[ad_1]

By Angela Ang, Andi Setianto, Whitney Mapes, and Elwyn Panggabean

As COVID-19 has uncovered financial fault strains all over the world, governments have responded by extending financial lifelines to probably the most susceptible populations. Based on the World Financial institution, at the least 200 international locations and territories have provided some type of COVID-19-related monetary reduction. One of many main questions amidst this rise in funds is underneath what situations government-to-person (G2P) funds encourage sustained engagement with monetary companies.

The Authorities of Indonesia—and particularly the Ministry of Social Affairs (MoSA)—has made outstanding strides in its efforts to advance monetary inclusion for ladies. Since 2017, Indonesia’s conditional money switch program, Program Keluarga Harapan (PKH or the Household Hope Program), enlisted state-owned banks to open digital monetary accounts for 10 million beneficiaries, lots of whom are ladies. Whereas this program improves entry to formal monetary accounts for ladies, who largely have a banking account for the primary time, earlier analysis by Girls’s World Banking has proven that 91% of the account utilization is proscribed to money withdrawals, not lengthy after receiving the G2P fund of their account. This demonstrates that it’s not ample to offer solely entry/accounts for ladies, however there should be efforts to drive engagement with these accounts so ladies really feel motivated and empowered to make use of them, and get the total advantages of getting a proper monetary account.

Over the previous yr, Girls’s World Banking has collaborated with Financial institution Negara Indonesia (BNI), one of many largest state-owned banks concerned within the PKH cost, with assist from MoSA. We’ve developed account activation/engagement options to construct the potential of girls PKH beneficiaries so they might actively use their G2P accounts past G2P transactions, corresponding to for financial savings and funds switch.

Our strategy to resolution design

Utilizing our women-centered design strategy, we outlined an issue area and explored it by means of deep buyer analysis. Then, we entered the design phases of ideation, and consumer testing earlier than arriving at our closing options, which shall be examined on a pilot implementation that started in October 2020.

Our analysis into the PKH ecosystem recognized 4 particular behavioral limitations that stop beneficiaries from extra actively utilizing their checking account.

- No lively option to open their BNI account: PKH recipients had been routinely assigned to BNI to obtain PKH funds and had been opened in bulk, so the purchasers weren’t supplied sufficient training and coaching on tips on how to use their BNI accounts.

- Low consciousness of account and lack of functionality to conduct transactions: Three-quarters of PKH beneficiaries didn’t know primary details about their account, past withdrawing their G2P cost. They had been additionally not assured and infrequently relied on others to conduct transactions. Surprisingly, these points weren’t solely amongst PKH beneficiaries, but additionally amongst peer group leaders and even PKH facilitators.

- Lack of belief within the account: PKH Beneficiaries have unclear guidelines or steering about tips on how to use their accounts which fuels distrust and confusion. Beneficiaries have obtained many conflicting messages concerning the account corresponding to withdrawing G2P funds and/or not saving of their PKH accounts.

- Low perceived worth of account: With such low consciousness of the account and its potential makes use of, clients see it as having little worth. Nonetheless, when clients are conscious and perceive use circumstances, their account does current worth—particularly for financial savings and transfers.

This deeper understanding of buyer limitations allowed us to maneuver into the answer design course of with a transparent roadmap of the limitations our resolution would wish to beat, primarily low consciousness of the account and restricted monetary functionality. To search out methods to deal with the belief barrier, we appeared on the PKH program ecosystem infrastructure as potential trusted touchpoints. The primary is to leverage the prevailing PKH month-to-month assembly organized by the PKH facilitators referred to as Household Improvement Periods (FDS). The second is to have a look at the influencers of the PKH program who’re well-respected and (bodily) nearer to the neighborhood such because the PKH Facilitators and the group chief.

