[ad_1]

I’m not a market prognosticator for a easy purpose. I’m simply not good at it, and the primary six months of 2023 illustrate why market timing is commonly the unimaginable dream, one thing that each investor aspires to achieve success at, however only a few succeed on a constant foundation. In the beginning of the 12 months, the consensus of market specialists was that this may be a troublesome 12 months for markets, given the macro worries about inflation and an impending recession, and including within the worry of the Fed elevating charges to this combine made bullishness a uncommon commodity on Wall Road. Markets, as is their wont, stay to shock, and the primary six months of 2023 has wrong-footed the specialists (once more).

The Begin of the 12 months Blues: Main into 2023

As we benefit from the second, with markets buoyant and economists assuring us that the worst is behind us, each by way of inflation and the financial system, it’s value recalling what the traditional knowledge was, coming into 2023. After a bruising 12 months for each asset class, with the riskiest segments in every asset class being broken essentially the most, there have been fears that inflation wouldn’t simply keep excessive, however go greater, and that the financial system would go right into a tailspin. Whereas this will likely appear perverse, step one in understanding and assessing the place we’re in markets now could be to return and study the place issues stood then.

Wanting throughout firm groupings, returns on shares in 2022 flipped the script in the marketplace efficiency over a lot of the prior decade, with the winners from that decade (tech, younger corporations, progress corporations) singled out for the worst punishment in the course of the 12 months.

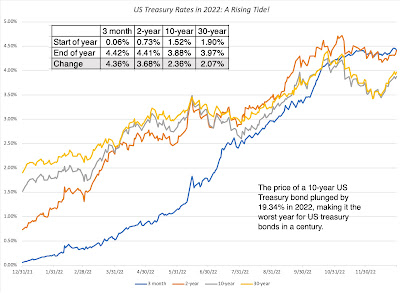

The decline in bond costs was pushed by surging rates of interest, with quick time period treasuries rising excess of long term treasuries, and the yield curve inverted in direction of the tip of the 12 months.

Whereas default spreads rose throughout rankings lessons, the rise was way more pronounced for the bottom rankings lessons, a part of a larger story about threat capital that spilled throughout markets and asset lessons. After a decade of quick access, translating into low threat premiums and default spreads, accompanied by a surge in IPOs and start-ups funded by enterprise capital, threat capital moved to the sidelines in 2022.

In sum, buyers have been shell shocked in the beginning of 2023, and there gave the impression to be little purpose to count on the approaching 12 months to be any completely different. That pessimism was not restricted to market outlooks. Inflation dominated the headlines and there was widespread consensus amongst economists {that a} recession was imminent, with the one questions being about how extreme it might be and when it might begin.

The Market (and Economic system) Surprises: The First Half of 2023

Midway by 2023, I feel it’s protected to say that markets have stunned buyers and economists once more, this 12 months. The mixture of excessive inflation and a recession that was on the bingo playing cards of some economists in the beginning of 2023 didn’t manifest, with inflation declining ahead of most anticipated in the course of the 12 months:

It’s true that the drop in inflation was anticipated by some economists, however most of them additionally anticipated that decline to come back from a quickly slowing financial system, i.e., a recession and to be Fed-driven. That has not occurred both, as employment numbers have stayed sturdy, housing costs have (a minimum of up until now) absorbed the blows from greater mortgage charges and the financial system has continued to develop.

It’s true that financial exercise has leveled off and housing costs have declined a little bit, relative to a 12 months in the past, however given the rise in charges in 2022, these modifications are gentle. If something, the financial system appears to have settled right into a secure sample, albeit on the excessive ranges that it reached within the second half of 2021. I do know that the sport will not be achieved, and the long-promised ache should arrive within the second half of the 12 months, however for the second, a minimum of, markets have discovered some respite.

In the course of the course of 2023, the Fed was on the heart of most financial storylines hero to some and villain to many others, with each utterance from Jerome Powell and different Fed officers parsed for indicators about future actions. That stated, it’s value noting that there’s little or no of consequence within the financial system or the market, in 2023, that you may attribute to Fed exercise. The Fed has raised the Fed Funds fee a number of occasions this 12 months, however these fee will increase have clearly achieved nothing to sluggish the financial system down and inflation has stabilized, not due to the Fed however in spit of it. I do know that there are various who nonetheless wish to imagine that the Fed units rates of interest, however here’s what market rates of interest (within the type of US treasury charges) have achieved throughout 2023:

