Absa Gold Credit Card Benefits, Rewards and How to Apply in South Africa

All Absa Gold Credit Card benefits and rewards, plus clear steps to apply and smart tips to manage your account across South Africa

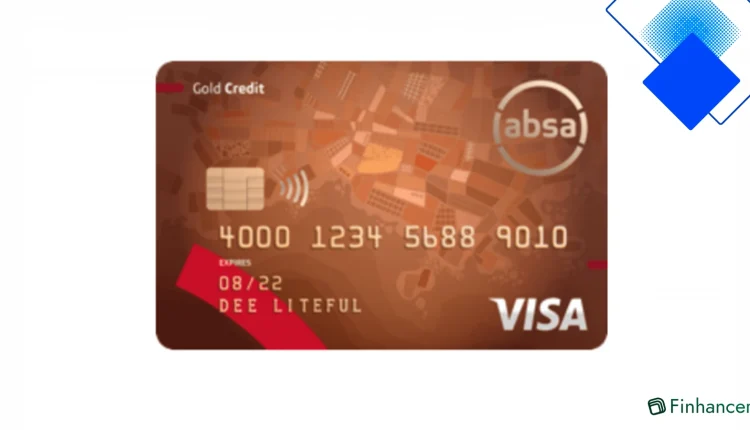

Why choose the Absa Gold Credit Card

The Absa Gold Credit Card is widely accepted across South Africa and designed for everyday South African lifestyles. With contactless tap-and-go payments for purchases under R200 and global MasterCard acceptance, the Absa Gold Credit Card gives practical convenience whether you’re filling up at a local garage or travelling abroad.

Cardholders also enjoy perks like discounted access to Bidvest Airport Lounges, complimentary basic travel insurance when flights are bought on the card, and enrolment in Absa Rewards so every spend helps you earn points. The blend of rewards, travel cover and local benefits makes the Absa Gold Credit Card a solid choice for many households.

Rewards, fees and interest

Every purchase on the Absa Gold Credit Card earns Absa Rewards points that can be redeemed for vouchers, retail discounts or flights, while qualifying fuel transactions may attract discounts. Interest-free purchases can run up to 57 days if you clear the statement balance by the due date, which helps manage cash flow between paydays.

Be aware of the cost structure: a one-off initiation fee, a modest monthly service fee and cash withdrawal fees apply, plus a foreign transaction currency conversion fee (around 2.75%). The standard interest rate sits around the advertised annual rate, so avoid unnecessary cash advances and stick to planned repayment to keep costs down.

How to apply and required documents

Applying for the Absa Gold Credit Card is straightforward. Apply online via Absa’s website, start the application at your local Absa branch or phone the card centre to get guidance. Typical approval times depend on your credit profile, ID verification and submission of supporting docs.

To speed up approval, have these ready: a South African ID book or smart ID, proof of residence or municipal account for the last three months, and your latest three payslips or bank statements showing income. You must be at least 18 and meet the minimum income requirement to qualify for the Absa Gold Credit Card.

Smart tips to manage your Absa Gold Credit Card

Use Absa’s mobile banking and online tools to monitor spending, set up SMS or e-mail alerts and automate payments so you never miss a due date. Paying the statement balance in full each month maximises the interest-free period and protects your credit score while earning rewards on regular spending with the Absa Gold Credit Card.

Treat cash withdrawals as a last resort because of associated fees and immediate interest charges. If you travel, notify Absa to avoid declined transactions and make the most of travel insurance and lounge discounts. Regularly review your limit and rewards balance to keep the card working for your financial goals.