Tangerine Cash Back World Mastercard, No Annual Fee and Up to 2% Cash Back on Everyday Canadian Spending

Make every loonie count with the no annual fee Tangerine Cash Back World Mastercard, earning up to 2% back on groceries, gas and everyday Canadian spending

Everyday Rewards with No Annual Fee

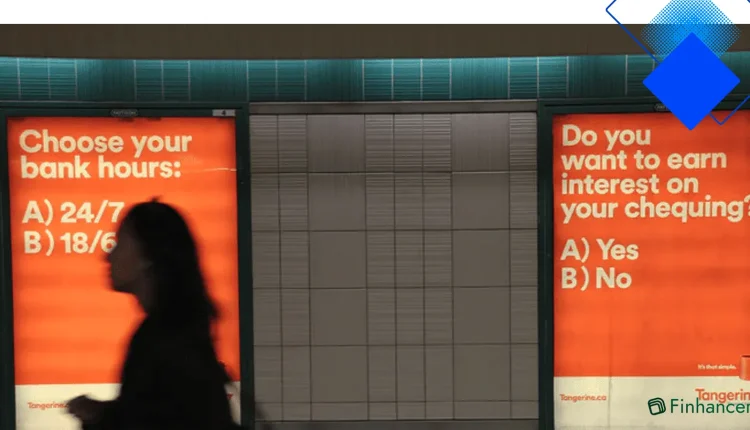

The Tangerine Cash Back World Mastercard is a straightforward, no annual fee option built for Canadians who want real value on everyday Canadian spending. With up to 2% cash back in selected categories, the Tangerine Cash Back World Mastercard turns regular purchases—groceries, gas and recurring bills—into tangible savings on your next statement or into your Tangerine account.

Cardholders in Toronto, Vancouver or smaller towns will recognise the appeal: simple rewards that stack up month after month without a yearly charge. The Tangerine Cash Back World Mastercard is ideal if you want easy-to-track cash back without the fuss of points conversion or confusing redemption rules.

Flexible Cashback Categories and Smart Savings

You pick two categories to earn up to 2% cash back, and if you hold a Tangerine Savings Account you can add a third category—so the Tangerine Cash Back World Mastercard adapts to how you actually spend. Choose groceries and gas or groceries and restaurants depending on your household; switching categories every three months is straightforward online.

Maximise returns by charging recurring bills and subscriptions to the card and timing category changes to match seasonal expenses. The Tangerine Cash Back World Mastercard’s simplicity makes it easy to plan: track categories, watch your monthly spend and let the cash back accumulate into your savings or statement credit.

Perks, Fees and Interest

Beyond cash back, the Tangerine Cash Back World Mastercard offers useful protections like purchase protection and mobile device insurance that give extra peace of mind on bigger buys. Another big plus for travellers and online shoppers: no foreign transaction fees, so purchases in USD or other currencies won’t carry the usual surcharge many Canadian cards add.

Keep in mind the interest rate: while competitive for a no-fee cash back card, carrying a balance can erode your rewards, so the smartest use of the Tangerine Cash Back World Mastercard is to pay in full each month. The favourable structure rewards disciplined spending and avoids turning rewards into interest payments.

How to Apply and Who Benefits Most

Applying for the Tangerine Cash Back World Mastercard is quick and entirely online—have your ID and proof of income ready and you can complete the application from your home in Calgary, Halifax or anywhere across Canada. Eligibility typically requires Canadian residency and a stable income, and approval times are usually a few business days.

If you want a no-fuss cashback card that aligns with Canadian lifestyles—earning on groceries, gas and everyday spending—the Tangerine Cash Back World Mastercard is a top contender. Compare it against other no annual fee cards and consider pairing it with a Tangerine Savings Account to squeeze out an extra cashback category. Ready to get more back on your loonie? Apply online and start earning with the Tangerine Cash Back World Mastercard today.