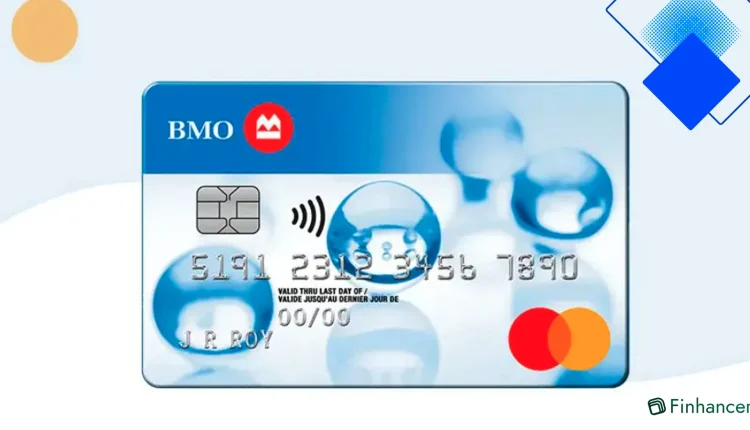

BMO Preferred Rate Mastercard, Canada’s top low-interest card for balance transfers

Cut interest costs with the BMO Preferred Rate Mastercard, a low‑interest credit card for Canadians that simplifies balance transfers and keeps fees clear

Why the BMO Preferred Rate Mastercard makes sense for Canadians

The BMO Preferred Rate Mastercard is a straightforward low-interest credit card built for Canadians who want to cut interest costs and simplify payments. It’s a no-nonsense option that prioritizes a low APR and clear fee structure, making it ideal for everyday use and for people carrying balances from month to month.

For residents in Toronto, Vancouver or smaller centres across Canada, this card can be a practical tool to manage debt. The card’s reputation in Canada rests on its blend of low interest, reasonable annual fee and BMO’s established customer support network.

Rates, balance transfers and fees explained

The main selling point is the low purchase APR and promotional balance transfer offers that often accompany the card. Canadians with high-rate debt can transfer balances and benefit from significantly reduced interest while they pay down principal. That makes the BMO Preferred Rate Mastercard one of the top low-interest credit card choices in Canada for debt consolidation.

Annual and foreign transaction fees are transparent and typically modest versus premium reward cards. Cash advances attract higher rates, so this card is best used for purchases and planned balance transfers. Always check the current APR and promotional terms on BMO’s site before applying.

Everyday perks, protections and practical use

Beyond low rates, the BMO Preferred Rate Mastercard includes standard Mastercard protections like zero liability for unauthorized transactions, purchase protection and extended warranty coverage on eligible items. These extras add value without the complexity of points programmes.

Canadians who shop online or travel occasionally will appreciate the card’s straightforward coverage and BMO’s mobile app for tracking payments in CAD. It pairs well with a disciplined repayment plan: lower interest means more of your payment goes to principal.

How to apply and whether it’s right for you

Applying is simple through BMO’s online application or in-branch across Canada. Have identification and income details ready; approval depends on credit history and ability to pay. The card is most suitable for those with fair-to-good credit who prioritise saving on interest over earning rewards.

If your goal is to reduce high-interest credit card debt, the BMO Preferred Rate Mastercard often delivers measurable savings. Compare current promotional balance transfer rates and annual fees with other low-interest Canadian cards to ensure you pick the best fit for your financial plan.