Vanilla Prepaid Card Canada Review, Fees, Reload Tips & Security

Practical Canadian breakdown of the Vanilla prepaid card covering fees, reload options and security tips

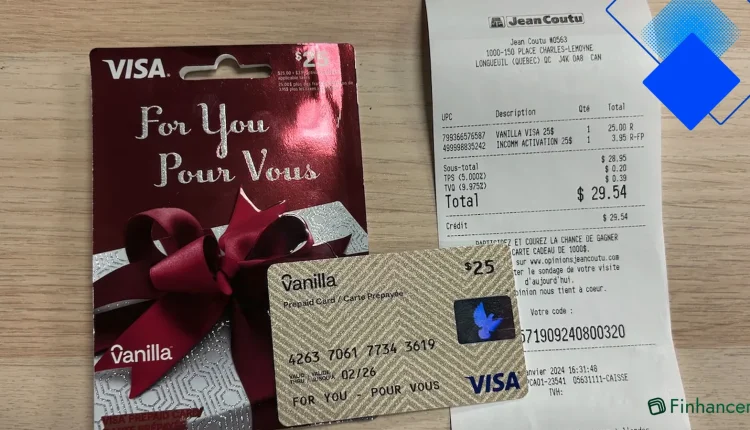

Overview of the Vanilla prepaid card in Canada

The Vanilla prepaid card is a straightforward way for Canadians to control spending without a bank account or credit check. Available as Vanilla Visa or Vanilla Mastercard, it works at millions of merchants that accept those networks across Canada and abroad.

For everyday use—online shopping, bill payments, or gifting—the Vanilla prepaid card offers predictability: you can only spend what you load. That simplicity is why many Canadians pick it as a budgeting tool or travel-ready backup.

Fees, limits and where to buy

Purchase fees vary by retailer; expect a one-time activation or loading charge at places like Shoppers Drug Mart, Walmart Canada and major grocery chains. There is usually no monthly maintenance fee on standard Vanilla prepaid cards, but ATM cash withdrawals and currency conversions can add costs.

Card limits depend on the specific Vanilla product. Some Vanilla cards are single-load gift cards while others are reloadable at participating stores or online. Always check the terms printed on the packaging or the issuer’s Canadian site for daily spend and reload caps.

Reload options and balance management

Reloading varies by product: some Vanilla cards support in-store reload at retail partners, while certain reloadable Vanilla prepaid cards let you add funds online or via customer service. Keep receipts after loading to reconcile your balance if needed.

To monitor funds, use the online balance checker or phone number on the back of the card. Regular balance checks prevent declined transactions and help with budgeting—important for Canadians managing household expenses or travel budgets.

Security tips and customer support

Vanilla prepaid card security includes standard protections like PINs and zero liability for unauthorised purchases when the issuer’s policies apply. If your card is lost or stolen, call the Canadian customer support number immediately to report it and block further use.

Protect your card number like you would a bank card: avoid entering details on sketchy sites, log into official issuer portals only, and shred receipts with full card numbers. For disputes or refunds, contact the retailer first and keep transaction records to speed up any resolution with Vanilla customer service.

Ready to decide? Compare the specific Vanilla prepaid card products available in Canada, check retailer activation fees, and pick the one that fits your budget and travel needs. Use the card for controlled spending, gifting or as a secure online payment method, and you’ll have a simple, low-risk financial tool in your wallet.