If there’s a Fed impact on rates of interest, it’s nearly solely on the very quick finish of the spectrum, and never on long term charges; the ten-year and thirty-year treasury bond charges have declined in the course of the 12 months. That doesn’t shock me, since I’ve by no means purchased into the “Fed did it” theme, and have written a number of posts about why it’s inflation and financial progress that drive rates of interest, not central banks. As inflation has dropped and the financial system has saved its footing, the company bond market has benefited from default spreads declining, as fears subside:

As in 2022, the change in default spreads is biggest on the lowest rankings, with the important thing distinction being that spreads are declining in 2023, relatively than rising, although the spreads nonetheless stay considerably greater than they have been in the beginning of 2022.

Inventory Markets Perk Up: The First Half of 2023

I famous that threat capital retreated from markets in 2022, with unfavorable penalties for dangerous asset lessons. To the extent that a few of that threat capital is coming again into the markets, fairness markets have benefited, with advantages skewing extra in direction of the businesses and markets that have been punished essentially the most in 2022. To know the fairness comeback in 2023, I begin by trying on the enhance in market capitalizations, in US $ phrases, the world over within the first six months of the 12 months, with the change in market capitalizations in 2022 to supply perspective:

In US greenback phrases, world equities have reclaimed $8.6 trillion in market worth within the first six months within the 12 months, however the severity of final 12 months’s decline has nonetheless left them $14.4 trillion under their values from the beginning of 2022. Wanting throughout areas, US equities have carried out one of the best within the first six months of 2023, including nearly 14% ($5.6 trillion) to market capitalizations, regaining nearly half of the worth misplaced in final 12 months’s rout. In US greenback phrases, China was the worst performing area of the world, with fairness values down 1.01% within the first six months on 2023, including to the 18.7% that was misplaced final 12 months. The 2 finest performing components of the world in 2022, Africa and India, carried out reasonably nicely within the first half of 2023. In US greenback phrases, Latin America was flat within the first half of 2023, although there have been a few Latin American markets that delivered stellar returns in native foreign money phrases, albeit with excessive inflation consuming away at these returns. It’s foreign money fee modifications that explains that distinction between native foreign money and greenback returns, and within the graph under, I take a look at the US greenback’s efficiency broadly (towards different currencies) in addition to towards rising market currencies , between 2020 and 2023;

After strengthening in 2022, the US greenback has weakened towards most currencies in 2023, albeit solely mildly.

US Equities in 2023: Into the Weeds!

The majority of the surge in world equities in 2023 has come from US shares, however there are various buyers in US shares who’re taking a look at their portfolio efficiency this 12 months, and questioning why they are not sharing within the upside. On this part, I’ll begin by trying with an general evaluation of US equities (ranges and fairness threat premiums) earlier than delving into the main points of the winners and losers this 12 months.

Shares and the Fairness Danger Premium

I begin my evaluation of US equities by trying on the efficiency of the S&P 500 and the NASDAQ in the course of the first half of this 12 months:

As you possibly can see, why the S&P has had a robust first half of 2023, rising 15.91%, the NASDAQ has delivered nearly twice that return, with its tech focus. One purpose for the rise in inventory costs, a minimum of within the combination, has been a dampening of worries of out-of-control inflation or a deep recession, and this drop in worry will be seen within the fairness threat premium, the value of threat within the fairness market. Within the determine under, I’ve graphed my estimates of anticipated returns on shares and implied fairness threat premiums by 2022 and the primary six months of 2023:

After a 12 months for the report books, in 2022, when the anticipated return on shares (the price of fairness) elevated from 5.75% to 9.82%, the most important one-year enhance in that quantity in historical past, we now have had not only a extra subdued 12 months in 2023, however one the place the anticipated return has come again down to eight.81%. Within the course of, the implied fairness threat premium, which peaked at 5.94% on January 1, 2023, is again down to five% in the beginning of July 2023. Even after that drop, fairness threat premiums are nonetheless at roughly the common worth since 2008, and considerably greater than the common since 1960. If the essence of a bubble is that fairness threat premiums turn into “too low”, the numbers, a minimum of for the second, do not appear to signaling a bubble (in contrast to years like 1999, when the fairness threat premium dropped to 2%).