Our early idea was Digital Monetary Functionality (DFC) and financial savings mobilization program collectively carried out by leveraging the prevailing PKH ecosystem. We select financial savings as the primary use case, based mostly on the wants and customary practices we discovered from the analysis. Person testing gave us an opportunity to guage our prototyping and additional refine the options. By way of this course of, we had been inspired to be taught that PKH beneficiaries and peer group leaders had been obsessed with collaborating within the financial savings program, as they did have want to avoid wasting however didn’t have the information, abilities, or self-discipline to take action. We additionally discovered that beneficiaries struggled to know widespread banking and monetary terminology utilized by BNI, so we simplified the language to colloquial language that ladies could be extra seemingly to make use of and provided a mixture of visuals and brief textual content every time attainable.

Our closing account activation and financial savings mobilization resolution

Our closing options present a holistic strategy to serving to PKH beneficiaries acquire the information, capabilities, and sensible abilities wanted to begin saving inside their BNI account. Launched by means of the PKH facilitators and peer group leaders in small group settings as a result of suspension of the FDS month-to-month conferences throughout the pandemic, the person resolution parts every present a important stepping-stone to deal with buyer limitations and provides PKH beneficiaries the mandatory instruments to efficiently construct a long-term financial savings behavior.

Particular person parts of the answer are:

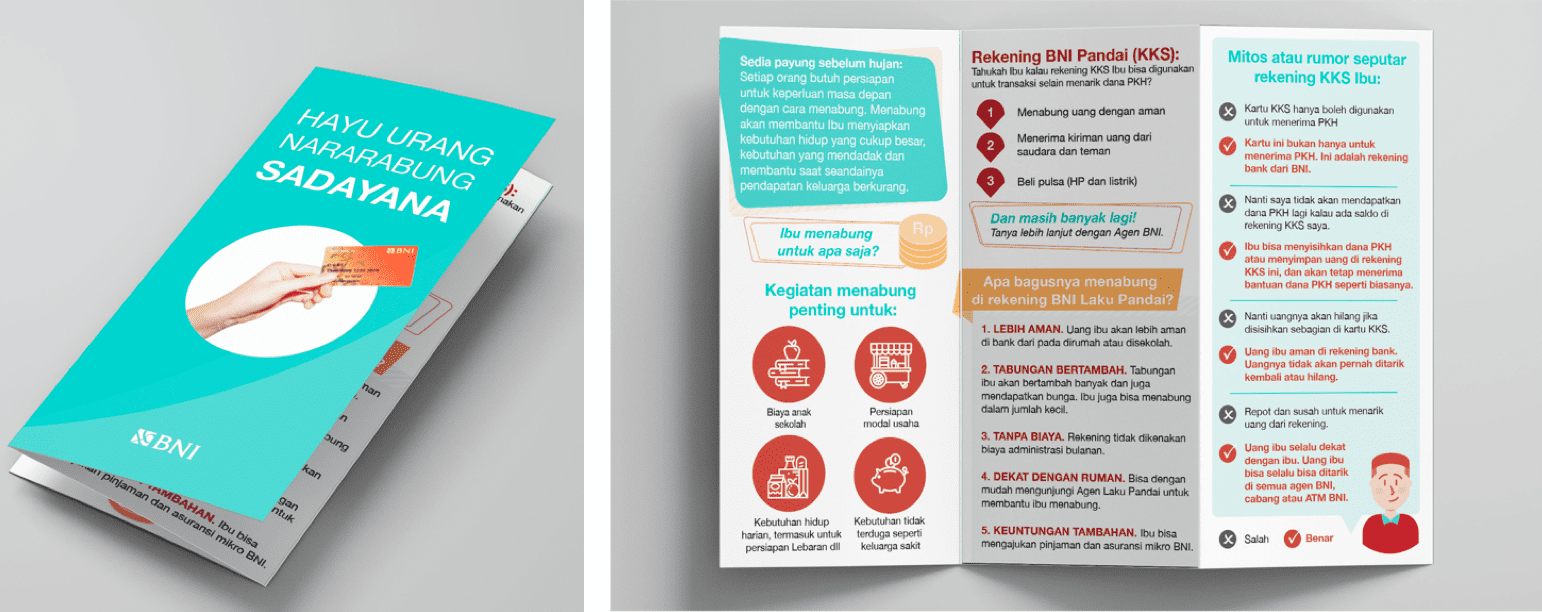

- Account training pamphlet: A visible pamphlet to coach beneficiaries about their account and its options, together with dispelling rumors/myths concerning the account, financial savings advantages, tips on how to save, and why they need to save with BNI. This data will enhance belief, consolation, and understanding of the account and its use circumstances.

