often on the video games they attended. With tv coming into the image, and streaming augmenting it, the portion of revenues that sports activities franchises get from media has grow to be a bigger and bigger slice of the pie, as may be seen within the graph under, the place we have a look at gate receipts, media income and different (merchandizing and sponsorship) revenues for all US sports activities franchises between 2006 and 2022:

As you’ll be able to see, the general revenues for sports activities franchises has grown between 2006 and 2022, with 2020 being the COVID outlier, however a lot of that progress has come from the media slice of revenues, as gate receipts have flatlined. That is clearly not only a US phenomenon, and you might be seeing the identical course of play out in Europe (with soccer the massive beneficiary) and in India (with cricket the winner).

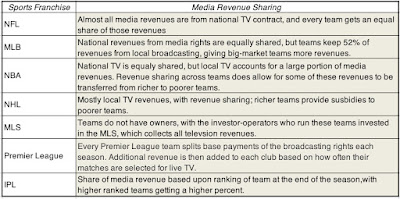

To worth a sports activities franchise, you not solely have to contemplate how a lot of a draw the group is on the stadium, however how a lot revenues the group will get from its media contracts, in addition to merchandising and sponsorship revenues. Whereas the gate receipts and merchandising revenues are vital, they’re comparatively straightforward to forecast, given historical past and ticket gross sales. Media revenues, although, are difficult, since they’re decided partly by the dimensions of the media market that the group operates in, and partly by how the sports activities franchise that the group belongs to shares its media revenues. Within the US, for instance, baseball groups get a good portion of their broadcasting revenues from native TV rights, and as a consequence, groups within the largest media markets (Yankees and Mets in New York, Dodgers in Los Angeles) have larger revenues than groups in smaller media market (Mariners in Seattle). In distinction, the media revenues for soccer (NFL) are principally nationwide, and people revenues are equally divided throughout the groups, leading to extra equitable media revenues throughout NFL groups. That distinction explains why the divergence between the very best and lowest priced groups is bigger in baseball than the NFL. The desk under offers a comparability of how media revenues are shared throughout groups, by franchise:

Whereas the entire franchises pay lip service to the necessity for stability, with giant media-market groups subsidizing small media-market groups, there may be extensive variation throughout franchises in how they observe by way of on fixing that imbalance. Solely the NFL has a robust sufficient system in place to create full stability, and that’s partly due to the truth that nearly all of its broadcasting revenues are nationwide (slightly than native) and partly as a result of it’s a league with a robust commissioner.

Whereas revenues have risen, aided by richer broadcasting contracts, sports activities franchises have been confronted with rising participant prices; in nearly each main sports activities franchise in america, participant bills account to 50% of revenues, or extra, and so they have risen over time. As soon as the opposite bills related to a group are netted out, the working earnings at sports activities franchises are, for probably the most half, average. Wanting throughout sports activities franchises, you’ll be able to see that the cumulated income and working earnings numbers, along with the collective pricing of groups (as estimated by Forbes) in the latest yr:

Whereas group financials are typically opaque, Forbes estimated that the NFL, the richest sports activities franchise on the earth, generated about $4.7 billion in working revenue on revenues of roughly $16 billion, in 2022. The NBA is the next-most worthwhile franchise, whereas baseball collectively struggles to generate income. Extra to the purpose, in the event you use the Forbes pricing estimates for groups, notice that 4 of the seven franchises (NFL, NBA, MLS and IPL) commerce at 8-10 occasions revenues and at excessive multiples of working earnings. It’s true that there are tech firms available in the market that commerce at related multiples, however these firms have extraordinary progress potential forward of them and new markets to beat. Even in the event you consider that media rights will proceed to the the goose that lays the golden eggs for sports activities franchises, it’s troublesome to see the way you justify these pricing multiples. To point out that the disconnect between what patrons are paying for franchises, and what they’re getting again in return, has been rising over time, I have a look at the pricing of NFL groups over time, relative to revenues at these groups (which embody the richer media contracts) from 2012 to 2022:

During the last decade, you’ll be able to see that the pricing of NFL groups has risen from simply over 4 occasions revenues in 2012 to greater than seven occasions revenues in 2022. In brief, NFL franchise costs are rising at charges that can’t be defined by income progress, richer media contracts however, or larger profitability.