Sector and Trade

The divergence between the S&P 500 and the NASDAQ’s efficiency this 12 months offers clues as to which sectors have benefited essentially the most this 12 months, as threat has receded. Within the desk under, I break all US equities into sectors and report on efficiency, in 2022 and within the first half of 2023:

As you possibly can see, 4 of the twelve sectors have had unfavorable returns in 2023, with vitality shares down greater than 17% this 12 months. The most important winner, and this could come as no shock, has been expertise, with a return of 43% in 2023, and nearly solely recovering its losses in 2022. Financials, handicapped by the financial institution runs at SVB and First Republic, have been flat for the 12 months, as has been actual property. Communication companies and shopper discretionary have had a robust first half of 2023, however stay greater than 20% under their ranges on the star of 2022.

Breaking sectors down into industry-level particulars, we will determine the largest winners and losers, amongst industries. Within the desk under, I record the ten worst performing and finest performing {industry} teams, primarily based purely on market capitalization change within the first half of 2023:

The worst performing {industry} teams are in monetary companies and vitality, with oilfield companies corporations being the worst impacted. The perfect performing {industry} group is auto & truck, however these outcomes are skewed upwards, with one large winner (Tesla) accounting for a big portion of the rise in market capitalization within the sector. There are a number of expertise teams which might be on the winner record, not simply by way of share will increase, but additionally in absolute worth modifications, with semiconductors, computer systems/peripherals and software program all including greater than a trillion {dollars} in market capitalization apiece.

Market Capitalization and Profitability

The primary six months of the 12 months have additionally seen concentrated good points in a bigger corporations and this may be seen within the desk under, the place I break corporations down primarily based upon their market capitalizations in the beginning of 2023 into deciles, after which break the shares down in every decile into money-making and money-losing corporations, primarily based upon web revenue in 2022:

Once more, the numbers inform a narrative, with the money-making corporations within the largest market cap decile accounting for nearly all the acquire in market cap for all US equities; the market capitalization of those giant money-making corporations elevated by $5.3 trillion within the first six months of 2023, 97.2% of the $5.45 trillion enhance in worth for all US equities.

Worth and Progress

Over the past decade, I’ve written many posts about how old-time worth investing, with its focus low PE and low value to guide shares, has lagged progress investing, with excessive progress shares that commerce at greater multiples of earnings and guide worth delivering a lot greater returns than old-time worth shares (low PE ratios, excessive dividend yields and many others.). In 2022, old-time worth buyers felt vindicated, because the injury that 12 months was inflicted on the very best progress corporations, particularly in expertise. That celebration has not lasted lengthy, although, since in 2023, we noticed a return to a well-known sample from the final decade, with the very best value to guide shares incomes considerably greater returns than the shares with the bottom value to guide ratios:

As you possibly can see from the chart, nearly all the worth enhance in US equities has come from the highest two deciles of shares, by way of value to guide ratios. Taking a look at worth and progress shuttle between the successful and shedding columns in 2023, I imagine that it is a sample that can proceed to play out for the remainder of the last decade, with no decisive winner.

An Evaluation

I do know that one of many critiques of this market rise is that it has been uneven, however nearly all market recoveries are uneven, with some groupings of corporations at all times doing higher than others. That stated, there are classes to be realized from trying on the winners and the losers within the first half of 2023 market sweepstakes:

- Massive tech: There is no such thing as a doubt that this market has been largely elevated not simply by tech corporations, however by a subset of enormous tech corporations. Seven corporations (Apple, Microsoft, NVIDIA, Amazon, Tesla, Meta and Alphabet) have seen their collective market capitalization enhance by $4.14 trillion within the first half of 2023, accounting for nearly 80% of the general enhance in fairness values in any respect 6669 publicly traded US equities. If these shares stage off or drop, the market could have bother discovering substitutes to maintain the market pushing greater, merely due to the dimensions of the opening that can should be crammed.

- With a profitability skew: Whereas this does seem to be a reversion to the tech growth that drove markets previous to 2022, the market appears to be extra inclined to rewarding money-making tech corporations, on the expense of money-losers. If threat capital is coming again in 2023, it’s being extra selective about the place it’s directing its cash, and it’s subsequently not stunning that IPOs, enterprise capital and excessive yield bond issuances have remained mired in 2022 (low) ranges.

- And an financial twist: One purpose that these large and money-making tech corporations could also be seeing the return of investor cash is that they’ve navigated the inflation storm comparatively unscathed and a few have emerged extra disciplined, from the expertise. The 2 finest instances in level are Meta and Google, each of which haven’t solely diminished payrolls but additionally appear to have shifted their narrative from a relentless pursuit of progress to considered one of profitability.