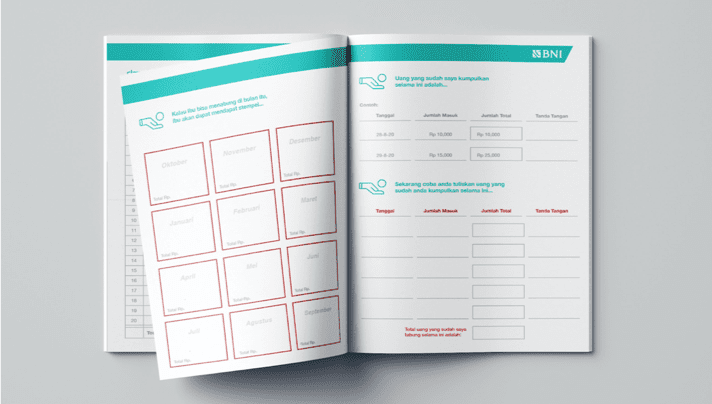

- Financial savings workbook: The workbook provides beneficiaries a step-by-step information to getting began with financial savings. It’s designed in a transparent and easy order to information ladies in planning their month-to-month bills, set and decide to their private financial savings purpose, and monitor their financial savings over time. The financial savings tracker can also be designed to inspire the shopper to constantly save and obtain their private financial savings purpose.

- A saving field: A saving field (or “celengan”) provides ladies a bodily place to avoid wasting brief time period at dwelling, with one thing that they’re already accustomed to and to avoid wasting their time from visiting brokers, earlier than depositing the cash into their account.

- Reminder messages: Beneficiaries obtain messages as soon as every week to nudge them to avoid wasting, reinforce accomplishments, and assist them keep on monitor with their financial savings targets.

The answer parts present the constructing blocks to making a financial savings behavior. As ladies be taught extra concerning the account, the advantages of saving of their checking account, and end-to-end financial savings exercise, this modification in information and abilities will assist them really feel extra assured saving of their account and be extra reassured of the safety of their financial savings. As soon as a basis of financial savings behaviors is established, ladies will develop their financial savings balances and construct a long-term financial savings capability.

Implications and subsequent steps for the venture

Our work on this venture suggests that there’s a higher function for presidency companies and their monetary companions past opening accounts and distributing G2P funds for beneficiaries. It additionally reveals there is a chance to leverage the infrastructure of each BNI and MoSA to additional speed up the inspiration for ladies’s monetary inclusion and empowerment.

Though this work began pre-COVID-19, it has solely grow to be extra related as financial insecurity and the variety of folks receiving authorities funds has elevated. It’s extra important now than ever to empower PKH beneficiaries to make use of their accounts as instruments for restoration and resilience. Beneficiaries want to have the ability to use their accounts to avoid wasting small quantities, to offer a security web for family bills and sudden emergencies when occasions get powerful. In addition they want to have the ability to make digital funds and transfers to remain COVID-19 safe, and even apply for credit score to assist restart their companies as they get well from the impression of COVID-19. If used to their full potential, these accounts can provide a lifeline to PKH beneficiaries to rebuild their monetary lives in a submit COVID-19 atmosphere. We hope that experiencing the monetary advantages of her personal financial savings will assist beneficiaries, and their households, be extra economically empowered and fewer depending on authorities help in the long run.

At this level within the venture, we’re progressing past testing to implementing our account activation resolution with choose teams of PKH beneficiaries. We stay up for sharing additional updates on this system implementation and impression evaluation within the coming months. We consider that the outcomes ought to cowl implications not just for the Indonesia/PKH program, however may give higher insights on how it may be carried ahead in different international locations with related authorities assist and infrastructure. Keep tuned!

Girls’s World Banking’s work with BNI is supported by the Australian Authorities by means of the Division of International Affairs and Commerce and the Caterpillar Basis.

[ad_2]