2. A brand new breed of homeowners

At first of this part, I discussed the Rooneys shopping for the Pittsburg Steelers in 1932 for $2,500, and so they proceed to personal the Steelers. Whereas it’s conceivable that they consider the Steelers as a enterprise they personal that has to proceed to ship earnings for them, a lot of the remainder of the NFL has seen a altering of the guard, with new house owners changing the older holdouts. Many of those new house owners are already rich, with their wealth gathered in a distinct setting (actual property, personal fairness, enterprise capital), after they purchase skilled sports activities groups, and from the outset, it appears clear that they’re much less curious about turning a revenue , and extra in taking part in the function of group proprietor. For example, I deal with the NBA, the place there was a lot turnover within the possession ranks, with near two-thirds of the groups buying new house owners within the final 20 years:

As you browse this listing, you’ll notice that whereas lots of the house owners are billionaires, not counting their NBA group possession, there are a number of house owners, in the direction of the underside of the listing, whose wealth is primarily of their group possession. Searching for traits, the more moderen a sports activities franchise transaction, the extra probably it’s that the client isn’t just rich, however immensely so, and this sample is taking part in out internationally.

So, why would these rich, and presumably financially savvy, people put their cash into sports activities groups? In step with the saying {that a} image is value a thousand phrases, check out this image of Steve Ballmer on the sidelines of a Clippers sport:

In some ways, sports activities franchises are the final word trophy belongings, since they’re scarce and proudly owning them not solely permits you to stay out your childhood desires, but in addition offers you an opportunity to indulge your family and friends, with front-row seats and participant introductions. Actually, it additionally explains the entry of sovereign wealth funds, particularly from the Center East, into the possession ranks, particularly within the Premier League. Should you couple this actuality with the truth that winner-take-all economies of the twenty-first century ship extra billionaires in our midst, you’ll be able to see why there isn’t a imminent correction on the horizon for sports activities franchise pricing. So long as the variety of billionaires exceeds the variety of sports activities franchises on the face of the earth, you must anticipate to see fewer and fewer house owners just like the Rooneys and an increasing number of just like the Steves (Cohen and Ballmer).

Penalties of Trophy Asset Standing

If you’re a sports activities fan, you might be questioning why any of this issues to you, since you aren’t a billionaire and will not be planning to purchase any groups, both as companies or as trophy assts. I feel that you must care as a result of the trophy asset phenomenon is already reshaping how groups are structured, sports activities get performed and maybe what your favourite group will appear to be subsequent yr, when it takes the sector.

- For Homeowners: For the house owners of franchises that aren’t members of the billionaire membership, there will likely be stress to money out, and the important thing to getting a profitable provide is to extend the group’s attraction to potential patrons, as toys. Including a high-profile participant, even one who’s approaching the top of his or her taking part in life, can add to the attraction of a sports activities group, as a trophy, even because it reduces its high quality on the sector, as is transferring to a metropolis {that a} potential purchaser could view as a greater setting for his or her costly toy (Oakland A’s and San Diego Clipper or Charger followers, take notice!). For billionaire house owners of franchises, the reactions to proudly owning an costly toy that doesn’t carry out as anticipated, can vary from impatience with managers and gamers, to trades pushed by impulse slightly than sports activities sense.

- For Gamers: As sports activities franchises grow to be trophy belongings, gamers grow to be the jewels that add dazzle to those trophies. Not surprisingly, the superstars of each sport will likely be prized much more than they was once, not only for what they’ll do on the sector, however for what they’ll do for an proprietor’s bragging proper. The current billion greenback bid for Mbappe and the upcoming bidding struggle for Shohei Ohtani make sense from this attitude, and you must anticipate to see extra mind-glowingly giant participant contracts sooner or later. To the extent {that a} participant’s trophy attraction is as a lot a operate of that participant’s social media presence and following, as it’s of efficiency on the sector, you must anticipate to see sports activities gamers aspire for celeb standing.

- For Followers: If you’re the fan of a sports activities franchise that’s owned by somebody to whom cash isn’t any object, you’ll have a lot to have a good time, as your group chases down and indicators the largest names within the sport. As a destructive, in case your group proprietor tires of their trophy asset, you might be caught with the results of benign (or not so benign) neglect. If however, you occur to be a fan of the group that continues to be owned by an old-guard proprietor, intent on working the group as a enterprise, you can see your self annoyed as homegrown stars get signed by different groups. The outdated divide of wealthy groups/poor groups that was primarily based on unequal media markets or stadium sizes will likely be changed with a brand new divide between wealthy group house owners and poorer group house owners, the place the latter nonetheless should make their groups work as companies, whereas the previous don’t.

In sum, in case your concern has been that sports activities has grow to be too business-like and pushed by information, the entry of homeowners who’re much less within the enterprise of sports activities and extra curious about buying trophies could very effectively change the sport, however at a price, the place sports activities turns into leisure, the place gamers and groups chase social media standing, and what occurs on the sector itself turns into secondary to what occurs off the pitch.

YouTube Video

Information

Spreadsheets

[ad_2]

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.