[ad_1]

Introduction

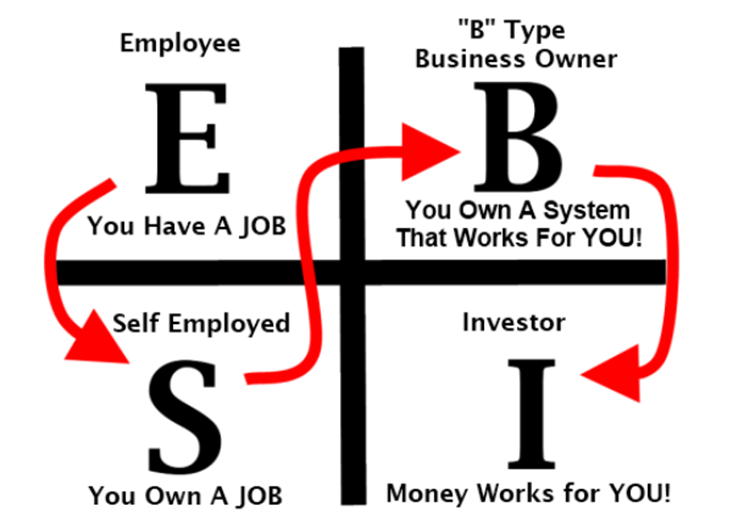

The idea of the Cashflow Quadrant was popularized by Robert Kiyosaki in his ebook “Wealthy Dad’s Cashflow Quadrant.” It’s a highly effective idea that categorizes the alternative ways folks generate revenue. The Cashflow Quadrant is split into 4 classes: Worker (E), Self-Employed (S), Enterprise Proprietor (B), and Investor (I). Understanding these quadrants can assist people navigate their monetary journey and obtain monetary independence.

The 4 Quadrants

Worker (E)

Staff work for others and earn a paycheck. They alternate effort and time for cash, usually receiving a gradual, predictable revenue. Staff usually take pleasure in advantages corresponding to medical insurance, retirement plans, and job safety. Nevertheless, they’re typically restricted by their wage and have much less management over their monetary future.

Earnings Supply: Wage or wages

Time Dedication: Mounted hours

Self-Employed (S)

Self-employed people work for themselves. They might personal a small enterprise, work as freelancers, consultants, or professionals corresponding to medical doctors and attorneys. Whereas they’ve extra management over their work, their revenue is straight tied to their time and effort, usually resulting in lengthy hours and restricted scalability.

Earnings Supply: Charges, commissions, or enterprise earnings

Time Dedication: Variable, usually intensive

Enterprise Proprietor (B)

Enterprise house owners construct methods and rent folks to work for them. They leverage different folks’s time and abilities to generate revenue, permitting for higher scalability and potential passive revenue. Enterprise house owners give attention to constructing and managing methods moderately than working inside them.

Earnings Supply: Enterprise earnings, dividends

Time Dedication: Preliminary excessive dedication, doubtlessly reducing over time

Investor (I)

Traders generate revenue by placing their cash to work. They spend money on belongings corresponding to shares, bonds, actual property, and companies. Their revenue is derived from the returns on their investments, offering the potential for substantial passive revenue and monetary freedom.

Earnings Supply: Funding returns (dividends, curiosity, capital positive factors)

Time Dedication: Low to average (analysis and administration)

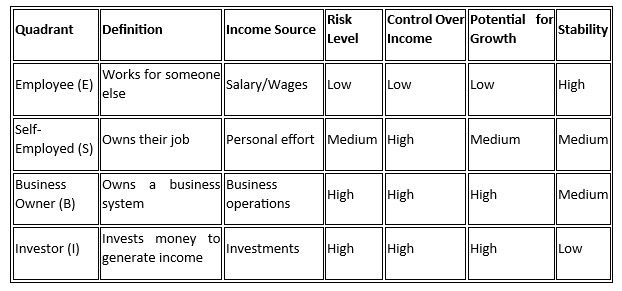

The Quadrants and their Traits

Transitioning Between Quadrants

Robert Kiyosaki emphasizes specializing in the appropriate aspect of the Cashflow Quadrant—Enterprise Proprietor and Investor—to realize vital wealth. That stated, you don’t want to completely transition to a different quadrant suddenly. You’ll be able to keep involvement in a number of quadrants concurrently. For instance, one could begin as an Worker + Investor. Beginning as an Worker + Investor permits people to construct a steady revenue whereas investing for progress. As investments develop, transitioning to a Enterprise Proprietor position can additional improve monetary stability and wealth. Combining Enterprise Proprietor and Investor roles maximizes wealth potential by way of diversified revenue streams and reinvestment of earnings.

By specializing in the appropriate aspect and strategically combining quadrants, people can construct a stable basis for long-term monetary success and wealth accumulation.

Transitioning from one quadrant to a different requires a shift in mindset and technique. Listed here are some ideas for making these transitions:

From Worker to Self-Employed

· Develop Abilities: Purchase abilities related to your required self-employed discipline.

· Construct a Community: Set up a community of potential purchasers and mentors.

· Create a Enterprise Plan: Define your small business targets, methods, and monetary projections.

From Self-Employed to Enterprise Proprietor

· Systematize Your Enterprise: Develop methods and processes to streamline operations.

· Rent Workers: Recruit workers or contractors to take over day-to-day duties.

· Give attention to Development: Shift your focus from working within the enterprise to rising it.

From Enterprise Proprietor to Investor

· Educate Your self: Find out about completely different funding choices and methods.

· Diversify: Unfold your investments throughout numerous asset lessons to mitigate danger.

· Leverage Experience: Work with monetary advisors and funding professionals.

To Sum Up

The Cashflow Quadrant offers a invaluable framework for understanding completely different revenue technology strategies. By recognizing the place you at present stand and the place you aspire to be, you may make strategic choices to realize monetary freedom. Whether or not you’re an worker seeking to transition to self-employment or a enterprise proprietor aiming to develop into an investor, the bottom line is steady studying and strategic planning.

[ad_2]