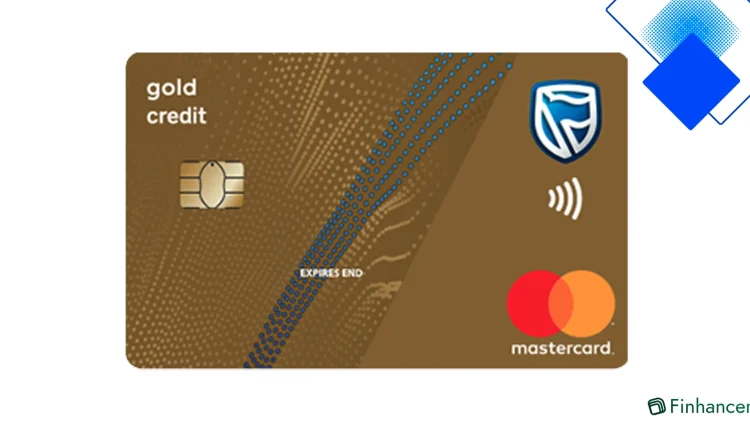

Standard Bank Gold Credit Card South Africa Save on Flights, Enjoy Travel Cover and UCount Rewards

Standard Bank Gold Credit Card South Africa lets you stretch your rand with Emirates flight savings, R1 000 000 travel cover, UCount Rewards and up to 55 days interest-free

Everyday value and rewards

The Standard Bank Gold Credit Card is a versatile choice for South Africans who want travel perks and solid everyday rewards. With UCount Rewards on every swipe, you earn points on groceries, fuel and online shopping that can be redeemed for flights, vouchers or statement credit, helping you stretch the rand further.

Cardholders benefit from contactless Tap to Pay for purchases under R500 and integration with SnapScan, MasterPass, Apple Pay and Samsung Pay, so paying in-store or online is quick and secure. The mobile app makes it easy to track spending, set alerts and manage your credit limit up to R100 000.

Travel perks that actually save you money

If you travel often, the Standard Bank Gold Credit Card delivers value: save up to 35% on Emirates flights booked through Leisure Desk and get basic travel insurance covering medical costs up to R1 000 000 for the first 90 days of a trip. Emergency assistance and competitive currency conversion rates add peace of mind when you’re abroad.

Enjoy up to 55 days interest-free on purchases when you settle the statement balance in full, ideal for planning holiday expenses or big purchases without immediate interest. Additional MasterCard promos like Buy 1 Get 1 food deals and Priceless Cities extras add lifestyle value at home and overseas.

Costs, fees and credit requirements

Applying for the Standard Bank Gold Credit Card requires you to be at least 18 and to earn a minimum of R5 000 a month. Standard fees include a R175 initiation fee, R40 monthly service fee and a small card fee; the exact interest rate is personalised to your credit profile.

Cash withdrawals carry higher charges, especially offshore, with a currency conversion fee around 2.75%. Always check your monthly statement and use the mobile app to set up Automatic Payments to cover the 3% minimum repayment and avoid interest where possible.

Security, limits and how to apply

Security features like Lost Card Protection, 3D Secure for online purchases and real-time transaction alerts keep your account safe. The card supports Zero Liability for unauthorised transactions when reported promptly and has fraud monitoring for peace of mind.

Applying is straightforward via the Standard Bank website, branch or mobile app with payslips and proof of residence for the last three months. If you travel, link the card to AlwaysOn WiFi and take advantage of freebies like 11GB data offers when you buy qualifying bundles with your Gold Credit Card.