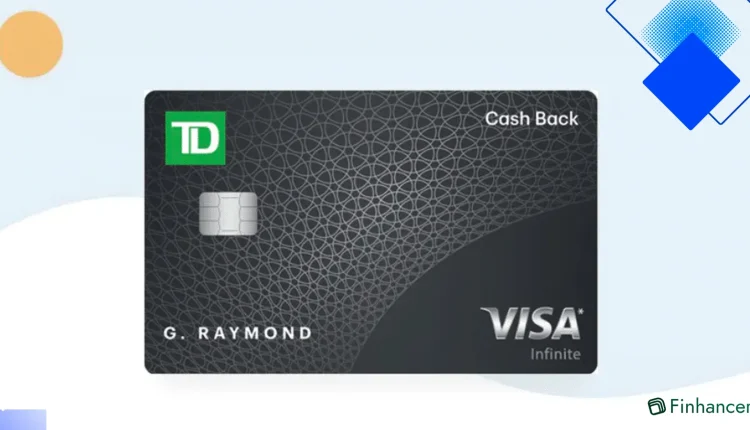

Maximize TD Cash Back Visa Infinite in Canada and Earn 3% Back on Everyday Groceries, Gas and Bills

Turn everyday spending into steady savings with the TD Cash Back Visa Infinite in Canada, using practical Canadian-tested tactics to lock in 3% back on groceries, gas and bills

Why the TD Cash Back Visa Infinite Makes Sense in Canada

The TD Cash Back Visa Infinite is built for Canadians who want straightforward rewards on everyday spend. With 3% cash back on groceries, gas and recurring bills, plus 1% on all other purchases, it turns routine payments into meaningful savings across provinces from Ontario to British Columbia.

Beyond the headline rates, the card brings Visa Infinite perks that Canadians value: travel insurance, purchase protection and concierge services. If your weekly groceries and monthly utilities are significant line items, this card quickly offsets its annual fee through regular cash back.

Costs, Eligibility and Practical Notes

The TD Cash Back Visa Infinite carries a $120 annual fee, and TD often offers a first-year rebate for new cardholders. Typical eligibility in Canada requires a minimum personal income around $60,000 or household income near $100,000, plus residency and age of majority in your province.

Interest rates are standard for a premium card — be mindful of purchase and cash advance APRs if you carry a balance. Use the card as a payments tool rather than short-term credit to keep rewards meaningful and avoid interest eroding your returns.

Maximizing 3% Cash Back on Groceries, Gas and Bills

To extract the most value from the TD Cash Back Visa Infinite, route all grocery shopping, fuel purchases and recurring bills through the card. Establish bill payments for phone, internet and streaming services to capture the 3% back automatically each month.

Pair the card with budgeting habits: track monthly categories, rotate spending to hit high-earning buckets, and use the card for required purchases rather than impulse buys. Over a year, consistently earning 3% on core expenses can outweigh the annual fee several times over.

Perks, Travel Insurance and When to Apply

Travel buffs will appreciate the TD Cash Back Visa Infinite’s medical and trip interruption insurance, plus travel accident coverage when travel expenses are charged to the card. Use the Visa Infinite concierge for bookings and local recommendations during trips within Canada and abroad.

If your spending profile lines up — steady grocery bills, regular fuel purchases and recurring monthly services — applying when TD runs a first-year fee rebate or a welcome offer makes the card especially compelling. Compare your annual spend to the $120 fee and project cash back to decide if it’s a match for your wallet.