It’s true that as market rallies lengthen, they draw in additional shares into their orbit, and it’s doable that the market rally will broaden over the course of the 12 months. That stated, this has been a decade of unpredictability, beginning with the primary quarter of 2020, the place COVID ravaged shares, and I do not suppose it makes a lot sense to take charts from 2008 or 2001 or earlier and extrapolating from these.

The Remainder of the 12 months: What’s coming?

The market temper is buoyant, as buyers appear to be satisfied that we now have dodged the bullet, with inflation cooling and a mushy touchdown for the financial system. The lesson that I’ve realized not simply from the primary six months of 2023, however from market efficiency over the past three years, has been that macro forecasting is pointless, and that making an attempt to time markets is foolhardy. If I have been to make guesses about what the remainder of the 12 months will deliver, listed below are my ideas:

- On inflation, the excellent news on inflation within the first half of the 12 months shouldn’t obscure the truth that the inflation fee, at 3% in June, nonetheless stays greater than the Fed-targeted worth (of two%). That final stretch getting inflation down from 3% to under 2% will likely be trench warfare, and we will likely be uncovered to macro shocks (from vitality costs or regional unrest) that may create inflationary shocks.

- On the financial system, however good employment numbers, there are indicators that the financial system is cooling and it’s once more solely doable that this turns right into a slow-motion recession, as actual property (particularly industrial) succumbs to greater rates of interest and shoppers begin retrenching.

- On rates of interest, I do suppose that hoping and praying that charges will return to 2% or decrease is a pipe dream, so long as inflation stays at 3% or greater. Briefly, with or with out the Fed, long run treasury charges have discovered a gradual state at 3.5% to 4%, and firms and buyers must study to stay with these charges. I’ve by no means connected a lot significance to the yield curve inversion as a predictor of financial progress, however that inversion is unlikely to go away quickly, as close to time period inflation stays greater than long run expectations.

-

On equities, the one certainty is that there will likely be uncertainties, and it’s unlikely that the market will repeat its success within the second half of 2023. I did worth the S&P 500 in the beginning of the 12 months, and and argued that it was near pretty valued then. Updating this valuation to mirror up to date views on each dimensions, in addition to an index value that’s about 16% greater, here’s what I see:

Observe that I’ve used the analyst projections of earnings for the index for 2023 to 2025, and adjusted the money payout over time to mirror reinvestment wanted to maintain progress in the long run (set to three.88%, after 2027). After the run up in inventory costs within the first six months, shares look pretty valued, given estimated earnings and money flows, and assuming that long run charges have discovered their regular state. (Not like market methods who present goal ranges for the index, an intrinsic worth delivers a price for the index immediately; to get an estimate of what interprets into as a goal stage of the index, you possibly can apply the price of fairness because the anticipated return issue to get index ranges in future time intervals.)

It goes with out saying, however I’ll say it anyway, that the financial system should go right into a recession, analysts could also be over estimating earnings and inflation could make a come again (pushing up long run charges). If in case you have considerations on these fronts, your investing ought to mirror these worries, however your returns will likely be solely pretty much as good as your macro forecasting skills. Mine should not that good, and it’s why I steer away from grandiose statements about equities being in a bubble or a discount. Whereas uncertainties abound, there may be one factor I’m sure about. I will likely be improper on nearly each single considered one of these forecasts, and there may be little that I can or need to do about that. That’s the reason I demand an fairness threat premium within the first place, and all I can do is hope that it giant sufficient to cowl these uncertainties.

A Time for Humility

If the biggest sin in investing is conceitedness, markets exist to deliver us again to earth and educate us humility. The primary half of 2023 was a reminder that regardless of who you’re as an analyst, and the way nicely thought by your funding thesis is, the market has different plans. As you hearken to market gurus spin tales about markets, typically primarily based upon historic knowledge and compelling charts, it’s value remembering that forecasting the place the complete market goes is, by itself, an act of hubris. Within the spirit of humility, I might counsel that in the event you have been a winner within the first half of this 12 months, acknowledge that a lot of that may be attributed to luck, and what the market offers, it will possibly take away. By the identical token, in the event you have been a loser over the course of the final six months, remorse shouldn’t lead you to attempt to load up on the winners over that interval. That ship has sailed, and who is aware of? Your loser portfolio could also be nicely positioned to reap the benefits of no matter is coming within the subsequent six months.

YouTube Video

Information Spreadsheets

Valuation Spreadsheets

[ad_2]