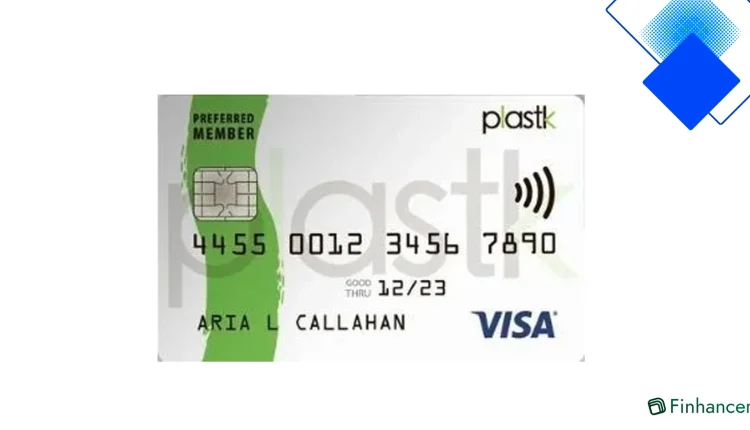

Plastk Secured Visa in Canada to Build Credit Fast and Earn Rewards

Build credit fast in Canada with the Plastk Secured Visa and earn rewards on everyday purchases

Why the Plastk Secured Visa works for Canadians

The Plastk Secured Visa Card is designed for Canadians who need to build or rebuild credit without the burden of high annual fees. It reports payment activity to Equifax and TransUnion Canada, which helps establish a positive credit history when you pay on time and keep balances low.

As a secured credit card, the Plastk Secured Visa requires a refundable security deposit to set your credit limit, giving issuers protection while you gain access to mainstream credit. For many residents in Ontario, Alberta or British Columbia, this is a practical step toward qualifying for better loan and mortgage rates.

Costs, rewards and transparent terms

Plastk keeps fees straightforward: no annual fee, a refundable deposit, standard interest on unpaid balances and a foreign transaction fee on purchases made in other currencies. Knowing these costs up front helps you plan spending in CAD and avoid surprises when travelling or shopping from US merchants.

Unlike many secured cards, the Plastk Secured Visa Card also offers a points rewards program that earns on everyday purchases. Earning and redeeming points for statement credits or travel makes the card useful beyond credit-building, adding real value to regular spending.

How to apply and build credit fast

Applying for the Plastk Secured Visa in Canada is simple: confirm eligibility, submit your application online with a Canadian address, and provide the security deposit that determines your credit limit. Approval tends to be faster than many unsecured options because the deposit reduces the lender s risk.

To build credit quickly, use the Plastk Secured Visa Card regularly but keep utilization below about 30% of your limit and pay the full balance on time. Consistent on-time payments reported to credit bureaus will noticeably improve your score over several months.

Maximize benefits and avoid extra fees

Get the most from your Plastk Secured Visa by setting up automatic payments to avoid late fees and watching foreign transactions when travelling. Track your points and redeem strategically for statement credits or travel, which increases the card s practical return on everyday spend in Canada.

If your credit improves, consider increasing your security deposit to raise your limit or request a review of your account for an upgrade to unsecured credit. Combining responsible use, low utilization and timely payments positions you to graduate to better cards and lower rates in the near future.